Top Trade Ideas - January 29th

A busy market schedule has us eyeing up lots of ideas for the week ahead.

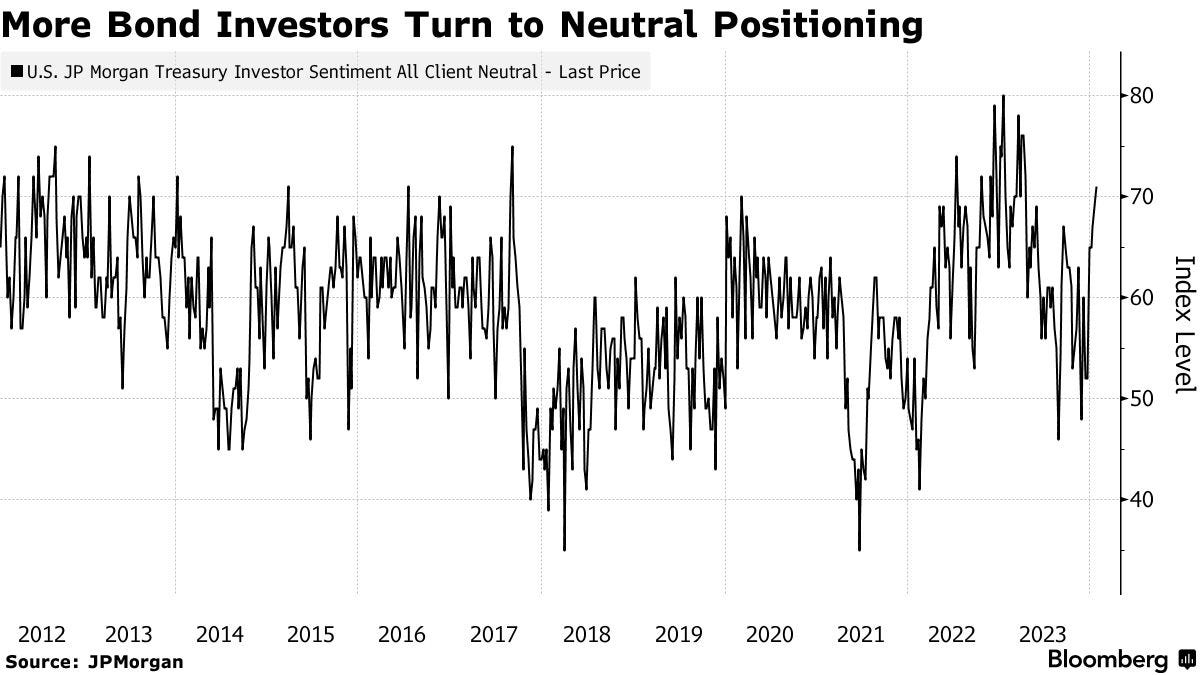

The Treasury market has been in a rut, and bond traders are waiting for a catalyst to break bond yields out of their recent range. The Fed meeting, quarterly debt-sale plans, and economic data are unlikely to provide decisive signals but may add some volatility. The Fed is not expected to change its policy stance at this meeting and bond markets still won't know the US central bank's policy path after next week concludes.

In G10 FX, we had a rather uninspiring week, with limited price action or meaningful rhetoric, even with the ECB meeting on Thursday. This week holds much more in store.

FX

We start with a very simple chart in terms of annotations, but one that shouldn’t be underestimated. We flag up GBP/JPY, with the Bank of England meeting on Thursday for the first time this year.

Given the latest inflation reading coming in hotter than expected, along with guidance from several MPC members that rate cuts this year aren’t a given, we feel the bias is for GBP to price higher after the meeting if the thoughts flagged above are reiterated more firmly.

A break above 189.00 would cause another breakout for the pair, pushing it to multi-year highs. Yet, if we’re mistaken and the BoE disappoints, a break below 187 could offer a much larger pullback to the 184.25 area. We like to leave orders to capitalise on either move.

TRADE IDEA - ONE CANCELS OTHER ON GBP/JPY

Limited Order (OCO): Either buy GBPJPY at 189.10 or sell it at 187.00

If done, target TP’s of 191.00 or 184.25 and set appropriate stop losses.

For the US Fed meeting on Wednesday, there’s almost a 0% chance of a rate cut, with our eyes on the 50:50 probability for March. Despite the likelihood of nothing happening this time, we expect USD movement based on whether March gets cited by Powell as being a live meeting for a first cut.

Based on our views, we do think the Fed will cut in March and see the potential for a knee-jerk USD lower move from the meeting. Our favourite way to express this is via short USD/CHF.

TRADE IDEA - PLAYING FOR MARCH CONFIRMATION ON USD/CHF

Entry: 0.8635

Take Profit: 0.8400

Stop Loss: 0.8740

To see more of our trade ideas that we planned out this weekend, join as a premium reader for just £10/week. You can also access a 7-day free trial here.

Onto more alpha.