Top Trade Ideas - February 26th

As your personal investment analyst, we strive to bring you informed decisions. After a thorough review of the market, here are ten trade ideas for you to capitalise on this week.

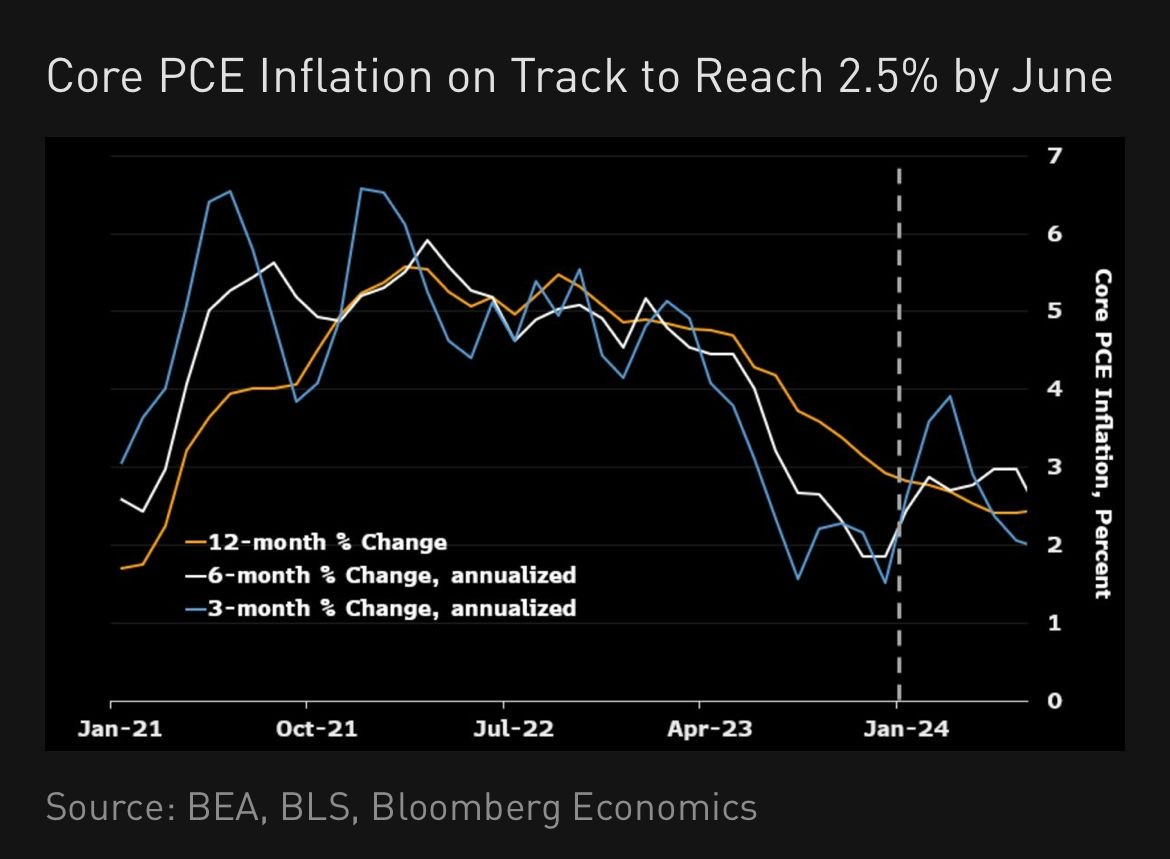

The stage is set for monthly PCE inflation to jump following hot CPI and PPI reports. While that certainly won't put the Fed at ease, policymakers may largely look through the January increase. Temporary factors - including residual seasonality and the increase in prices of portfolio-management services - serve as critical drivers behind the January increase.

When annualising the data on a three- or six-month basis, both would rebound above 2% after dipping below the Fed’s target in December. This may be a headwind for equities in the week ahead.

In G10 FX, the risk-on move in equity markets meant the US Dollar struggled to continue to rally. Yet, despite a quiet week, we look ahead to Core PCE inflation out on Thursday to dictate the next move for the DXY.

Equities

Our first idea this week turns to the luxury space: Tapestry (NYSE: TPR). This sector has seen a recent move higher. We can think of other names like LVMH, which has continued to rally since earnings and ANF, which seems to be allergic to a red week.

Tapestry has started a breakout move from a major resistance trend last week. We think this is a momentum move to jump in on and could keep going for some time.

TRADE IDEA - TAPESTRY BREAKOUT

Entry: 48.60

Stop Loss: 44.00

Take Profit: 55.00, 60.00

Our next two ideas are from the reinsurance industry. There are a few names that pique our interest when looking for some equity ideas.

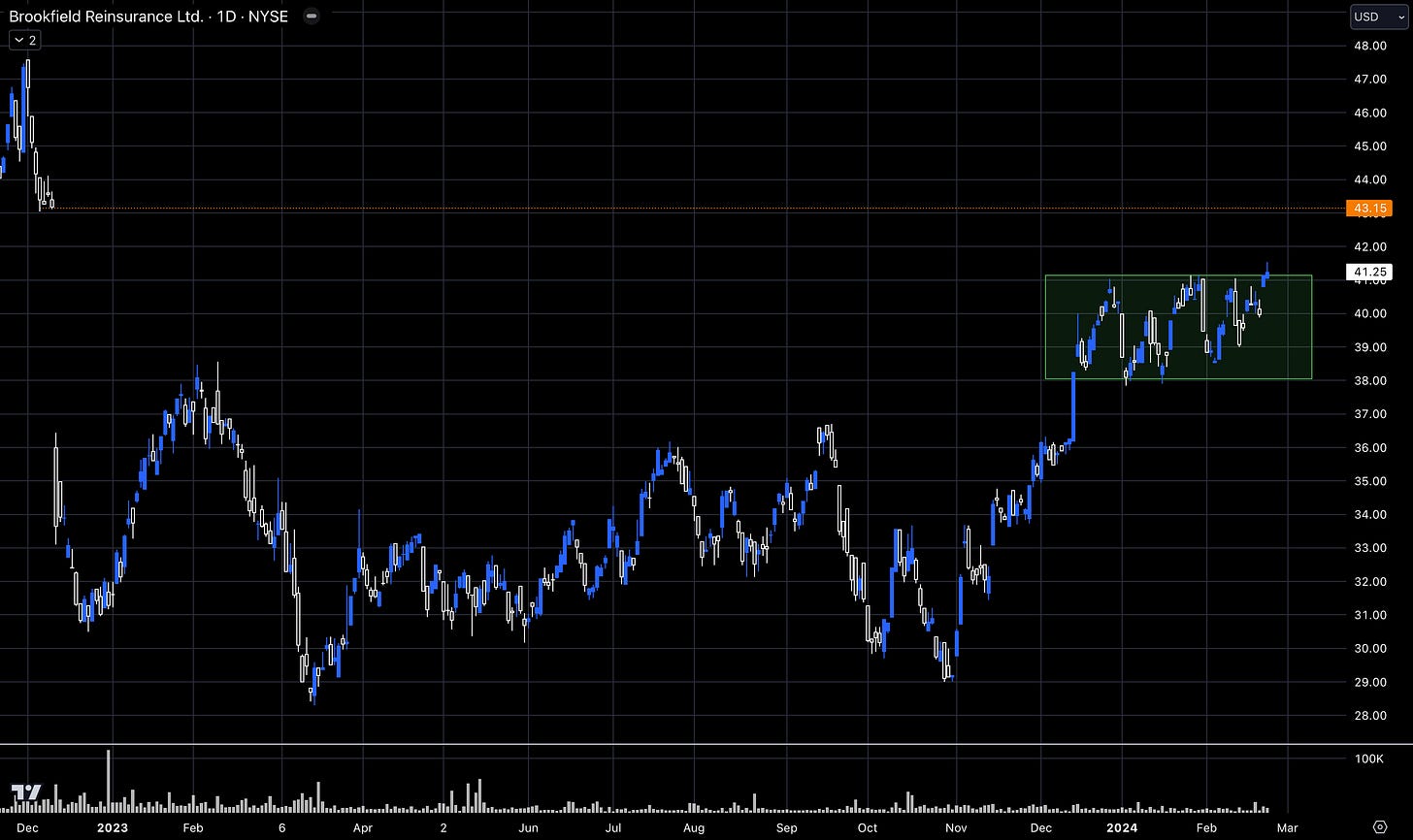

Brookfield Reinsurance (NYSE: BNRE) followed the market higher from November (returning 41%) and now looks to be breaking out of consolidation. A gap down from 43.15 at the end of 2022 sets up our upside target.

TRADE IDEA - REINSURANCE LONG

Entry: 41.25

Stop Loss: 40.00

Take Profit: 43.15

Greenlight RE (NASDAQ: GLRE) is another name that also has a breakout potential.

The past two weeks have seen price reject a hold above 12.00. But what is interesting is that price has not been taken lower by sellers, indicating buyers are still strong. We’re keeping an eye on this name at this level for a break above this resistance zone.

The market cap is small on this name, so a higher return is more likely. But that also comes with more beta, so we place our risk wider.

Our week-ahead preview and trade ideas continue below. You can access these for free by joining on a 14-day free trial.

Onto more alpha.