Top Trade Ideas - February 12th

CPI and PPI data are in the spotlight for markets this week. Here is what we're watching.

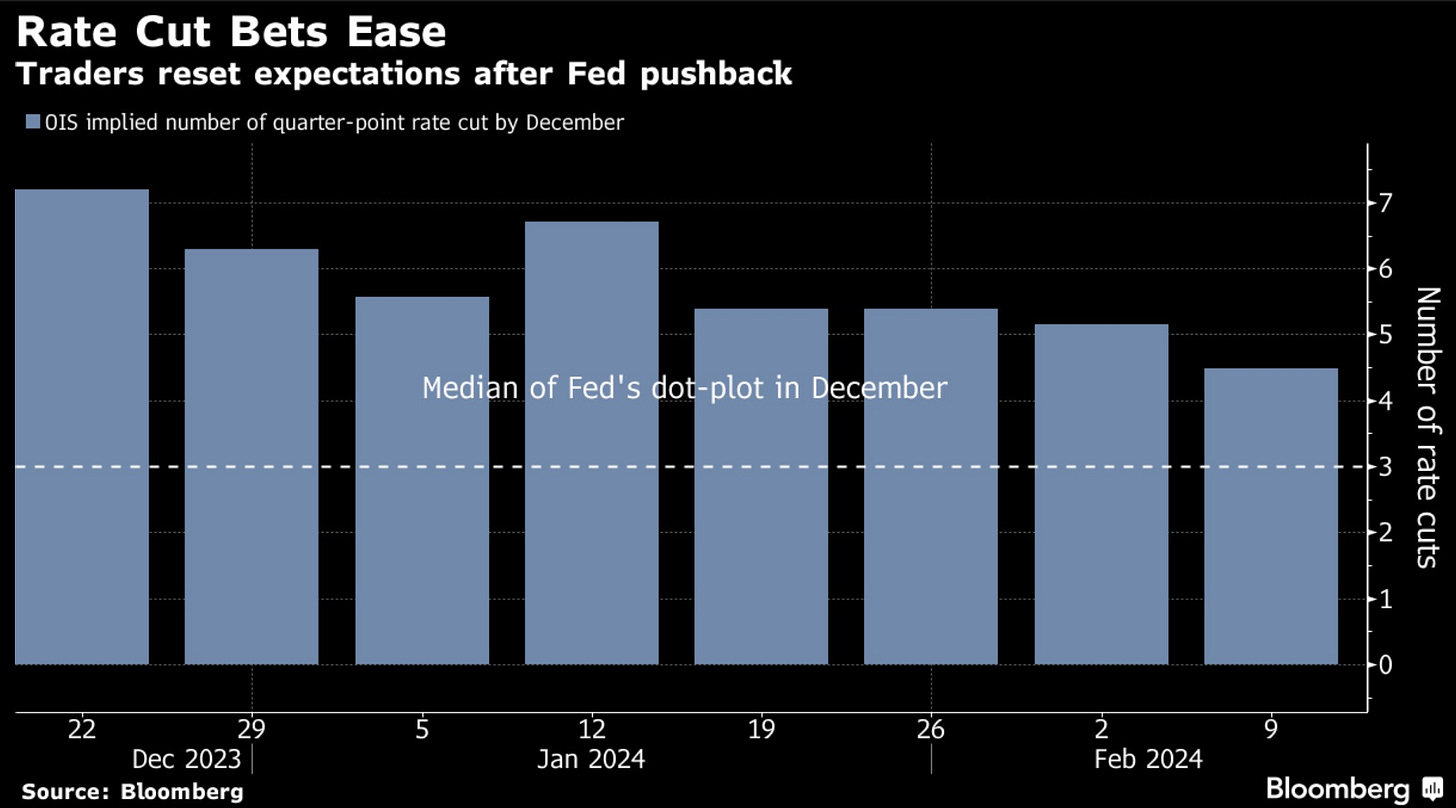

CPI is the name of the game this week for the markets. Analysts expect 2.9% versus last month’s 3.4% surprise. It will be a key event, not just as the data is released, but in the days following as markets digest the outcome - one that the Fed keeps a very close eye on for their monetary policy.

Any surprise outcome in either direction will cause some strong moves in treasury and equity markets. An outcome in line with estimates will see markets keep the trend, which is most definitely up after the S&P 500 notched past a record 5,000 last week.

In G10 FX, we had a quieter week following the bumper NFP print. The trend of a stronger USD persisted despite the risk-on mood in the equity markets. This week we focus on inflation data out from both the US (Tues) and UK (Wed).

Equities

Exxon (NYSE: XOM), along with Chevron, reported strong earnings at the beginning of this month. Price has traded within range since the move higher at the end of January, and Friday’s pullback gets our interest peaked.

A long trade at 101.10 sets up a clear risk/reward trade. We’re looking for price to hold above 99.50 and move higher towards a previous key level around 108.50.

TRADE IDEA - XOM LONG

Entry: 101.20

Stop Loss: 99.40

Take Profit: 108.40

Procter & Gamble (NYSE: PG) broke higher out of a resistance trend line and now looks to be coming back lower for a retest. A break and retest of a key resistance level can create some of the strongest trades from a technical perspective.

Price closed the previous week at 157.42, but we’d be looking to grab a long trade a few cents lower at 156.76. If the strong trend continues, this could be a good trade to swing toward new highs and risk a close below the level noted on the chart below, 154.40.

TRADE IDEA - PG RETEST

Entry: 156.76

Stop Loss: 154.00

Take Profit: 164.00

Every week, the AlphaPicks team studies global markets to share our favourite ideas with our readers. These trades cross equities, currencies, commodities, bonds and indices.

The rest of our rundown can be found below. You can read it for free by joining a trial here.

Onto the rest of the alpha.