Top Trade Ideas - January 22nd

All-time highs.

All-time highs were the news last week. The S&P 500 reached a new high for the first time since January 4th 2022. The Nasdaq continued flying higher as semiconductor names led the way. Super Micro Computer was the standout as shares surged after a strong preliminary report.

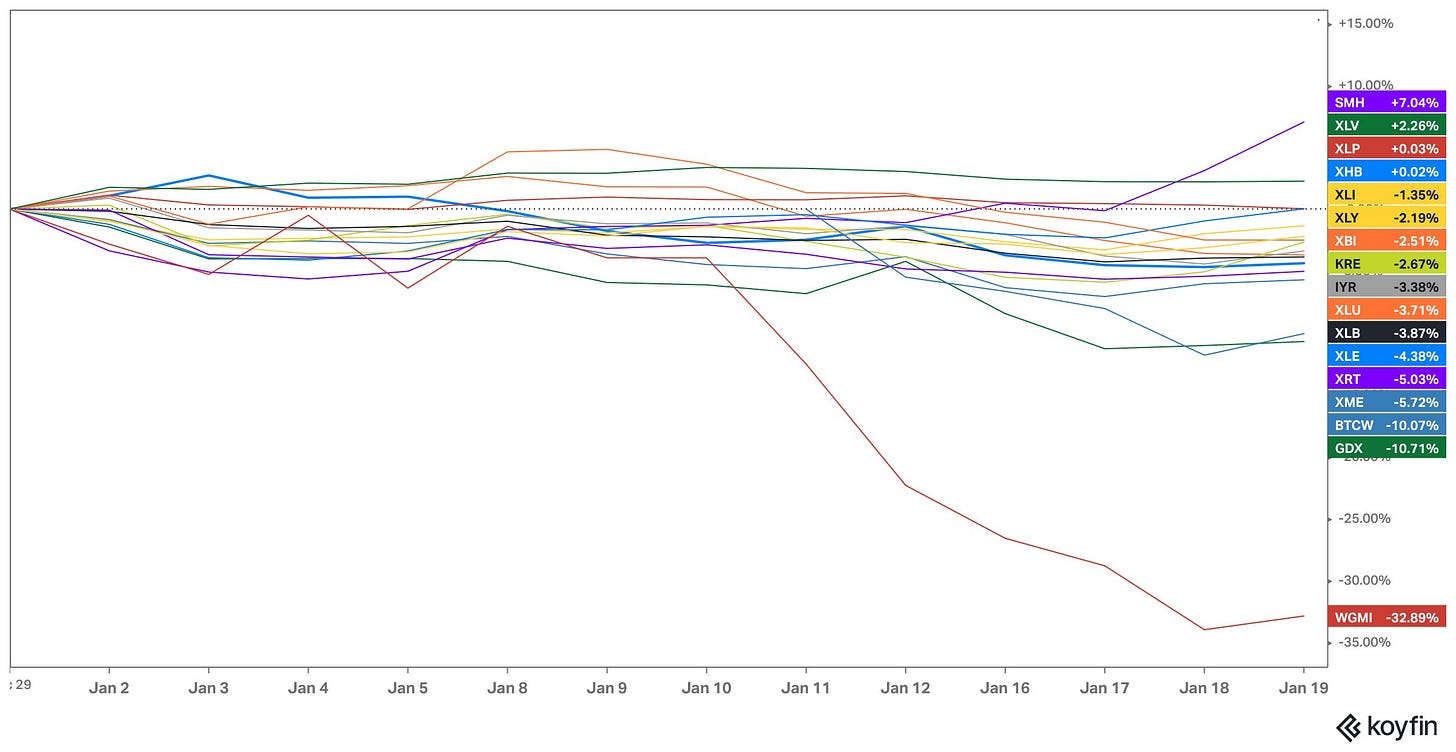

Eliant’s Exploits said it well, “A great start to the year for Semis [up 7.04%], everything else, lackluster.”

Spirit Airlines was also in the headlines, but for different reasons, falling 73% in three days. Crypto ETFs have indeed been a sell-the-news event, down 32.89%.

In G10 FX, we saw a sharp USD bid as US yields rallied and chatter on rate cuts was pushed back. We discussed this in more detail in our opinion piece on Friday.

As always, the Monday rundown follows as usual. Equity, currency, index and commodity ideas.

Equities

A positive macroeconomic scenario can pave the way for a bullish turnaround for PayPal shareholders. Adding to this, Alex Chriss, the CEO of PayPal, made his first appearance on CBNC since taking over the position. Chriss affirmed his commitment to “shock the world” with innovative ideas despite acknowledging the lack of progress in recent years. This promise is linked to an upcoming “innovation day” scheduled for January 25, which the market has already started to price in.

Price broke higher above a shorter-term trend line but now faces a further breakout higher. We’re long through the Jan. 25 event and will readjust our thoughts after.

TRADE IDEA - PAYPAL PAYING

Entry: 66.00

Stop Loss: 62.50

Take Profit: 72.50

The cybersecurity industry is commonly known for its sustainable growth, as companies are unwilling to compromise their digital security for cost-effectiveness. With the rise in frequency, complexity, and sophistication of cyberattacks, the industry is anticipated to grow exponentially in the coming decade.

Zscaler (NASDAQ: ZS) has moved higher with the market in recent months. With tech continuing strong, we expect price to continue towards the previous swing high, April 2022.

TRADE IDEA - ZS RETEST

Entry: 231.50

Stop Loss: 219.50

Take Profit: 253.00

You can access all of our trade plans and full research articles by joining as a premium subscriber. But we understand there is a bit of a paywall paradox: You don’t want to pay without knowing what you’re getting, and you don’t know the value of what we offer without paying. So, here’s a 7-day free trial so you can see for yourself.

Onto more alpha.