Top Trade Ideas - March 10th

Europe’s fiscal reform, continued tariff-induced vol, and some thoughts on commodities.

Investors looking for President Donald Trump to use policy to stop the stock market from falling are likely to be disappointed, Treasury Secretary Scott Bessent said Friday, after he rejected the notion of a “Trump Put.”

That sums up the feeling across markets. A year that started full of euphoria has fizzled out as the narrative towards growth concerns. The other narrative of 2025 is one of Europe > U.S. (as highlighted below).

Europe has beaten the U.S. stock market by more than 19ppt in 42 trading days. This comes after Europe’s worst such stretch ever.

The other note we had from Bessent’s Friday speech: “The market and the economy have become hooked, become addicted, to excessive government spending and there’s going to be a detox period.”

That sounds like a recession, if you ask us.

The other big stories from last week came from Germany, which plans to unleash hundreds of billions of euros in debt-backed financing for defense and infrastructure investments in a historic shift to overhaul its notoriously tight limits on government borrowing. Friedrich Merz, who will likely be the next chancellor, announced late Tuesday that Europe’s biggest economy would amend the constitution to exempt defense and security outlays from limits on fiscal spending to do “whatever it takes” to defend the country. This will allow Berlin to allot (essentially) unlimited amounts of money to bolster its military.

More fuel added to the European rocket this year. We’ll touch more on this story later.

Some selling was eased on Friday as Fed Chair Powell said the economy was “fine,” but that only added to the whipsaw nature of markets trading off headlines around the economy, tariffs and geopolitical developments. Bonds fell, maybe opportunistically.

U.S. job growth steadied last month while the unemployment rate rose—a mixed snapshot of the labor market. Nonfarm payrolls increased 151,000 in February after a downward revision to the prior month. The unemployment rate climbed to 4.1%.

We’re not placing much confidence in the jobs report right now. Friday’s figures were mixed at best, and we still lack clarity on the direction of the economy. Markets, businesses, and consumers are uneasy with uncertainty, which is likely to lead to increased volatility, which is about the only thing guaranteed right now (FX vol is almost great again).

That sums up the events of last week. Here’s what to note for the coming days.

To access full articles and research, manage your account here.

The Week Ahead

U.S. inflation data for February will be the highlight of economic data as investors continue to follow President Trump’s back-and-forth announcements on tariffs.

The Bank of Canada’s rate decision is due on Wednesday. Rates are likely to be cut amid concern about the economic impact of U.S. tariffs on Canadian imports.

In Asia, the focus is on China’s annual legislature session, which will end during the week, as well as a slew of data releases from Japan, including GDP.

Oracle and Adobe are the only companies of note on the corporate front this week.

Overall, relatively quiet. But there’s always the possibility for some surprise events.

Germany’s Fiscal Reform

Trialing this week with a slightly different format. We’ll run through the themes we’re watching and the linked ideas, rather than asset by asset rundowns. Let us know (comments or email reply) if you prefer this format or the previous.

Since President Donald Trump has signaled he’ll pare back the US security presence in Europe, governments on the continent have been rushing to boost defense spending to counter the threat of Russian aggression. Trump also ordered a pause to all military aid to Ukraine, which will shift a massive burden on Kyiv’s European allies.

The European Union separately announced a plan on Tuesday that could mobilise as much as €800bn in additional national spending, which includes €150bn of EU loans to member states for defense investment. The €500bn for infrastructure spending should be ready quickly and stretched out over 10 years. Some €100bn of the total amount will be allocated to Germany’s 16 states.

While “Europe Rearmament” has been a theme that started on the back of the November U.S. election and ramped up in 2025, the news last week highlights more attention to other industrial names. This area may possess a better risk/reward than jumping on the military theme.

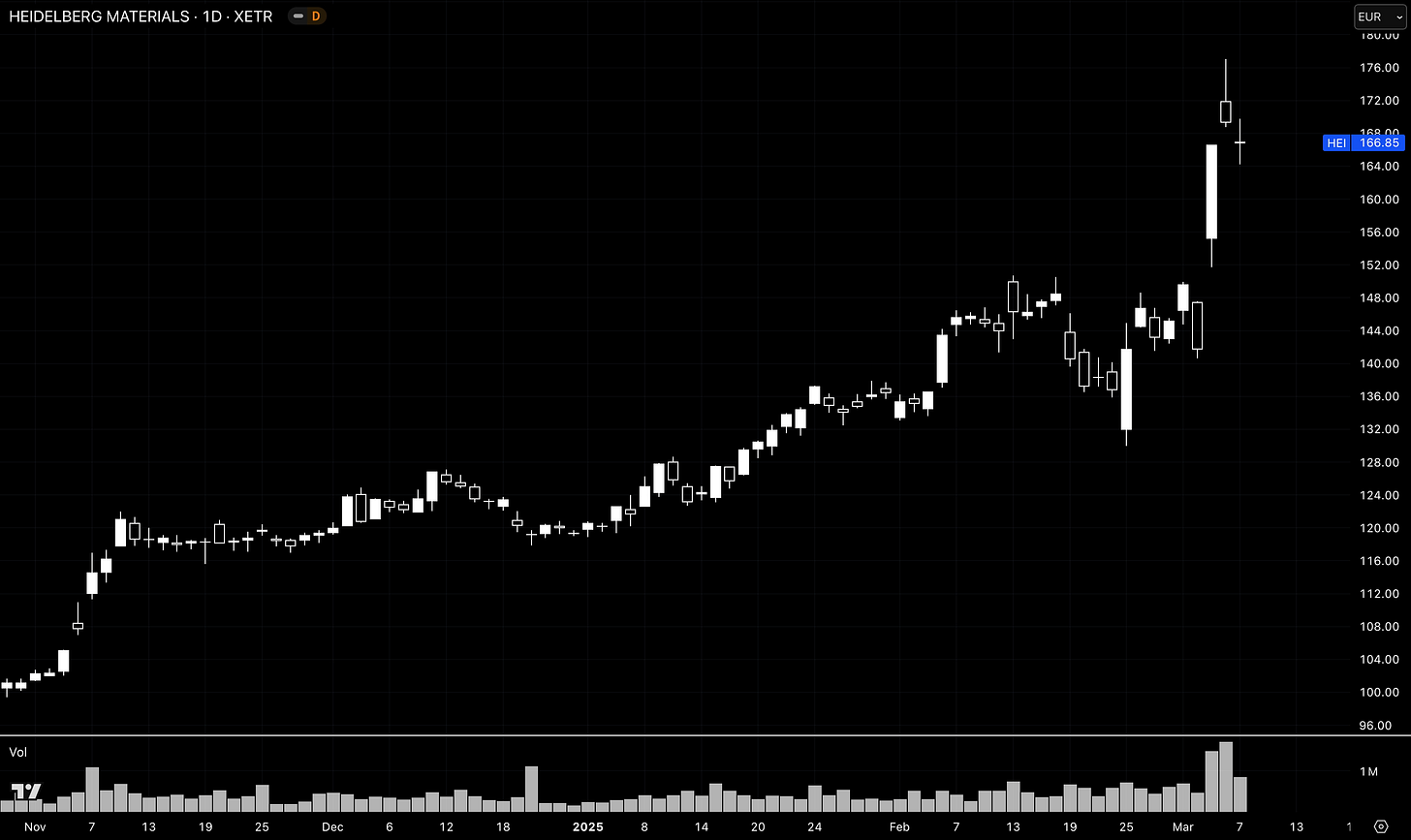

The announcement of the infrastructure package boosted cement maker Heidelberg Materials and construction group Hochtief, which were among the best-performing German blue-chips on Wednesday, with gains of up to 14%. That is a notable jump higher, but if you take a long-term view that the shift in Europe will create a lasting benefit, these levels may not be too bad to get long.

If fiscal measures include incentives for German manufacturing or support for key industries, Siemens AG could see increased demand for automation and industrial digitalisation solutions. Additionally, if policies aim to boost Germany’s exports, Siemens could benefit as a global industrial leader.

Regardless of fiscal policy specifics, Siemens has been growing its digital and AI-driven automation segments, which are high-margin businesses. If fiscal policy favours industrial expansion, Siemens’ growth outlook could improve further.

We’re targeting 265 for a short-term move.

TRADE IDEA - LONG SIEMENS AG

Entry: 230

Stop Loss: 220

Take Profit: 265

Shifting towards some macro trades on this topic, one spread that we have been watching this year is between the SOFR and EURIBOR Z5 contracts. After the Fed reduced by 50bps in September, the rate cut outlook in the U.S. has diminished while Europe stayed on course. The spread widened to about 210bps, but an inflection is observable over the last few weeks.