Top Trade Ideas - March 17th

Back to buying the dip or still selling the rip?

Most of the noise from last week came in the equity space as U.S. stocks headed into correction territory. However, Friday saw a turnaround attempt after a $5tn selloff since mid-February. A mean reversion looks on the cards, more on this later. The S&P 500’s 2.1% advance was the biggest since the aftermath of the November presidential election. The moves wrapped up a week filled with drama that featured Trump’s fluctuating tariffs, rising recession fears, geopolitical discussions, and worries about a potential US government shutdown. Dead cat bounce or “scared cat bounce” (as Ed Yardeni put it)? We will have to wait and see.

Gold rejoiced after passing $3,000 for the first time, +13.71% YTD.

Treasury Secretary Scott Bessent, said he’s not worried about the recent downturn, calling the correction “healthy.” The word “correction” is such a therapeutic euphemism for everyone losing a lot of wealth very quickly.

Yields on German bonds surged as government leaders agreed on a massive defense spending package. Germany’s new spending deal, which earmarks €100bn for climate projects, gave a jolt to green energy companies that could benefit from the wave of extra funding. Shares of German wind turbine maker Nordex SE soared 10%. Siemens Energy AG (one of our longs last week), which makes critical grid equipment and wind turbines, gained as much as 5.1% on the announcement.

The meme to summarise last week:

Here’s what to note for the coming days.

To access full articles and research, manage your account here.

The Week Ahead

The centerpiece for investors next week: the Federal Reserve. The central bank is unlikely to lower interest rates, but investors will be keen to hear the Fed's perspective on the inflation outlook and borrowing costs during the Trump administration. We will also have the release of the latest dot plot. Additionally, several other monetary authorities are scheduled to meet as well.

Elsewhere, it is a comparatively light week for economic data and earnings. The BoJ have a rate decision in the Wednesday Asian session, and the EU have inflation data out on the same day. The BoE meets on Thursday for the same decision on rates.

Notable blue-chip companies due to update investors include FedEx, Micron and Nike.

Onto the team’s ideas and thoughts for the week ahead, which includes high beta names, macro trades, attention back towards China, and a special situations play.

Risk On/High Beta

To start this week’s thoughts, we focus on the equity space. The 2% rally on Friday persisted, even as data showing a slide in consumer confidence was released. The week could see a reversal in high beta names that have been under heavy selling pressure in recent weeks.

NVDA barely participated in the election rally compared to other names like TSLA. Up 16% from lows on March 11th, the extension of this move could head towards the 130 region if a U.S. recovery builds momentum on Friday’s action.

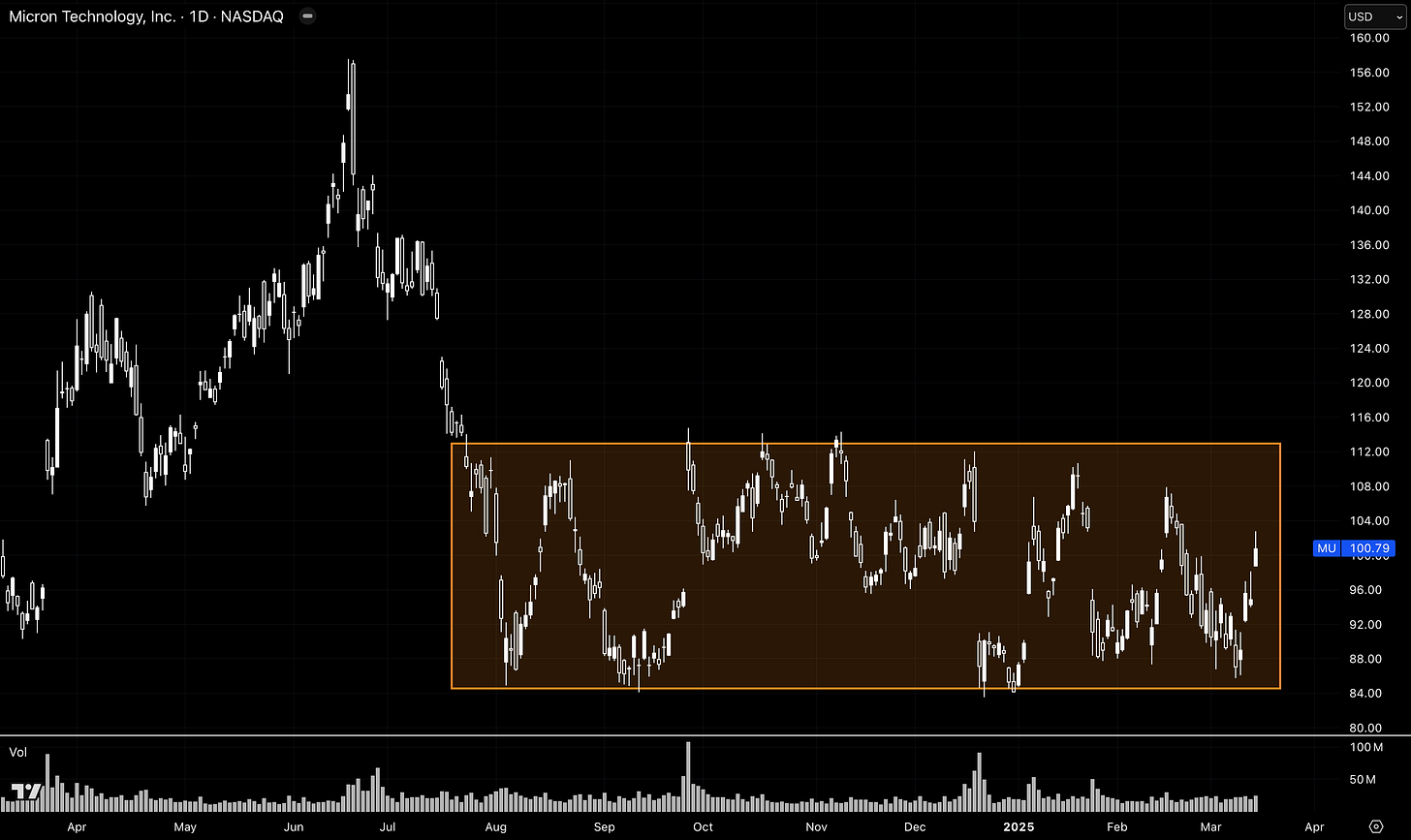

A catalyst in the chip sector is the Micron earnings, mentioned earlier. Micron stock has had a bumpy start to the year, seeing it swept up in broader tech sector volatility, leaving the stock up 18% in the green YTD, but still within a larger consolidation. The chipmaker’s CEO Sanjay Mehrotra warned that “consumer-oriented markets are weaker in the near term” but anticipated a return to growth in the second half of its fiscal year.

We’re on watch for guidance for the rest of 2025. With the stock having been in range for eight months, any upside surprise in earnings/guidance could see an extended breakout higher, helping to boost any tech recovery this week.

The final equity high beta name to note this week is TSLA, a key name for many reasons, with Elon’s part to play in the new administration.