Top Trade Ideas - June 19th

10 trading ideas to watch this week.

Last week, the bullish flow continued. Names such as Apple reached all-time highs, and Nvidia closed the week as a $1 trillion company.

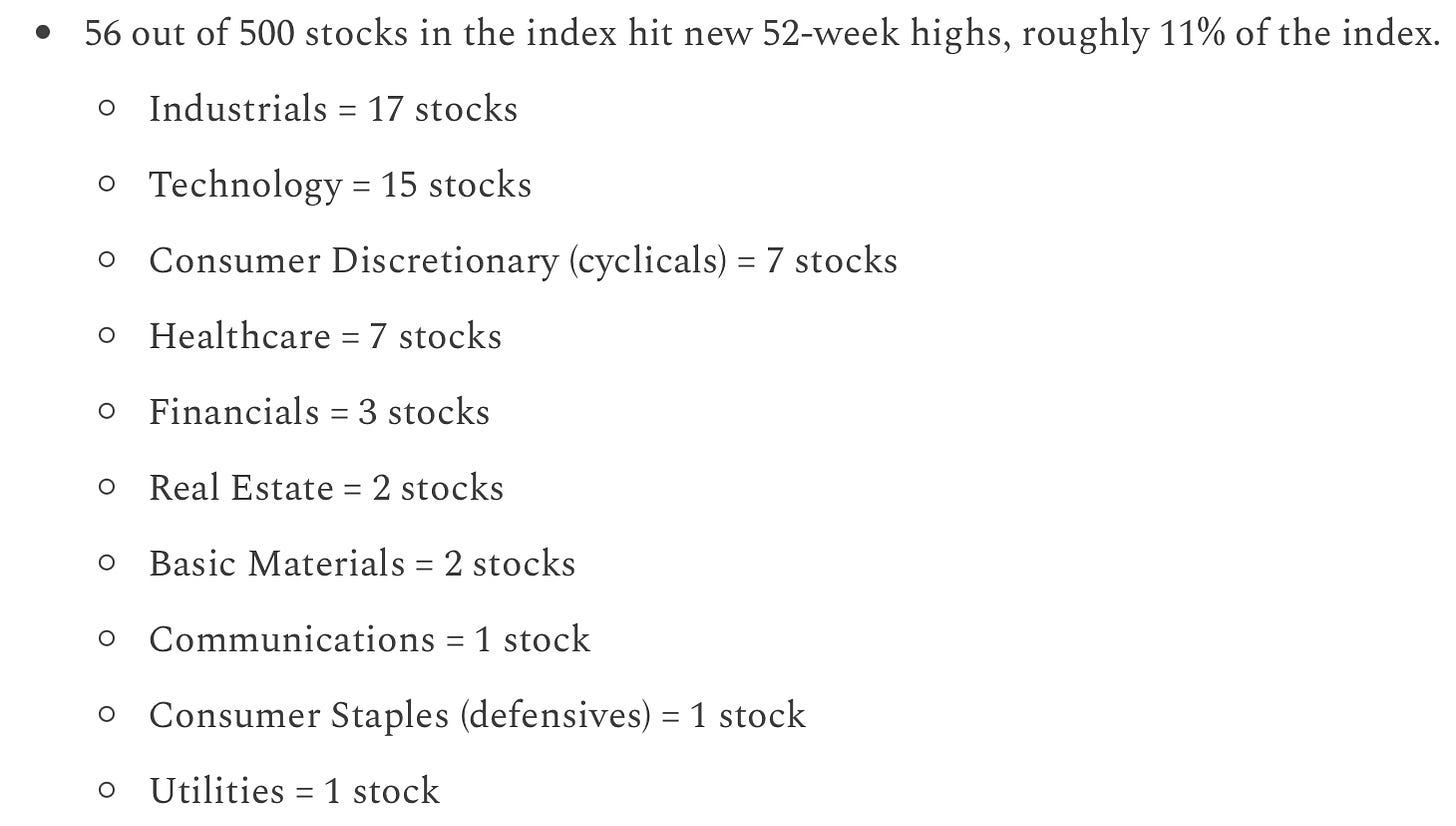

Plenty of stocks are reaching recent highs. A great snapshot of the performance can be found below, with credit to Caleb Franzen and Cubic Analytics (the publication is worth checking out).

11% of the index hit 52-week highs. This is no bear market rally.

Our equity ideas from last week all made major moves. CrowdStrike flew higher after reports of hacking in the US, Unity broke higher out of resistance, American Airlines flew higher (missing our target by a mere $0.08, and our other ideas of AMD and NVDA both hit targets early in the week. Not a bad week, and we expect the same again this week with our ideas.

In the FX complex, we got a sharp move lower in the US Dollar post-Fed, with the market not really believing the hawkish tone that Powell tried to strike. This was further compounded by a resolute ECB, helping to push EUR/USD back towards the 1.10 level. On the flipside, JPY bulls were once again disappointed by the BoJ, with USD/JPY soaring up to high 141s.

We are including two equity ideas for free this week so all readers can get an insight into how we explain and layout our ideas. Take note of these plays.

Equities

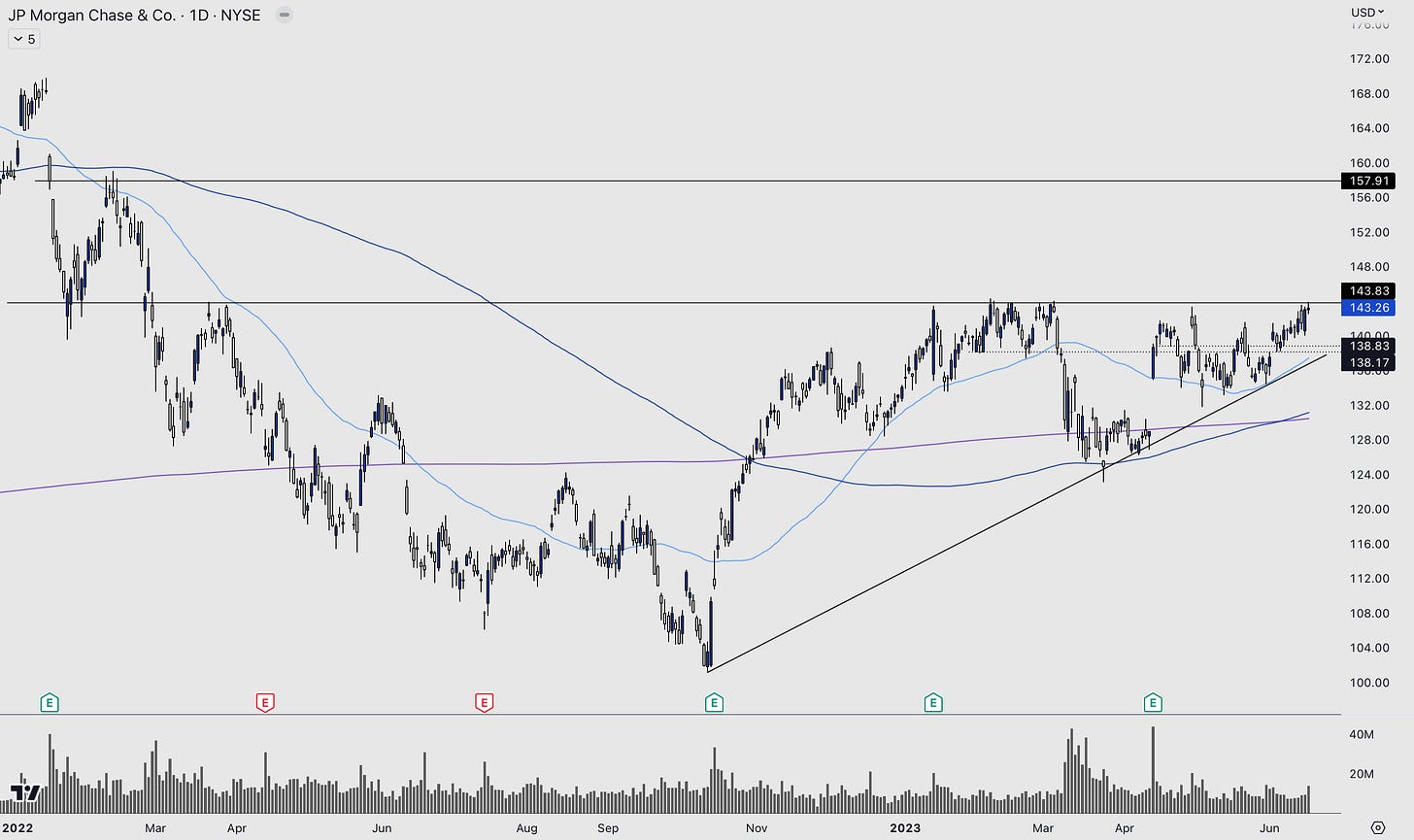

Banks have been recovering from the March madness. JP Morgan Chase (NYSE: JPM) is back at the same levels as before the bank failures started.

In fact, this current level has been a resistance throughout 2022 and into this year. We think banks will continue to trend higher, and a breakout on this name is likely.

TRADE IDEA - JP MORGAN MOVING

Entry: 143.26

Stop Loss: 137.00

Take Profit: 157.90

Consumer stocks are starting to see some interest. Target caught a lot of attention last week after bouncing 10% off lows. We think momentum can continue in the sector, and Walmart (NYSE: WMT) has a great look.

We would prefer to wait for a pullback to the breakout level before entering long. Make an alert for this level, set and forget.

TRADE IDEA - WALMART BREAK AND RETEST

Entry: 153.70

Stop Loss: 152.00

Take Profit: 160.50