Top Trade Ideas - November 11th

Insights and ideas for the week ahead.

It’s history on all fronts as the U.S. announces a new President-Elect and markets rally to all-time highs. For the first time, the S&P 500 crossed the 6,000 milestone.

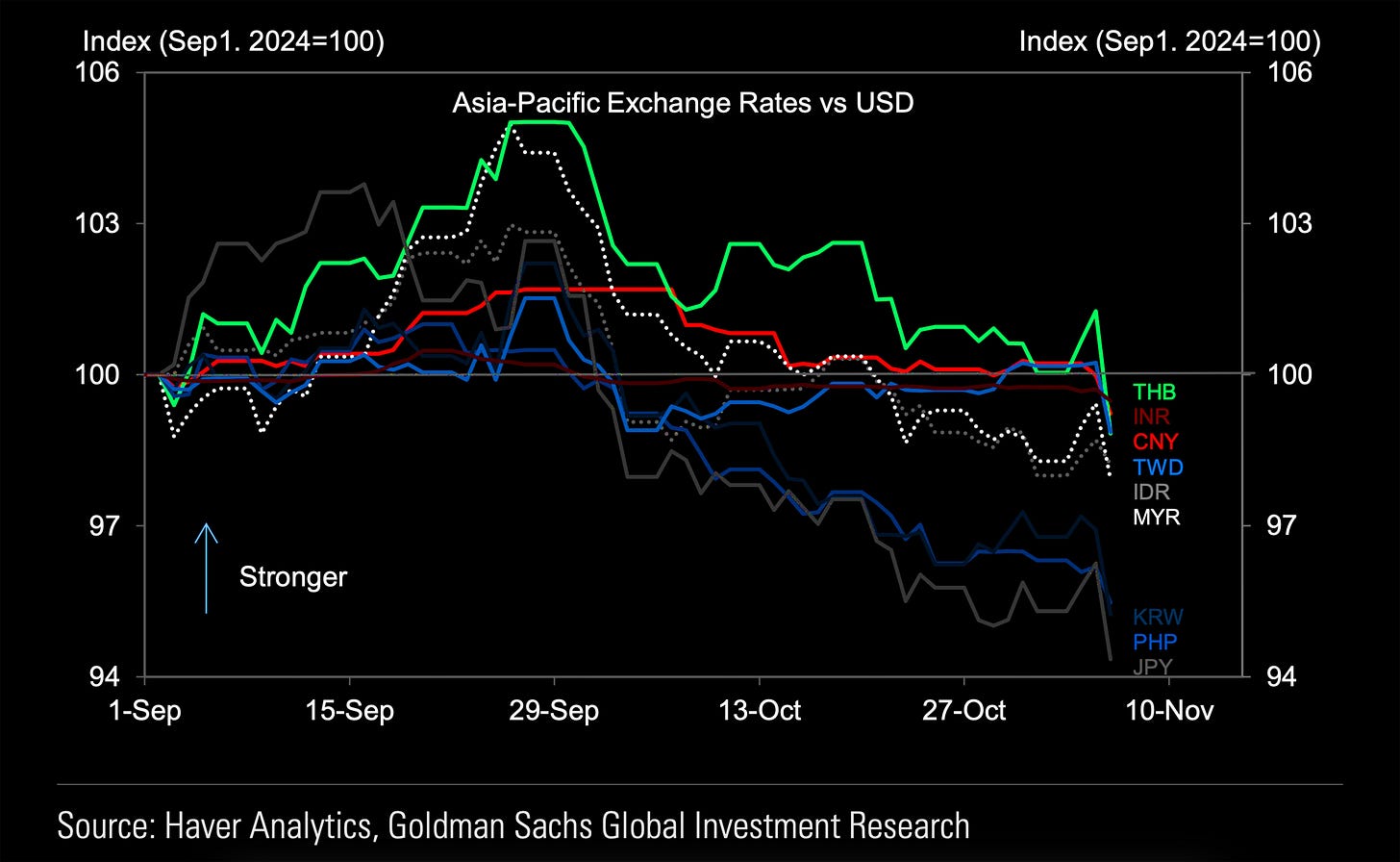

In G10 FX, the main initial reaction post-U.S. election was a strong USD bid, which was retained to close out the week post-FOMC (Asian currencies declined most against the USD, chart below). GBP gained thanks to a reassuring BoE meeting, with EUR coming under pressure with political headaches in Germany.

The Fed cut interest rates last week as expected during its November meeting, but another rate cut in December looks more uncertain following the noncommittal tone. The shift in the Fed’s statement accompanying the latest rate cut suggests that the central bank is less confident that it is winning the battle against inflation.

The Week Ahead

The upcoming week in the U.S., shortened due to Veterans Day on Monday, is poised to be relatively quiet after Donald Trump’s electoral victory the previous week. The specific details of Trump’s policies and their broader implications remain unclear until his inauguration in January. Nevertheless, his proposed initiatives concerning trade tariffs and tax reductions are anticipated to exert inflationary pressures, which may result in fewer interest rate reductions by the Federal Reserve than previously anticipated.

Given this, Wednesday’s CPI inflation data for October will be closely watched and could also affect the Fed’s path. Analysts expect headline annual CPI inflation will be higher in October than September’s 2.4% due to base effects.

Retail sales figures on Friday, Nov. 15, will also be closely watched as they give indications of the health of the U.S. economy.

Elsewhere, a raft of data from China will attract attention, alongside Japanese growth figures and ZEW economic sentiment numbers from Germany. UK GDP figures will be released on Friday.

Below the paywall: A weekly overview of the multi-asset short-term themes we’re currently trading and the fresh opportunities presenting themselves.

FX

We have successfully traded the DXY move higher from the end of September. After sitting on our hands last week to see how the election and FOMC panned out, we feel confident enough to get back long.