Top Trade Ideas - July 7th

Tariffs are back in the spotlight, but the fine details remain unclear.

US equity markets closed the shortened holiday week at record highs, fueled by a strong non-farm payrolls report and continued optimism around global trade. The S&P 500 rose 1.7%, the Dow 2.3%, and the Nasdaq 100 1.5%, as nearly all sectors advanced, led by materials, tech, and financials. Typically lower liquidity during the summer period, coupled with the holiday-shortened week, led to slightly higher volatility.

Economic data reaffirmed momentum, with payrolls and unemployment both beating expectations. Powell struck a more cautious tone, saying inflation could rise over the summer, prompting markets to scale back expectations for near-term rate cuts. The 2s10s flattened by 7bps as yields rose across the curve.

Trade headlines were front and centre. The US struck deals with Vietnam, while talks with Canada resumed after Ottawa scrapped its digital services tax. However, negotiations with the EU and South Korea remain unresolved ahead of looming tariff deadlines. Meanwhile, Trump’s signature tax bill passed the Senate but faces hurdles in the House.

The dollar ended flat, while short-end rates rose alongside strong data and Powell’s remarks, helping support the greenback into week’s end.

(To get full access to all research and notes posted, subscribe to premium.)

The Economic Week Ahead

Markets face a key inflexion point this week as the July 9 deadline for the US reciprocal tariff pause arrives; however, Scott Bessent has said that August 1 will be the implementation date for April 2 tariff rates. A decision to impose across-the-board tariffs would likely trigger risk-off moves across FX and bonds, while another delay could boost risk appetite. With trade still the dominant macro tail risk, investors will also parse Fed minutes, global inflation data, and a wave of central bank decisions across Asia-Pacific.

In the US, attention turns to Wednesday’s Fed minutes for clues on how close officials are to cutting. While a few policymakers floated the possibility of a July move, the stronger-than-expected jobs report has pushed market pricing for the next cut into Q4. Powell has said the Fed might have already eased if not for tariff uncertainty—a theme likely to dominate this week's narrative as the deadline approaches. Data releases include jobless claims, small business sentiment, and the NFIB index, while $119 billion in long-end Treasury supply could test demand amid ongoing fiscal concerns.

In Europe, economic data is light, but German industrial production and French/Italian inflation prints will offer signals on growth momentum and disinflation. Eurozone finance ministers meet early in the week. The ECB’s path to further easing will be shaped not only by incoming data but also by global risk sentiment tied to US policy. Germany leads sovereign issuance with two bond sales midweek.

The UK sees a dense domestic calendar, including monthly GDP, trade, and industrial production on Friday. A weak print could reinforce expectations for an August BOE cut, which markets currently price at over 60%. The OBR’s fiscal risk report and the BOE’s Financial Stability Report may also spark debate on the long-term sustainability of UK public finances.

In Asia, monetary policy decisions from Australia, New Zealand, South Korea, Malaysia, and Thailand dominate the calendar. The RBA is expected to cut rates on Tuesday amid falling inflation and weak demand. The RBNZ, by contrast, is likely to hold steady, citing neutral policy settings and early signs of recovery. The Bank of Korea is also expected to stay on hold after May’s surprise cut, balancing household debt concerns and a tech-led export rebound.

Malaysia’s central bank faces a close call; recent macro weakness may push it toward easing, though most expect a cut by September. Thailand’s CPI will show whether deflation pressures persist; fuel base effects may lift the headline figure.

Japan releases its regional economic report at the BOJ branch managers’ meeting on Thursday. Key focus: whether the recovery and wage trends are becoming broad-based. The BOJ will also conduct JGB purchases on Friday, while the Finance Ministry auctions both 5-year and 20-year paper.

China’s inflation data is expected to confirm persistent deflation, with both CPI and PPI remaining negative. Any deeper slide could revive calls for further stimulus. Credit and FX reserve data are also due, while markets remain alert for signals from Beijing on tariff negotiations, particularly around rare-earth exports.

Indices

Markets head into the week with a familiar script: Trump talks tough on trade, US indices shrug, and the “TACO” trade keeps running. Headlines may cause intraday ripples, but structurally, the market has seen the pattern before. US equities have learned to look through the fog.

But watch Japan…

The bigger vulnerability isn’t in the S&P. It’s in Tokyo.

The Nikkei has been a standout performer year-to-date, rallying on AI exposure, policy divergence, and strong inflows from foreign and domestic investors. But that strength now leaves it exposed. Trump’s tariff sabre-rattling carries real headline risk for Japan, particularly around autos—a sector that is both economically central and politically symbolic.

No hard details have emerged yet, but the setup is fragile: Japan was first in line for Trump’s trade recalibration back in April, but no deal materialised. If tariffs are announced (or even credibly threatened), we could see a sharp drawdown in the Nikkei (200d and 50d are targets below), especially in auto and industrial names that have outperformed. Trump has stated that he will not be lenient with those he views as poor negotiators.

Trade View:

US Equities: Maintain core longs. Tariff noise is more theatrics than threat. Stay selective—focus on AI infrastructure, services, and domestically leveraged names that benefit from fiscal thrust and consumer resilience.

Japan: We’re watching closely for short setups in the Nikkei. The market is stretched, momentum has cooled, and tariff risk gives the bears something to work with. Any sharp drop may attract dip buyers, but positioning is no longer light. The first move could be real.

FX

Tactical long USD / short GBP:

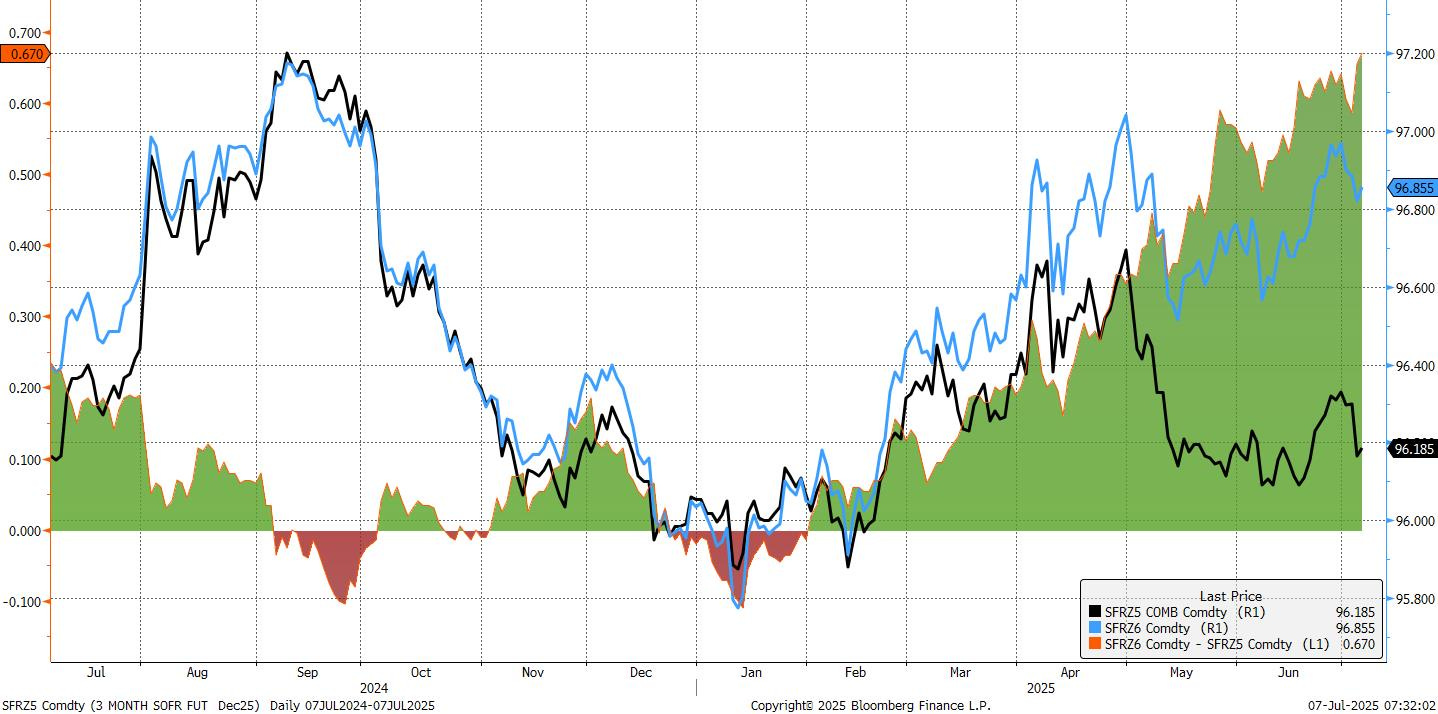

The strong June jobs report and subsequent move in SOFR futures mean that there’s scope for a short-term squeeze higher for the USD. While we still favour being long EUR/USD over the medium term, we do like tactically being short GBP/USD.