Top Trade Ideas - June 24th

Inflation, intervention and ideas.

In G10 FX, the US dollar had a quieter week, but a dovish hold from the BoE and a surprise cut from the SNB kept other G10 currencies skittish.

Focus switches back to US economic data in the coming week, particularly Friday’s PCE inflation data, the Federal Reserve’s preferred measure of inflation.

In Europe, the focus remains on politics and any moves in French assets as investors remain nervous ahead of snap elections in France, with the first round set for June 30. Polls show strong support for Marine Le Pen’s far-right National Rally party, raising concerns about potential political gridlock and excessive fiscal spending.

Rate decisions in Sweden, the Czech Republic and Turkey, plus inflation data in Canada, will also attract attention.

A string of economic data from Japan, a decision by the Philippines central bank and China PMIs are the main events in a relatively quiet week in Asia.

Inflation prints from Australia, Singapore and Malaysia are also on the radar, shedding light on how price pressures are doing midway through the second quarter.

Equities

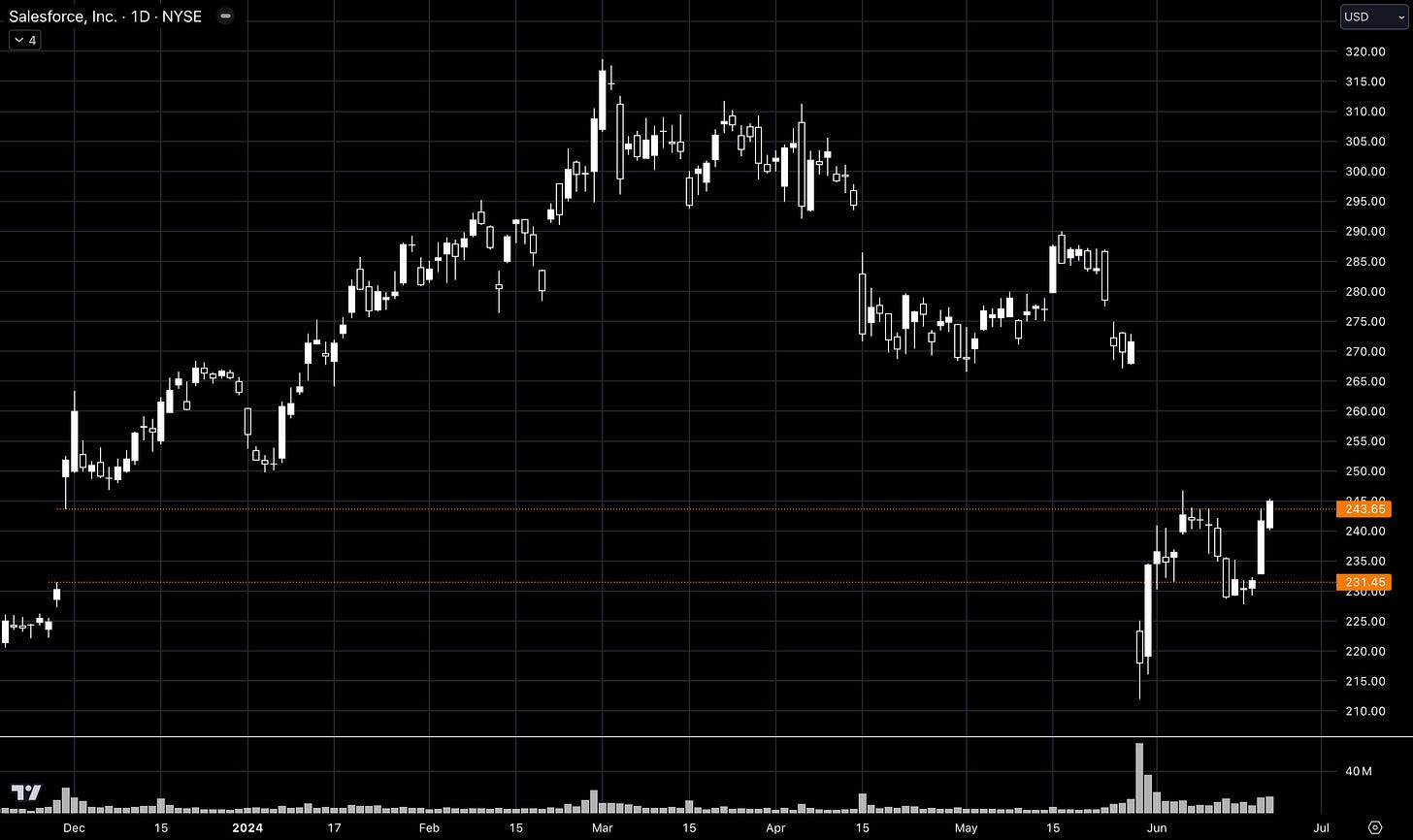

Salesforce was a standout performer last week, closing the week up 5.7% compared to the S&P 500’s relatively flat week (0.6%). Software companies were a strong sector last week.

CRM closed last week above a resistance level we have noted. There is a big gap above from an earnings drop. These gaps can usually see price move quickly higher or lower through them.

This is a main watch for us this week for a continued break higher.

TRADE IDEA - CRM BREAKOUT

Entry: 245

Stop Loss: 238

Take Profit: 260

Coinbase has been a strong stock this year with cryptos resurgence in the markets. But that same reason driving it higher could be the reason for a further move lower in the coming week.

Bitcoin is down 13.4% from MTD highs. We believe this move can go lower in the short term (more on that trade later), and COIN will struggle to make a material move higher if it does.

Therefore, we think COIN offers a good short setup this week in the markets.

TRADE IDEA - CRYPTO LEADING COIN

Entry: 224.50

Stop Loss: 230.00

Take Profit: 201.00

If you’re new, or maybe you’ve never tried our premium content, you can access a 7-day free trial here.

Trades are shared every week, as well as access to our long term positioning in our Global Asset Portfolio. Plus, full access to our research articles.