Top Trade Ideas - November 4th

Election day is here.

The S&P closed lower for the second consecutive week. Stocks erased their October gains after disappointing outlooks from Big Tech companies such as Microsoft and Meta.

Emerging-market assets wrapped up a turbulent month as volatility surged in October with rising global yields, a stronger dollar, and investors rushing to reprice risk assets before the U.S. election.

In G10 FX, we had a mixed bag from U.S. data, which culminated in a large miss in NFP headline print, but this was glossed over with weather-related distortions. A hawkish BoJ also caught our eye.

If you haven’t tried it already, you can become a premium subscriber (£16/$20 per month) to access full articles and our chat feature to follow trades throughout the week. Manage your account here.

The Week Ahead

The Federal Reserve and many rich-world peers are widely expected to lower interest rates again in the coming week, right after a US presidential election that may not be decided yet.

Central banks responsible for more than a third of the global economy will set borrowing costs in the wake of the vote, clinging to whatever certainties they can discern on the likely path of American policy for the next four years.

In the early hours of Tuesday morning, the RBA will make their decision, likely holding rates. The BoE is expected to cut rates by a quarter point on Thursday alongside the Federal Reserve.

Apart from CB decisions, the only other event, and this being the most anticipated day for markets in 2024, is the U.S. Presidential Election on Tuesday.

As we start the week, the odds are pretty much 50/50.

FX

First - let’s be clear - trading the US Dollar over the immediate election period and then the Fed meeting is something that needs to be done very carefully and opportunistically as the events unfold. We’ll post our thoughts and ideas on the chat function rather than outlining trades here.

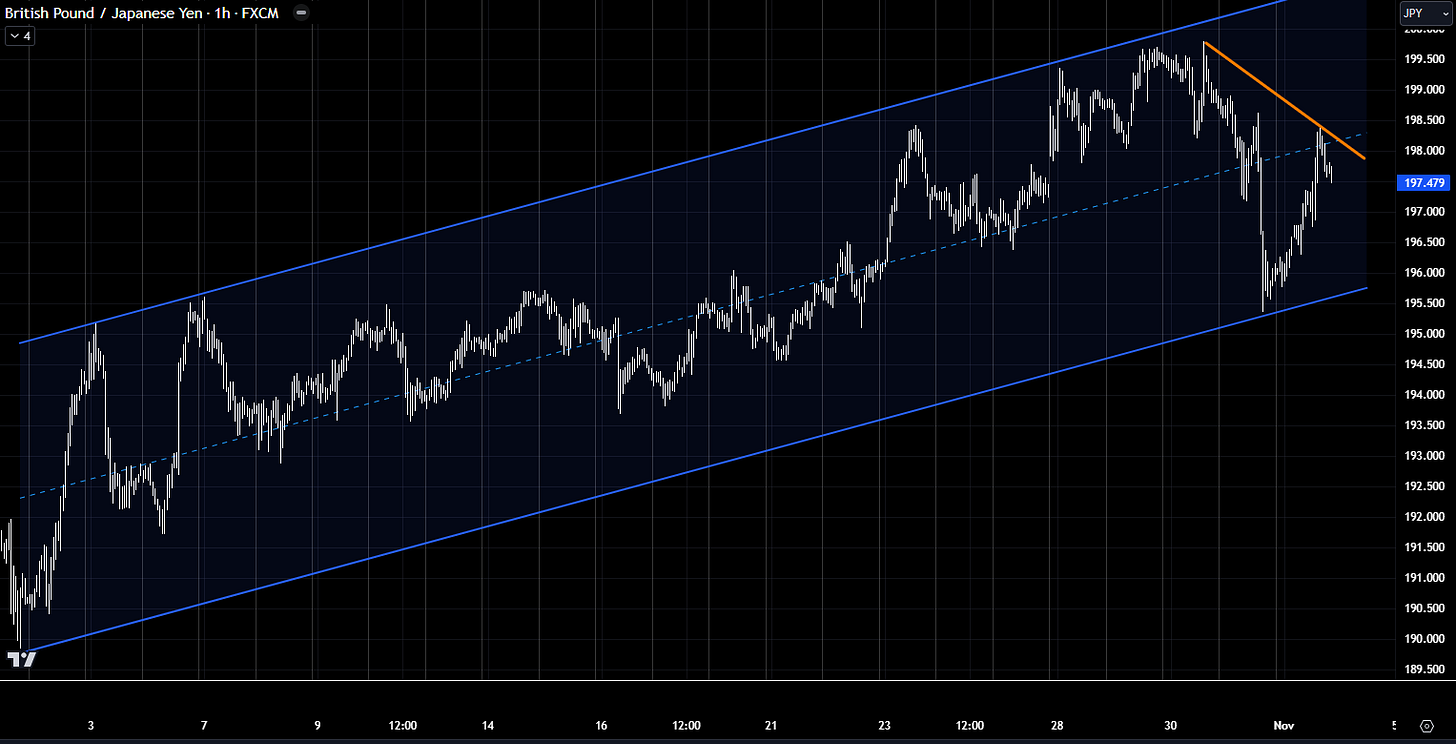

The broader trend for GBP/JPY might still be pointing higher, but following the BoJ meeting and the upcoming BoE meeting, we like to be tactically short here.

The BoJ brushed aside any concerns around the election results impacting monetary policy, with a Dec/Jan hike likely. Even though the size of the move isn’t a game changer, it does reaffirm that the direction of travel for Japanese rates is higher.

On the flipside, the UK Budget from last week saw GBP weaken, with a tone that we feel will continue this week. The BoE have a 25bps almost priced in, so we see little movement from that. Even though the BoE will try to avoid getting pulled into politics, we’re interested to see if any comments slip through about the unwanted market volatility as a result of it.

TRADE IDEA - SHORT GBP/JPY

Entry: 197.48

Stop Loss: 198.20

Take Profit: 195.70

Equities

The volatility across global markets in the coming days will be tough to navigate. The picture towards the end of the week should at least be clearer, given the election doesn’t bring any civil unrest and echoes of January 6th, 2021.

One way or another, thematic moves in the market will continue or die out post-result as candidate mandates get priced in or out fully. There are some implied moves we want to highlight in our equity section this week:

KWEB + FXI

China is one theme tied to either candidate, but more significantly in the case of a Red sweep. China internet stocks (KWEB) have an implied move of 9.3%, with a straddle trade priced at 6.4%, while China large caps (FXI) have an implied move of 7.0%, higher than the straddle cost.

Straddles are a great strategy to use in highly uncertain events such as an election. You’re no longer taking directional bets and now just betting on the volatility in a trade. It’s also easier to manage risk, with the total price paid on the options as your limit.