Top Trade Ideas - March 3rd

What next after disaster in D.C.?

It was ‘disaster in D.C.’ last week. Zelensky and Trump/Vance’s near-on bust up in the White House has sent some shockwaves worldwide. Starmer and Macron are now vowing support for Ukraine in the aftermath. This is all drawing many cautious eyes on a situation that was supposed to be resolving between Ukraine/Russia. On the back of this event, which primarily focused on the aid going from the U.S. into Ukraine, the Trump administration has set up a crypto reserve.

In other news, Nvidia once again reported strong earnings but failed to wow Wall Street, who now have the bar set at perfection for every report. The open following the earnings was well below the +/-8% implied move. Max pain felt for option buyers.

Equities continued to sell on Thursday as the growth scare developed in the U.S. Everything high beta or high momentum seemingly died. An MOC buy imbalance on Friday saw some relief from the selling, but ultimately, it was a painful week across many markets, including commodities and crypto. Bonds were the safe haven as more rate cuts—on the back of the growth scare—started to get priced in.

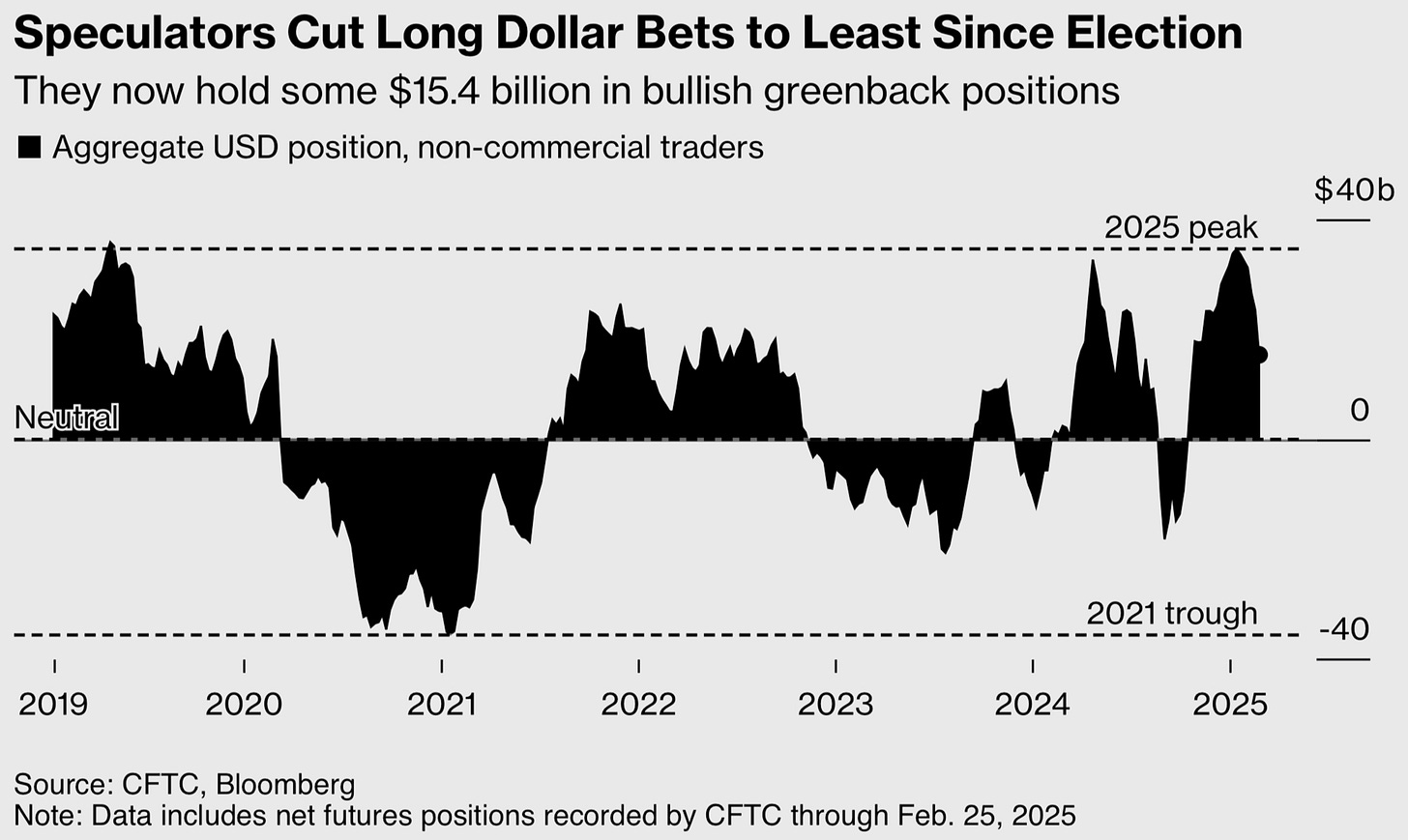

Chart of the week: Dollar bets are off.

Meme of the week: A summary of how it went.

The Week Ahead

Tariff deadlines will be the main watch for the week. Whether Trump goes ahead with levies for Canada and Mexico, or instead, uses them as last-minute leverage to set up some trade deals will have to be seen. These are currently due to come in on Tuesday.

NFP data for February are due on Friday and could be a key indicator of where U.S. interest rates are heading. January’s data showed below-consensus jobs growth but also the unemployment rate falling to 4.0% from 4.1% and wage growth edging up to 4.1% from 3.8%.

Still, investors await more signs of how the economy has been faring since the November election, they said. U.S. money markets currently price in another three 25bps rate reductions by the middle of 2026, with the next one priced for July, LSEG data show.

One key question will be the extent to which recent cuts to government jobs hit jobs data. These could pave the way for rate cuts, although they aren’t expected to be evident just yet.

Apart from that, some Fed speak (notably Waller with Timiraos) is on the agenda.

The ECB’s monetary policy meeting will be the main event in the eurozone with a 25bps rate cut widely anticipated by market participants. This would bring the deposit rate to 2.50%. However, the outlook for a subsequent rate cut in April is uncertain, and investors will pay close attention to ECB comments about the likely pace of future reductions.

Higher defense spending in the European Union could potentially be inflationary. However, weak eurozone growth continues to warrant further, cautious rate cuts. Money markets show the deposit rate is expected to fall to a low of just below 2% in September.

The ECB will also release quarterly staff forecasts on GDP and inflation.

That’s the formalities done. What is the team thinking across markets?

FX

Despite a tick higher in U.S. OIS pricing for more cuts this year, the DXY actually outperformed last week. We put this down partly to the risk-off mood in other asset classes, as well as by Trump’s step up in tariff chatter.

Yet ever since the index traded above 110 at the start of the year, our view has been that the greenback has peaked for the year. We therefore look to fade any short-term pops, with the DXY chart below showing how it has popped to the top of the recent trend line and is now faced with resistance to push higher.

We feel that the mild panic from investors last week will ease. We’re not saying that there’s not more downside potential in equities, but we feel the knee-jerk USD pass through reaction has finished. If Treasury yields keep falling, more attention will be paid to this, causing a likely USD lower move, not higher.

TRADE IDEA - FADING USD STRENGTH

Entry: 107.55

Stop Loss: 108.15

Take Profit: 106.00

EUR/GBP has been trending lower over the course of the past month, with it now back in a key 30 pip band. Late last year, the low 0.82s was defended twice, with the pair turning back higher. With a close last week at 0.8249, and Eurozone CPI along with the ECB meeting on Thursday, there’s a chance that we could test the previous lows of 0.8222.