Top Trade Ideas - June 10th

CPI, FOMC and stock splits.

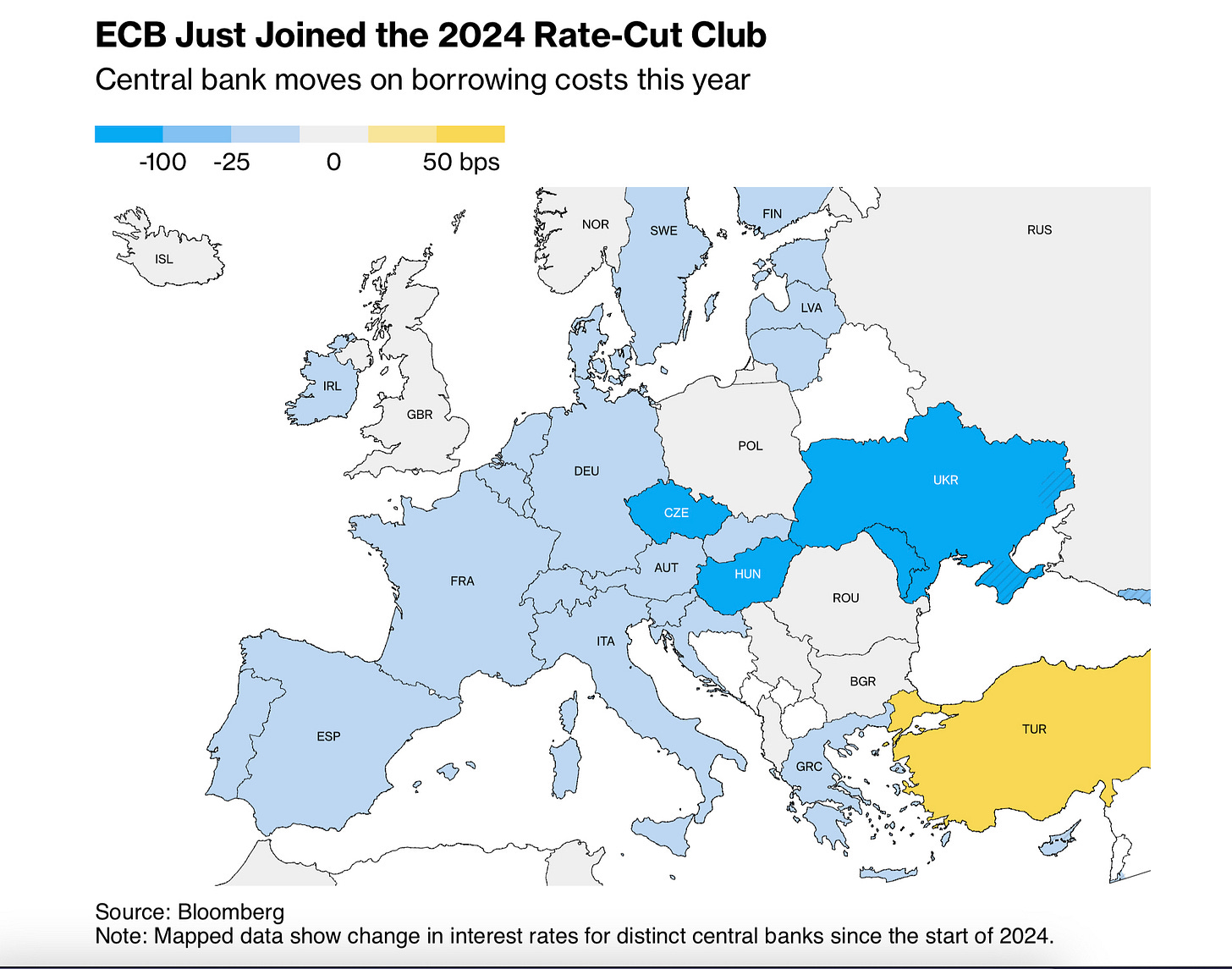

Equity markets in the US were back to their usual 2024 self, soaring to new all-time highs. Elsewhere, markets were relatively calm. Stoxx 50 and 600 made progressive moves higher as the ECB made their first cut of the year (and the first move lower by a major CB). But this was heavily priced in already.

Indian markets saw the most volatility. After an open at new highs, markets saw a 5% decline as polls indicated Modi was not about to have a landslide victory. A heavy overreaction saw prices recover back towards highs. India should continue higher from here.

In G10 FX, EUR hardly reacted to the ECB meeting, but the US Dollar certainly did following the large NFP beat to close out the week, with the DXY closing just shy of 105.00

The week ahead sees US CPI and an FOMC meeting take the headlines on the calendar front. Oh, just an NVDA 10-1 stock split, too. (A short trade…?)

All good? Okay. Now, onto the rundown from the team. Let’s start with FX.

FX

We like to be a dip buyer on EUR/USD following the events of last week. The ECB delivered a hawkish cut, with the commentary clear in our eyes that they are cutting from a position of relative strength. We feel the market has the potential to price out some of the bps worth of cuts by year-end, adding support for EUR buyers.

As for the USD leg, sure, the headline NFP print was a surprise, but unemployment ticked higher to 4%. The bid in the dollar was warranted on the day, but we struggle to see how this materially makes the greenback a buy this week. We think people are either USD bears or neutral, with few outright bulls right now.

We flag as a risk the US Fed meeting on Wednesday and will look to tighten up the position ahead of this event to limit risk.

TRADE IDEA - BUY THE DIP ON EUR/USD

Limit Order: 1.0790

Stop Loss: 1.0705

Take Profit: 1.0990

We’ve steered clear of trading JPY in recent weeks. For one there has been little news out post-MoF intervention. Further, the price action has been rangebound.

Yet we do feel that this is about to change due to the falling wedge pattern that has been building in recent weeks. For any of the technical analysts out there, the textbook would say that this should break out to the high side.

Given our lack of USD bullishness, we’re not 100% convinced on this, and with the wedge tightening up, we could see a break lower. Either way, next week should tell us where the next move is coming, and with the US Fed meeting on Wednesday and the BoJ meeting on Friday, there are clear catalysts for a move.

TRADE IDEA - PLAY THE WEDGE BREAK ON USD/JPY

Either buy a break above 157 or sell a move below 155 on Monday, or chart the above wedge and play the break on either side when it occurs.

Targets 160 topside and 152 downside

As per, we offer a free trial to our premium content, which is just £10/month.