Top Trade Ideas - November 13th

The week ahead sees CPI, jobs data and Fed speakers as markets come off the back of another equity move higher and a dollar decline.

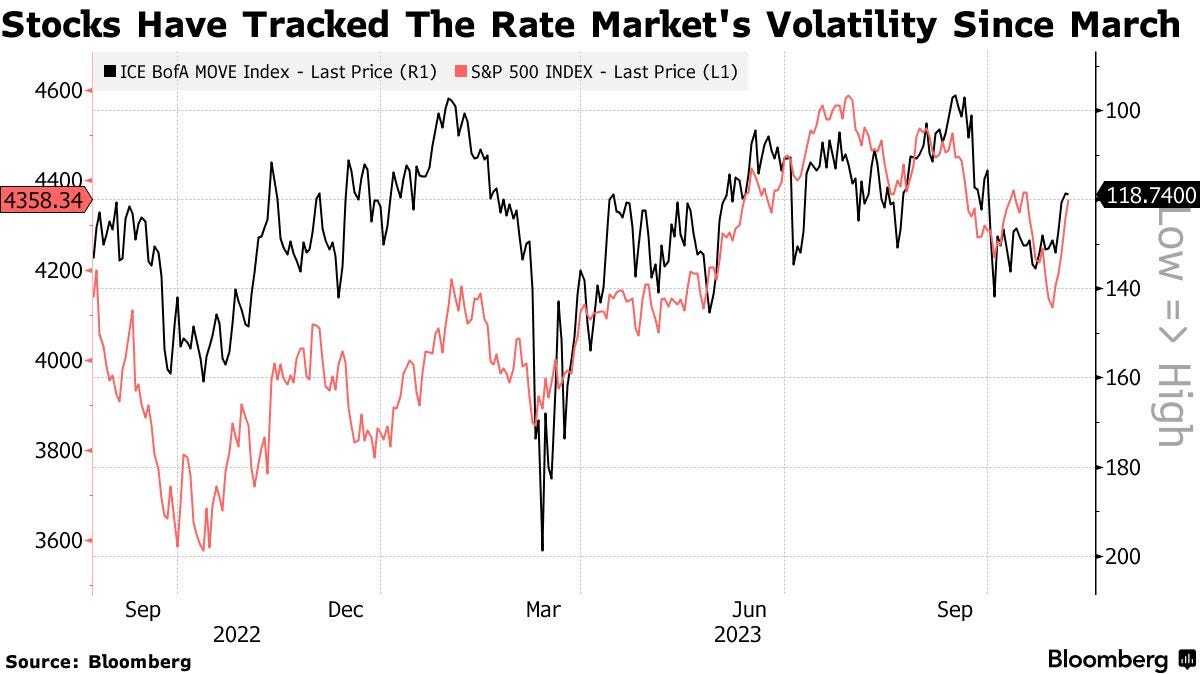

US equities ended the week higher last week after teasing a breakdown on Thursday. The S&P 500 held the 50-d moving average and is now up 7.7% since the recent low.

The story that “rate hikes are over” continued as markets continued to price in rate cuts sometime in 2024.

On Tuesday, we get the October Consumer Price Index reading. The current consensus, per the Bloomberg survey, is for a headline sequential increase of just 0.1% and for the core number to grow by 0.3%.

Oil fell further. A knee-jerk reaction at the start of the war in the Middle East has quickly faded as conflicts remain restricted to Israel and Gaza, leaving neighbouring countries (who have a significant impact on oil) out of the mix. Wholesale gasoline futures are near their lowest level of the year and aren’t that much higher than in early 2019.

In G10 FX, the US Dollar managed to retrace some ground from the sharp NFP-induced sell-off from the previous Friday. It was a much quieter week, with most pairs staying rangebound.

Let’s start with this week’s trade ideas…

Equities

A majority of the S&P7 have been, for lack of a better word, parabolic since stocks took a turn higher during a week of treasury refunding and the Fed meeting. However, Tesla has been unusually non-volatile during the same period, and Google has had muted returns.

Our focus is on the latter of the two. Google now tests the 50-d MA, as well as a previous level of interest at 135. We like this name to continue higher towards 139.04. It can be traded via common shares or via call options. We prefer to have more time on our side, so we would focus on December calls with a strike at 140.

TRADE IDEA - GOOGLE PAST 50D

Entry: 134.00

Stop Loss: 130.00

Take Profit: 140.00

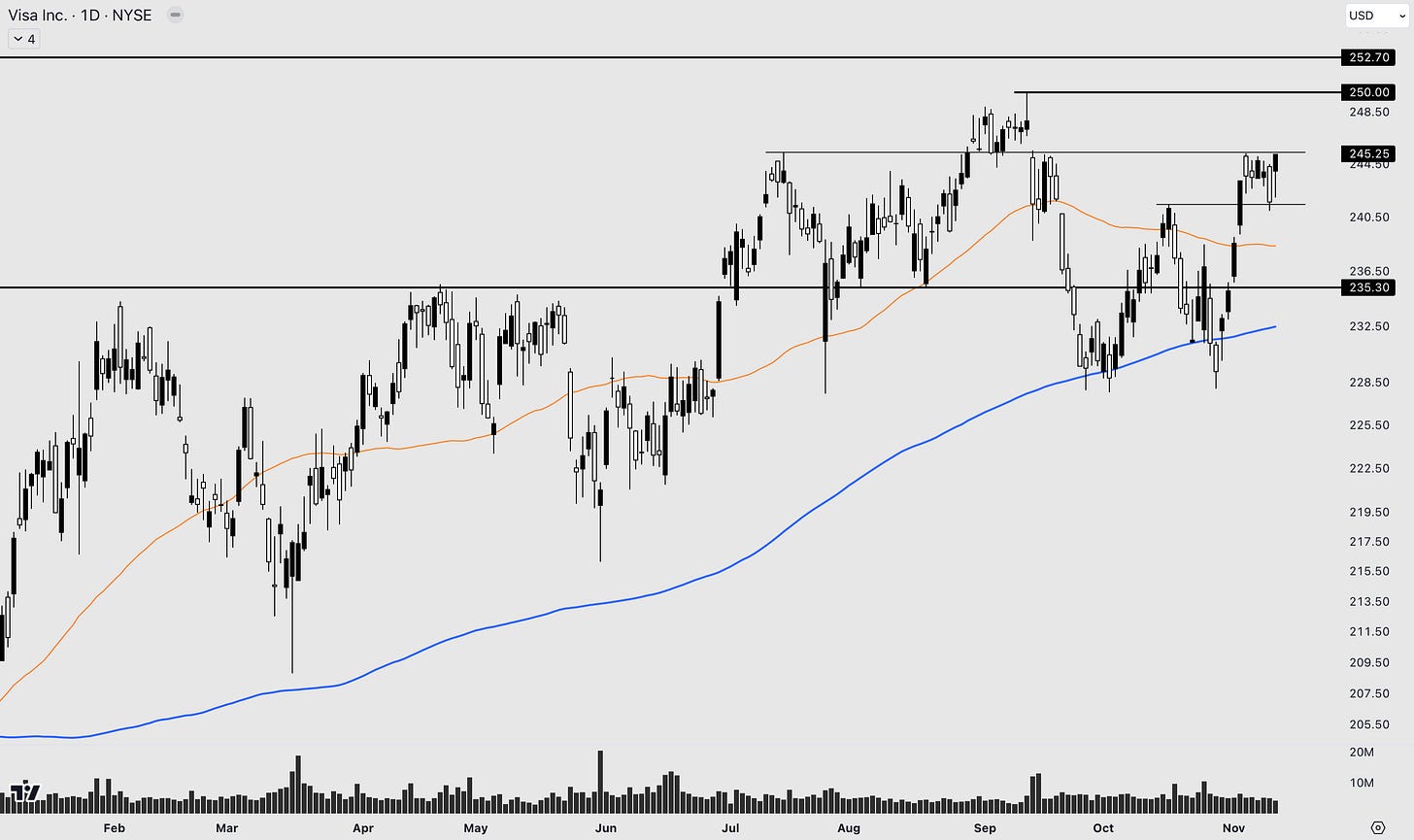

Our next two equity ideas turn towards the financial sector. The first name is Visa.

Visa has been a strong stock this year, up 18%. Price has held the 200-d MA for most of the year, rarely falling down to it. It only dropped below on two occasions and quickly recovered losses on each.

Now, price flags after a quick move higher. We like this name for a retest of YTD highs at 250.

TRADE IDEA - VISA TO YTD HIGHS

Entry: 245.25

Stop Loss: 240.00

Take Profit: 250.00

In the rest of this article, we turn to two more equity ideas before we take a deep dive into the currency markets. We finish off with some indices and commodities.

You can sign up as a premium subscriber and gain access to this full rundown (which is released every Monday), as well as access to full research articles on the markets and macro released every Wednesday and Friday.

Onto the rest of the ideas…