Top Trade Ideas - July 21st

Do markets keep fading the noise, or is the signal getting louder?

US equity markets climbed to new highs last week as earnings season ramped up and inflation data cooled, giving investors more reasons to stay long. The S&P 500 rose 0.6%, led by tech and industrials, while the Nasdaq 100 added 1.25% thanks to AI-related tailwinds. Even as President Trump briefly reignited fears about firing Fed Chair Jerome Powell, markets shook it off. Just another twist in a now-familiar playbook.

Chipmakers helped carry the rally. Nvidia and AMD both surged after securing approval to resume some AI chip sales to China, yet another reminder that Washington’s trade stance may be more pliable in practice than in rhetoric. Meanwhile, Powell’s job may be safe for now, but his authority wasn’t exactly affirmed: jawboning from the White House sent a brief shiver through bonds and the dollar midweek.

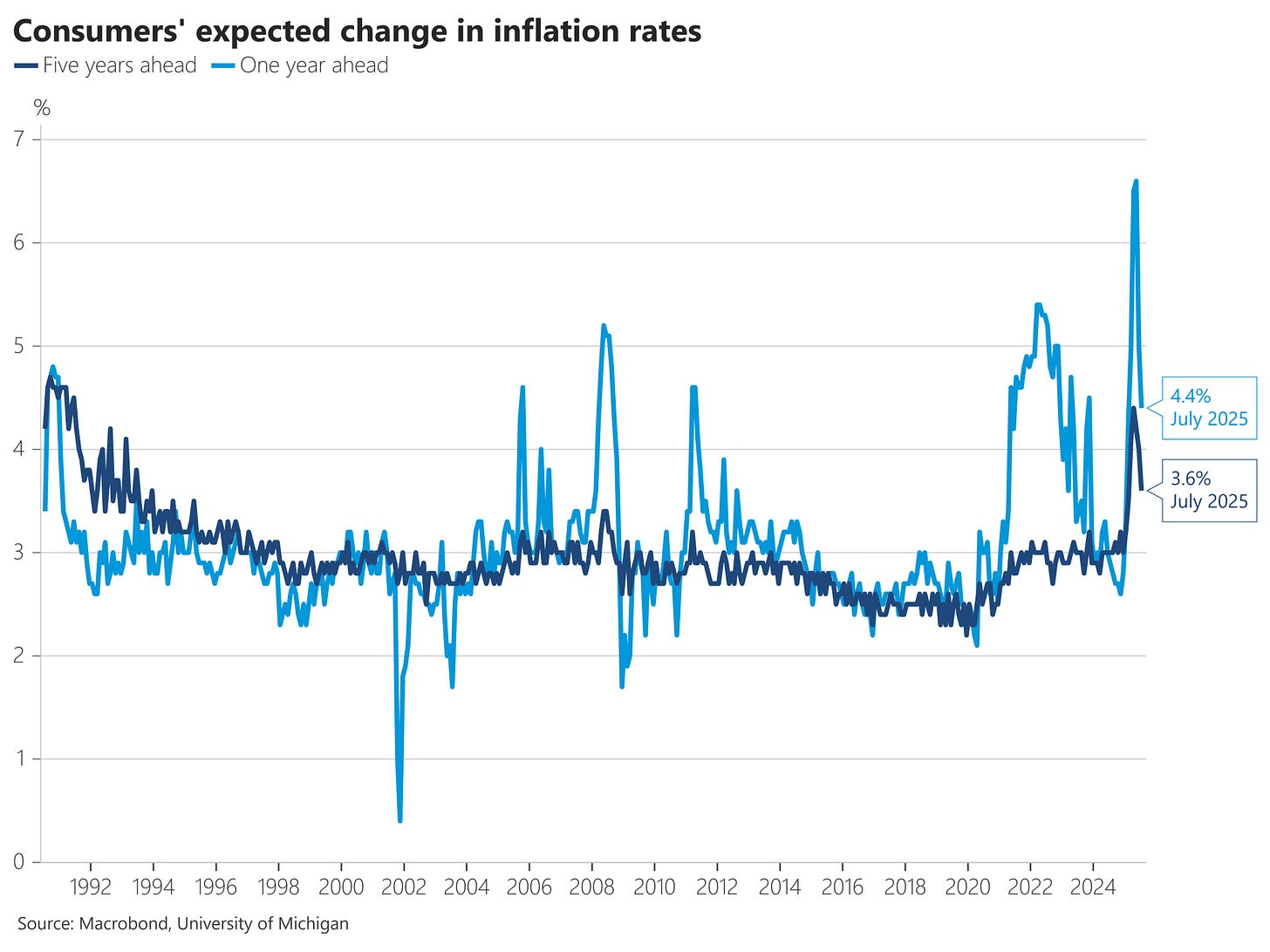

Economic data gave the bulls cover. Core CPI and PPI both came in softer than expected, and retail sales surprised to the upside. Inflation expectations continued to drift lower, with the Michigan 1-year gauge hitting its lowest since February. In response, the OIS curve now fully prices no action in July, leaving October as the earliest plausible liftoff for cuts.

Earnings kicked off with Wall Street’s heavyweights. Trading desks shone amid tariff-induced volatility, but a mixed reaction in bank stocks suggests investors are looking past the quarter and toward guidance. Goldman and Citi impressed, while JPMorgan and Wells Fargo underwhelmed in terms of their outlook.

In FX, the dollar clawed back midweek losses to end higher, particularly against the yen, where rising political risk in Japan pushed USD/JPY risk reversals to the most bullish level since 2022. US Treasuries were rangebound and quiet despite the Trump-Powell noise, with the front end continuing to attract the most attention as the inflation path becomes less alarming and the soft-landing narrative gains traction.

The Economic Week Ahead

In the US, Markets will focus on provisional PMI surveys for July, offering the first look at how US manufacturing and services activity is holding up amid tariff uncertainty. While the economy has shown resilience in recent data, investors remain alert for signs that Trump’s trade policies are pushing up prices or dampening business sentiment. Existing and new home sales data, weekly jobless claims, and durable goods orders round out a light calendar. Treasury auctions include $13 billion in 20-year bonds on Wednesday and $21 billion in TIPS on Thursday. Markets also await any movement on tariff negotiations ahead of the August 1 deadline for reciprocal measures.

Over in Europe, the ECB is widely expected to hold rates steady on Thursday following seven straight cuts, but markets will parse the language for any hints on September. Flash PMIs from France, Germany, and the eurozone will gauge whether manufacturing and services continue to hold up despite Trump’s 30% tariff threat on eurozone goods. Confidence indicators from Germany’s GfK, France’s consumer survey, and Italy’s sentiment data will help flesh out the near-term outlook. The ECB is unlikely to provide strong forward guidance while EU-US trade policy remains in flux. Germany auctions green Bunds on Tuesday and conventional paper on Wednesday; Italy follows with a syndication on Thursday.

Meanwhile, UK PMIs for July will give a snapshot of how the economy is faring amid weak growth and elevated inflation. Markets will be particularly sensitive to the employment components, with recent data pointing to a softening jobs market. The Bank of England is expected to keep cutting rates at a gradual pace, though Governor Bailey has flagged more aggressive moves if labour market conditions deteriorate. June retail sales and the GfK confidence survey are also due, alongside public finance figures, on Tuesday. The UK will sell linkers due 2035 on Tuesday and conventional gilts maturing in 2040 on Wednesday.

Japan is a major focus this week, with Prime Minister Ishiba’s coalition losing its majority. A change in government may delay trade talks with the US and lead to calls for aggressive fiscal easing, including tax cuts that would complicate the BOJ’s path to normalisation. Deputy Governor Uchida is due to speak on Wednesday. Friday’s Tokyo CPI is expected to remain well above target, reinforcing the BOJ’s cautious stance. The Finance Ministry auctions 40-year JGBs on Wednesday, with investor demand likely to be shaped by election results and debt trajectory concerns.

Over in China, attention shifts to policy. The PBOC is expected to hold loan prime rates steady on Monday, though economists still forecast modest easing later in the year. The focus turns to the upcoming EU-China summit amid rising bilateral trade tensions. Any signalling on tariffs or economic support could shift sentiment, but few expect bold moves while global uncertainty persists.

FX

ECB Central Bank Play:

The ECB meeting on Thursday provides us with a better view of where Lagarde and Co see the neutral rate to be, and although there’s little chance of a cut now, there’s a 50/50 probability currently implied for September.

We believe that without a trade deal with the US, and given the current tier 1 economic data, there’s little reason for the ECB to cut further from here. Of course, a lot can happen between now and September, but we like to position for a rare case of a hawkish ECB meeting.

Given that several EUR crosses have taken a breather over the past week or so, it gives us some nice ways to set up a central bank play.

Buy a 2-week EUR/CHF risk reversal, buying a call at 0.9350 and selling a 0.9275 put for a zero up-front cost, targeting a move to 0.9400.