Top Trade Ideas - July 22nd

More fuel to the volatility fire.

The week behind us was a story for tech. More concerns about the US-China trade war saw the tech-heavy Nasdaq fall 4%. Elsewhere, European markets fell following this news, which was negative for major names such as ASML. Japan markets joined China in a decline. In good old British fashion, the FTSE remained relatively flat. Markets up, markets down, the FTSE never goes anywhere… it seems.

In G10 FX, it was a tale of two halves. The start of the week continued the USD off, risk-on mood. However, the sharp move lower in US equities, along with higher yields, caused the DXY to end the week higher, along with other safe- with rising US haven currencies.

The Week Ahead

US Q2 gross domestic product data and PCE inflation numbers will be closely watched as investors increasingly expect the Federal Reserve to start reducing interest rates in September.

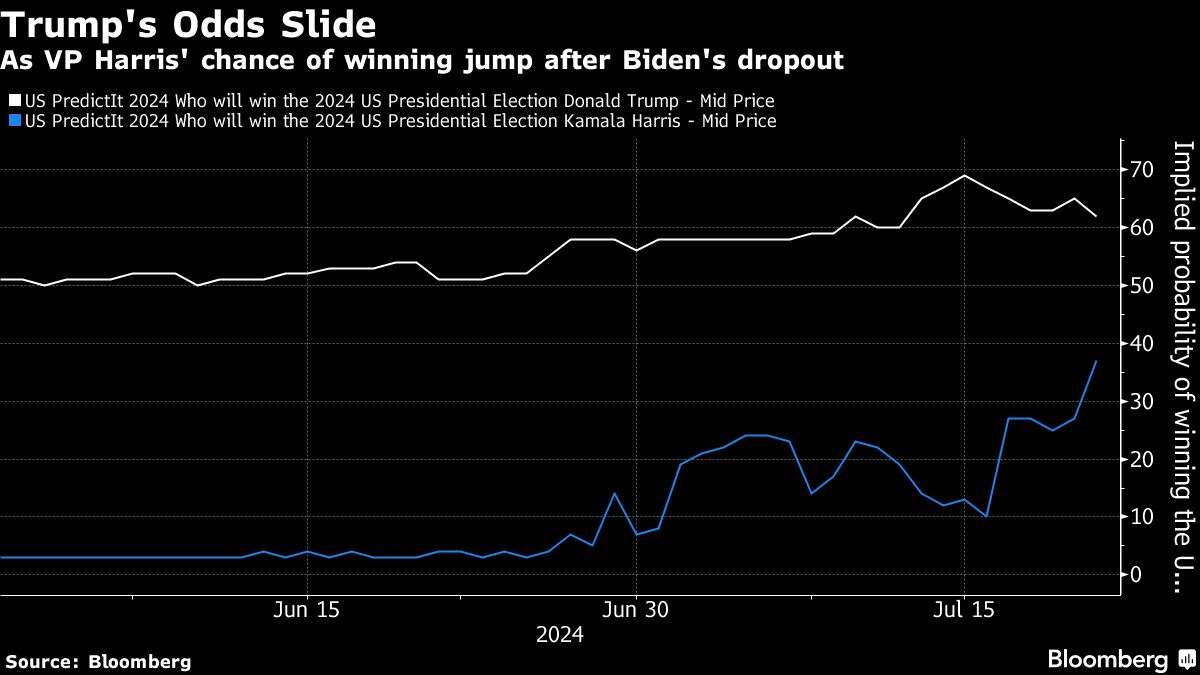

Markets will keep a close eye on politics and any signals from Republican presidential candidate Donald Trump—who is expected to win the election—about his policy plans. Analysts expect plans for extensive tariffs and fiscal spending to lift the dollar and longer-dated Treasury yields, although Trump has also hinted at wanting a weaker dollar. But this week may also see a shift as Kamala Harris gets the Democratic nomination.

The Bank of Canada announces a decision and could deliver a second consecutive rate cut, while in Europe focus will be on the latest provisional purchasing managers’ data for July.

A relatively quiet week in Asia features a rate announcement from the People’s Bank of China and a meeting of Singapore’s monetary authority.

Other data on tap include some inflation numbers out of Japan and Singapore, plus a second-quarter growth print from South Korea.

Equities

Investors are starting the week scrambling to decide if President Joe Biden’s decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump’s chances of regaining power.

The announcement is expected to create more uncertainty, which usually leads to a decline in stock prices and an increase in demand for quality assets.

Within financials, Trump has made overtures to Bitcoin miners. In June, the former president met with the industry’s executives, saying he loves cryptocurrency and would advocate for miners. That gives us two ideas: Coinbase and Marathon Digital.

Coinbase (NASDAQ: COIN), unlike many names last week, ended higher. It’s good to find strong sectors amidst rising concerns. Crypto names look like a good option. BTC held up over the weekend, and we expect a move in both the digital asset and the stock-related names to continue.

TRADE IDEA - COINBASE WITH CRYPTO STRONG

Entry: 258

Stop Loss: 250

Take Profit: 280

MARA pulled back in the middle of last week and failed to have a standout day on Friday as COIN did. For this reason, we leave our order just below last week’s price action and at the support on the 23 level.

TRADE IDEA - MARA ON SUPPORT

Entry: 23

Stop Loss: 21

Take Profit: 28

The Biden administration’s support for electrification and blue and green hydrogen production has been a boon for clean-energy stocks. A November election win for Donald Trump will threaten $369 billion in US clean energy initiatives from the Biden administration’s landmark climate law.