Top Trade Ideas - November 20th

Markets saw big moves last week. A low CPI print led to rate hikes and a recession being priced out.

From the weakest borrowers in Corporate America to the abandoned districts of the S&P 500, Wall Street traders are placing fresh all-or-nothing bets that the US economy will survive Jerome Powell’s war on inflation.

Small-cap stocks just surged the most versus the broader market since February 2022, while a version of the large-cap benchmark that dilutes the influence of mega-caps posted its biggest weekly outperformance since early summer. After money was drained from them for months, funds tracking high-yield bonds have sucked in nearly $11 billion.

Even Cathie Wood’s flagship Ark fund is back en vogue.

In G10 FX, the lower-than-expected US inflation print caused a sharp move lower in the US Dollar Index, with the DXY breaking below the key 105.50/60 region on Tuesday. It hasn’t looked back since then, closing the week sub 104.

Equities

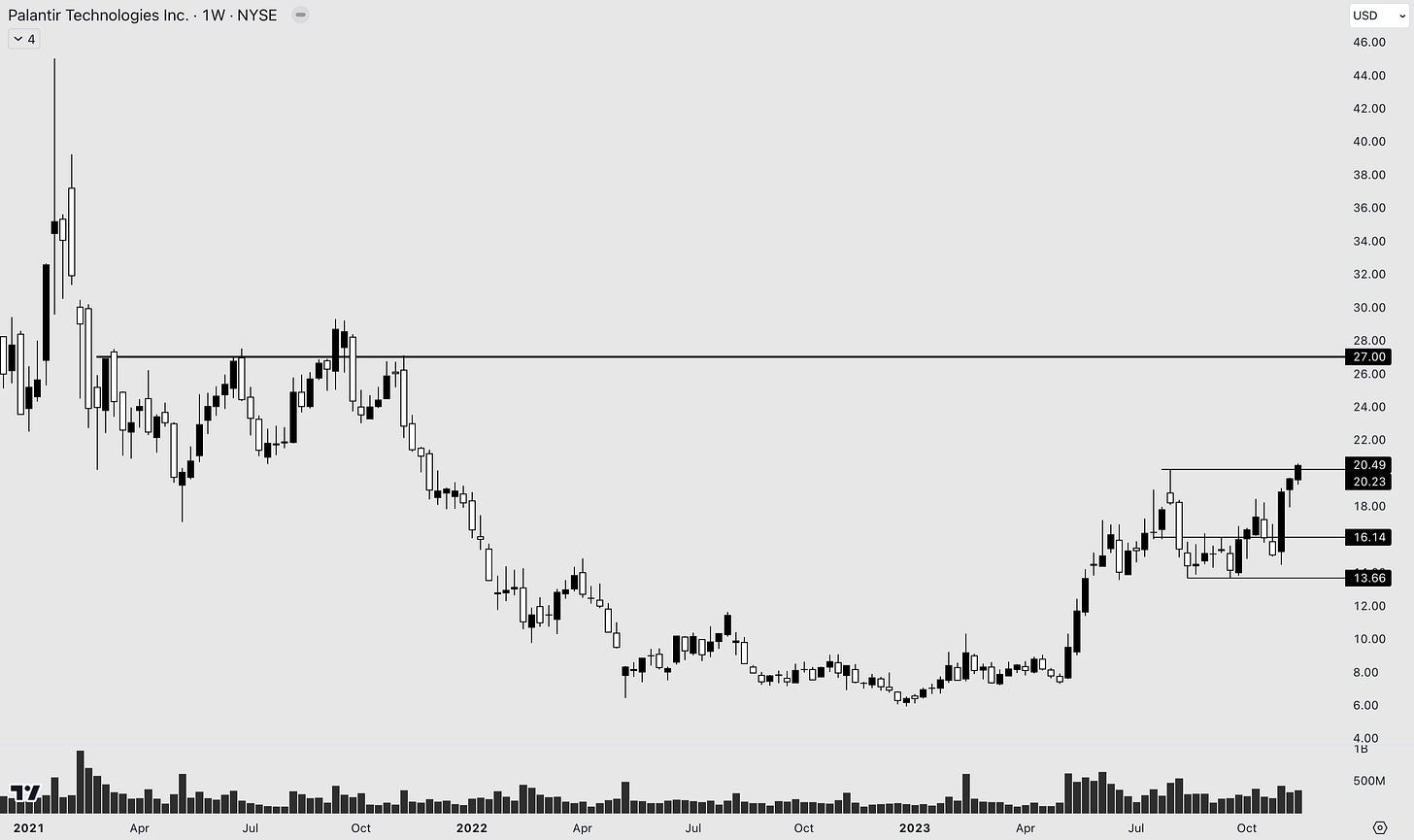

Palantir (NYSE: PLTR) has had quite the year, driving up from $6 to $20. The company specialises in big data analytics, which means they’ve been able to cash in on the AI hype this year.

Price just made a new 52-week high, and we believe there’s more to come. Equities are risk-on as markets digest the low CPI print, expecting no recession to come in 2024. Tech will stay an out-performer when markets are bullish, so Palantir is a name to keep an eye on over the next year.

But for the rest of this year and into Q1 of next, we’re targeting a further 30% move higher to a level of interest at $27.

TRADE IDEA - PALANTIR PERFORMANCE

Entry: 20.50

Stop Loss: 17.40

Take Profit: 27.00

Meta Platforms (NASDAQ: META). Who would’ve thought a 285% return in just over 52 weeks was possible? After a 77% decline from highs, price just needs a further 14% upside move to return.

The technical setup is clear. Expansion into consolidation. Now, price is rising higher again. The next key level of interest is 353.50, where price was rejected several times towards the end of 2021.

TRADE IDEA - META MOVES

Buy 350 Dec Calls

Risk a daily close below 325

In the rest of this article, we highlight three more equity trades, taking a dive into tech names and small caps. We then take a turn towards the currency markets as inflation data last week started some strong trends. Finally, we run through some analysis of world indices.

Pretty much all media and information services are subject to an economic paradox — you only want to consume the good if it’s high quality, but you can’t tell what quality it is until you’ve consumed it. So, here’s a 7-day free trial to read all of our work for free. There’s no risk, and you may enjoy and see the benefit of our work.

Link.

Onto the rest of the ideas…