Top Trade Ideas - March 18th

A big schedule for the week ahead provides the team with lots of trade ideas. Here's what we're watching.

The upcoming policy meeting of the Federal Reserve on Wednesday is expected to have a significant impact on the global stock market for the next quarter. Before the blackout period, the Fed Chairman, Jerome Powell, hinted that the central bank is close to gaining the confidence to cut the interest rates, while there are ongoing debates on the extent of those cuts.

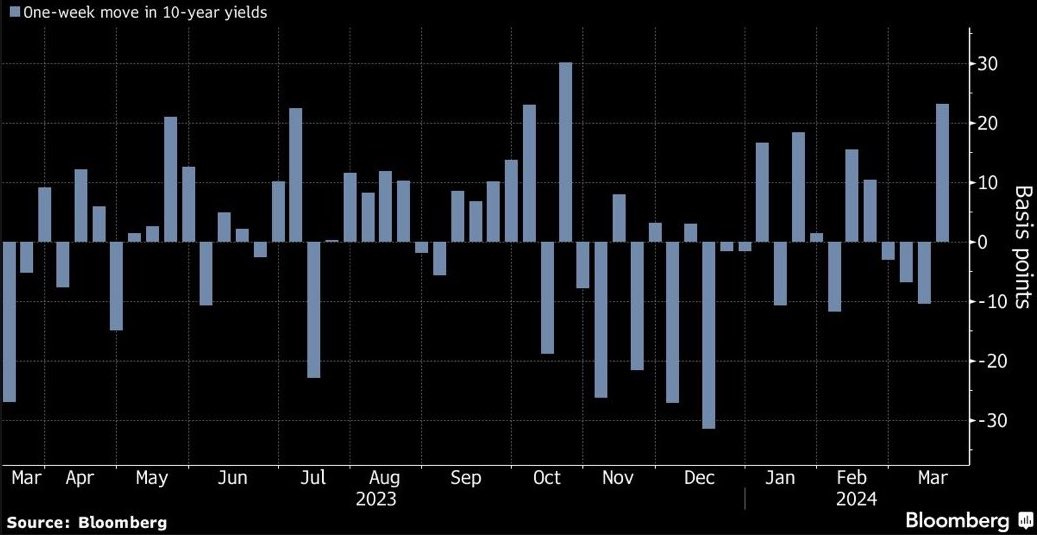

On the other hand, bond traders seem to have come to terms with the reality of higher yields for a longer period. The yields on two-year Treasuries, which are sensitive to policy changes, have surged by 11 basis points this month, adding to last month's gains. Swaps traders are currently estimating about 71 basis points of rate cuts by the end of the year, which is down from 134 basis points at the beginning of the year.

In G10 FX, the market couldn’t make up its mind whether it wanted to bid or offer USD following the stronger-than-expected inflation print. Ultimately, the greenback ended the week higher than where it started.

We have plenty of action up ahead, with the US Fed, BoJ and key UK data out.

FX

Readers from the past week will record how our bias was long USD, which we expressed via a resting order on USD/CHF. Unfortunately, our order didn’t get filled, but our thinking was correct.

Ahead this week, we have the US Fed meeting. Based on the data since the last meeting and comments from Fed Chair Powell in his recent testimony, we don’t see much tail risk of a weaker USD. There’s a 50/50 chance of a June cut, which feels about right, but our bias is again towards getting long dollars for a hawkish tilt that prices out further cuts later in the year.

We like to express this via long USD/CHF again, with an order close to spot with the aim of targeting the top of the trend channel post FOMC.

TRADE IDEA - THE FED WON’T CUT SOON

Limit Order: 0.8800

Take Profit: 0.9080

Stop Loss: 0.8715

Another key event this week is the Bank of Japan meeting. There’s currently a 56% chance of a 10bps hike coming on early Tuesday morning (UK time).

It’s a really tough one to call, but my gut tells me that they won’t move now but strongly guide for a hike in the spring. This should still provide JPY will a knee jerk stronger move.

However, given the FOMC noise (and the fact that we are bullish USD going into it), it doesn’t make sense to buy USD/JPY puts. Therefore, we turn to CHF/JPY, which we have successfully played lower already this year.

We buy a 168.00 strike Put with a 1 week tenor, which although costs 0.53%, we feel it is good value as we look for a move towards 166.00.

TRADE IDEA - PLAY FOR A STRONGER YEN

Buy a 1 week 168 strike Put on CHF/JPY for 0.53%, targeting 166 for a 3:1 Risk/Return

As usual, we continue our currency, equity and commodity ideas below. You can access these for free by trying our 14-day free trial.

Onto the rest of the alpha.