Top Trade Ideas - January 1st

New year. More alpha.

We’re ready for another great year of ideas. Let’s start the first week off with a bang.

Nasdaq closed the year with its best performance since 1999. Many other markets performed well, too, beating the common consensus for last year.

As 2024 gets underway, what expectations do you have for global markets?

Last week wasn’t as quiet as we were expecting, given the low-volume holiday period. The US Dollar underperformed, with GBPUSD trading above 1.28 and EURUSD taking out 1.1100 for the first time since the summer. The year kicks off on Wednesday with FOMC minutes and Eurozone inflation and NFPs on Friday.

Equities

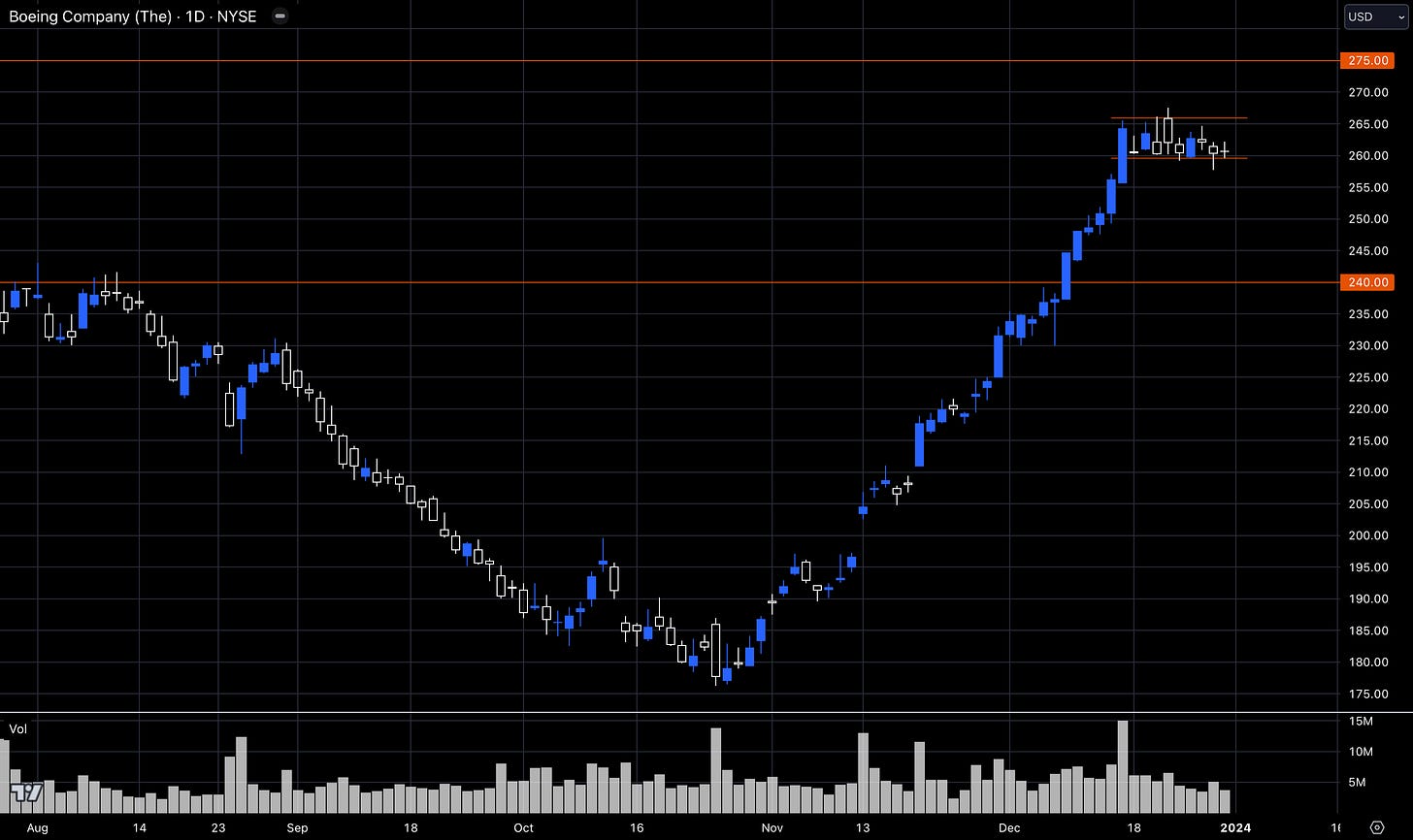

Our first idea this week turns to Boeing. The name has been very strong over the final quarter of 2023. Price was consolidating over the last few weeks of the year.

Although we have $240 noted as a buy level for the longer term, we think going long at the current level on a technical basis is a good risk:reward.

$275 was a big high in 2021, so we have this level as our target if price does breakout.

TRADE IDEA: BOEING BREAKOUT

Entry: 260.60

Stop Loss:257.00

Take Profit: 275.00

Goldman Sachs had a strong end to 2023, but it didn’t quite match the rally from its peer, JP Morgan. However, price looks constructive for upside as a new year gets underway.

If financial stocks continue the recent strength, we have a shorter term break out of this daily flag setup. But we also have a potential break higher past October 20222 highs.

TRADE IDEA: GOLDMAN GOING

Entry: 386

Stop Loss: 380

Take Profit: 390/400

As usual, the rest of our ideas continue for the week ahead, covering more equity trades, turning towards the currency markets, and finishing with some commodity ideas.

A quick reminder: Our prices for premium subscriptions will go up to £10/month from TOMORROW (this only applies to new subscriptions, so if you are already a paying reader, you’ll stay on the same plan).

However, if you join now, you can benefit from the current plan of just £5/month forever (or £50/year). To make the offer even sweeter, we’re offering a 14-day free trial as well. It wouldn’t be fair to ask you to sign up without letting you see what value we offer first.

Onto the rest of the alpha.