Top Trade Ideas - March 24th

The first signs of tariffs being walked back, EU/US short-term flip, and financial momentum.

After keeping rates steady last week, Federal Reserve Chair Jerome Powell downplayed growth concerns and the price hits that could be coming from a trade war. President Donald Trump’s administration is preparing to announce a fresh wave of tariffs on April 2, though the exact scope isn’t clear.

Comments about “flexibility” allowed markets to price some walk back in the firmness of Trump’s actions. A weekend headline may have proved that move right.

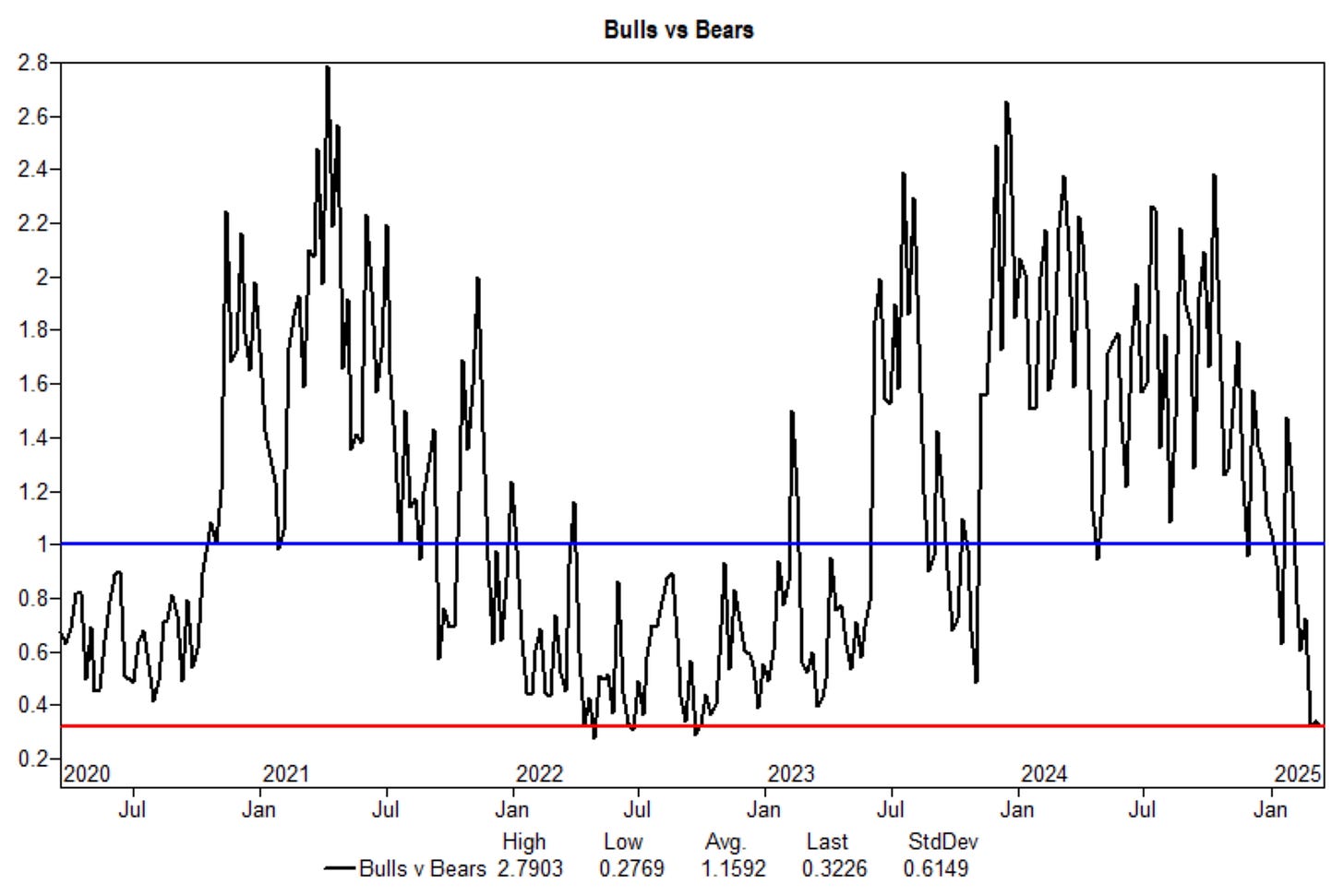

We will go up and down as policy uncertainty continues. Investor sentiment is going to be very volatile, and that will be reflected in the market, but we may have reached a bottom here. Positioning is un-stretched, and investors have room to pile on but are opting to wade in slowly as trading can only be done in incremental periods until we clear the April Fools hurdle.

Stabilisation doesn’t mean immediately reversing and trading in a straight line higher. Usually, it takes a period of back-and-forth churning before the market can gain enough energy to stage a rally.

Elsewhere last week, the BoE kept rates steady, as did the BoJ. Canadian Prime Minister Mark Carney called an election for April 28, with polls showing a close contest between his Liberal Party and the Conservatives.

All in all, it was a reasonably quiet week (maybe because tariff talk took a backseat). Maybe the funniest news of the week is Klarna’s latest deal with DoorDash to offer customers the choice to pay for food deliveries in interest-free instalments or deferred options aligned with payday schedules.

Over the weekend, memes circulated about shorting the new sub-prime BBS market (Burrito Backed Security) or the new “Chimichanga Default Swaps.”

Back to more serious matters. Before we get to the team’s ideas, here are the events to watch in the coming days.

To access full articles and research, manage your account here.

The Week Ahead

Economic data from the U.S. will be closely monitored for indications of how President Trump’s policies might affect consumer and business sentiment. The PCE inflation figures will play a role in shaping the outlook for interest rates. Fed speakers are also out of their blackout period now that the FOMC is behind us. Expect Fed comments to weigh in on markets again.

In Europe, the spotlight will be on the U.K.’s budget, as well as insights into how sentiment within the eurozone is holding up in light of Germany’s recent substantial stimulus proposals and the announcement of upcoming U.S. tariffs.

In Asia, key highlights will include inflation data from Japan, along with minutes from its central bank, Australia’s budget presentation, and a significant policy rate announcement from the People’s Bank of China.

State of Themes

The latest rout in SPX has potentially hit a tradeable low, offering a better upside reward than downside at current levels. A fresh wave of bad news (tariff, growth, inflation, etc.) may need to occur before markets trade lower than March 13th’s price. Until then, we will see some monetisation from the shorts on this move down, helping support a retrace.

On the other leg of this EU>U.S. Exceptionalism theme that we’ve seen so far this year, EU names (SXXP) are up over 8% YTD. There may be a cool-off on this pair, presenting an opportunity to tactically long more U.S. exposure. Ultimately, we feel the trend of EU>U.S. will continue while Europe continues down the path of fiscal expansion, and the new Trump administration keeps the U.S. on a path of budgetary retraction.

Our TSLA long idea was viable as Tuesday’s trading took the stock down to our area of interest, rallying 12% from those lows. The bulk of the move happened Friday, so we expect to see a continued move higher on high beta names.

Some others to keep an eye on are PLTR and NFLX (more obvious large caps), but we also note some smaller names such as HWM, TRGP and TPR.

The banking sector is an area of Europe that can uphold momentum independent of the market. While over a more extended period, the “Bag7” smoked Euro banks in return, over the past year, the financial industry across Europe has done very well. It highlights that, sometimes, beaten-down value stocks do rear their heads again.