Top Trade Ideas - January 6th

The first full week is underway.

It was a relatively quiet week as assets wrapped up their annual returns. After notching up a second consecutive annual gain greater than 20%, the S&P 500 boasts a 53% rally over the past two years. This is the strongest two-year stint from the index since the juicy 66% gain from 1997-1998.

Bitcoin gained 119% during the year, topping $100k for the first time. Gold kept its shine, also hitting all-time highs amid a 27% move higher. The U.S. Dollar rose over 7%, closing the year at the highest level since November 2022.

The other week’s news saw Hindenburg Research, a notorious short seller, go after Carvana, citing “accounting manipulation.” Carvana is one of the hedge fund darlings that saw a boom and bust cycle to start the decade but had recently made a redemption rally, capturing the interest of the retail market on the way back up.

Tesla’s total vehicle deliveries fell to 1,789,226 in 2024, down from 2023’s record of 1,808,581, marking its first annual decline. The electric vehicle maker’s fourth-quarter deliveries of 495,570 units, while setting a new quarterly record, failed to prevent the yearly drop.

The Week Ahead

As 2025 gets into full swing, investors will be watching a raft of U.S. economic data, including key monthly jobs data and Federal Reserve meeting minutes. They will be gauging the health of the U.S. economy and the consequent outlook for interest rates ahead of Donald Trump’s inauguration on Jan. 20th.

Further strong U.S. data could reduce rate-cut expectations even more, especially since President-elect Trump is expected to announce policies, including trade tariffs and tax cuts, after his inauguration on Jan. 20th. These could boost the economy and stoke inflation.

Wednesday’s minutes from last month’s FOMC meeting could provide details on how different policymakers perceive Trump’s planned policies will impact the economy and how that could feed into the interest-rate outlook.

Ahead of Friday’s nonfarm payrolls data, further clues on the health of the jobs market will be provided with Tuesday’s JOLTS November job openings figures, Wednesday’s ADP private payrolls data for December, plus the latest weekly jobless claims numbers Thursday.

The ISM nonmanufacturing index for December, due Tuesday, is another key indicator that investors will watch to gauge how well the U.S. economy is performing, as well as the University of Michigan’s preliminary consumer confidence survey for January due Friday. Trade data for November are due Tuesday.

The U.S. Treasury will auction $58 billion in three-year notes on Monday, $39 billion in 10-year notes on Tuesday and $22 billion in 30-year bonds on Wednesday.

Eurozone inflation data could add to expectations for interest-rate cuts as the region’s economy stutters, in contrast to a much brighter outlook in the U.S. A string of inflation prints are also due in Asia.

Onto the thoughts and ideas for the week.

If you are not yet a premium subscriber, you can manage your account here.

Fixed Income

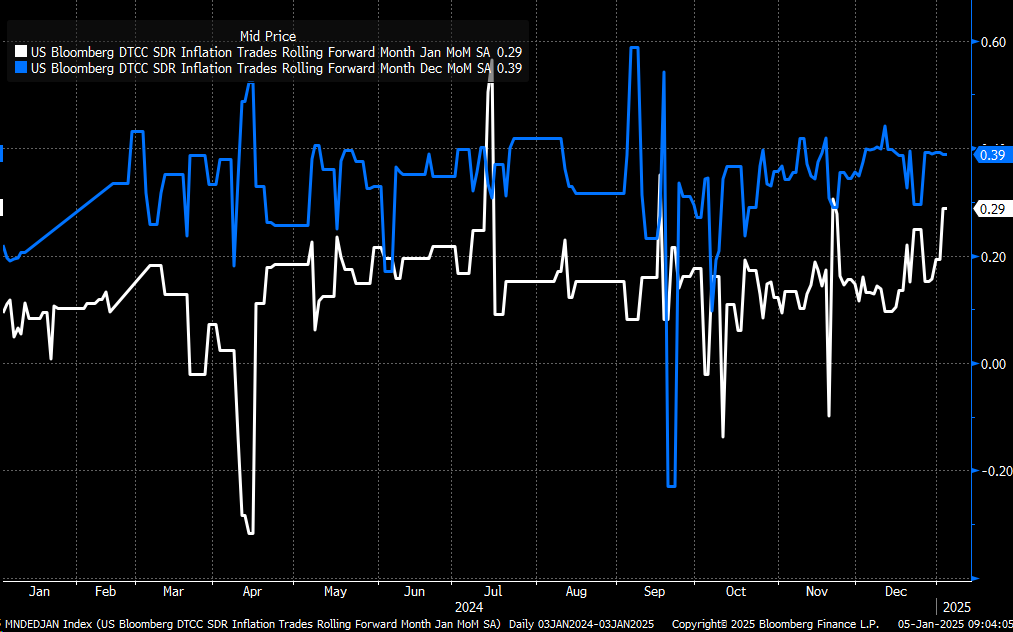

December’s CPI is expected to show a 0.4% month-over-month increase, while January is tracking a 0.3% rise, according to CPI swaps (h/t Michael J. Kramer). These numbers don’t align with a trajectory toward the Fed’s 2% inflation goal.

With the release of the minutes this week, comments on reignited inflation and Trump policies could further hinder the rate cut outlook this year. However, we will note that following the Fed meeting in December, markets went into full hawk mode. There may only be a little bit more room on the downside for ZT, which is most heavily influenced by rates, but there is some room nonetheless.

Many want to get long bonds, so maybe a little bit more pain before the move is needed.

FX

The year properly gets going this week, with most people back at their desks to track a host of key data that are due out. With Eurozone inflation data and the U.S. NFP’s two main pieces of the EUR/USD puzzle, we want to be involved.

We have existing downside option exposure to the pair, which was put on at higher levels late last year. The move lower has continued, with the pair trading to the low 1.02s last week.

Even though there’s the argument being voiced more vocally that we might be reaching peak EU pessimism, we feel that the mix of weak EU data and strong US labour market data this week could see us take a run lower (with a test of parity during January not out of the question), before the ‘peak’ is in.

So below is an alternative new Option structure to consider for EUR/USD downside. We add in a knock-in feature to cheapen the price and helps in case we get a short-term data-driven pop instead.

TRADE IDEA - EUR/USD PARITY TARGET

Buy a 1.03 strike Put with a 1.04 knock-in with an end-of-month expiry, targeting a move towards 1.00, with an initial cost of 0.30%

Poor UK PMI data caused a sharp drop in GBP pairs on Thursday, with more aggressive rate-cut pricing being factored in to close out the week. The strong USD means that playing the weaker GBP story on GBP/USD doesn’t have a huge amount of risk/reward down at 1.24.