Top Trade Ideas - October 21st

Trade thoughts and market musings for the week ahead.

“Don’t worry about what the markets are going to do, worry about what you are going to do in response to the markets.” — Michael Carr

Last week, as earnings season kicked off in full swing, the focus shifted away from the macro headlines and towards the corporate setting. Banks have been the standouts, with Morgan Stanley, JP Morgan, and Goldman all hitting new highs.

In G10 FX, the DXY continued to push on, fuelled by strong US data and a dovish ECB meeting. Up ahead, we focus on the cross-asset spillover impact into FX from equities as a key week in US corporate earnings kicks off.

The Week Ahead

A rate decision in Canada is due on Wednesday, while U.S. manufacturing and services PMIs are released on Thursday.

It’s busier on the earnings schedule, with Tesla, IBM, Boeing, and Coca-Cola releasing quarterly results on Wednesday.

How are the team setting up for the week?

To access full articles and research, manage your account here.

Equities

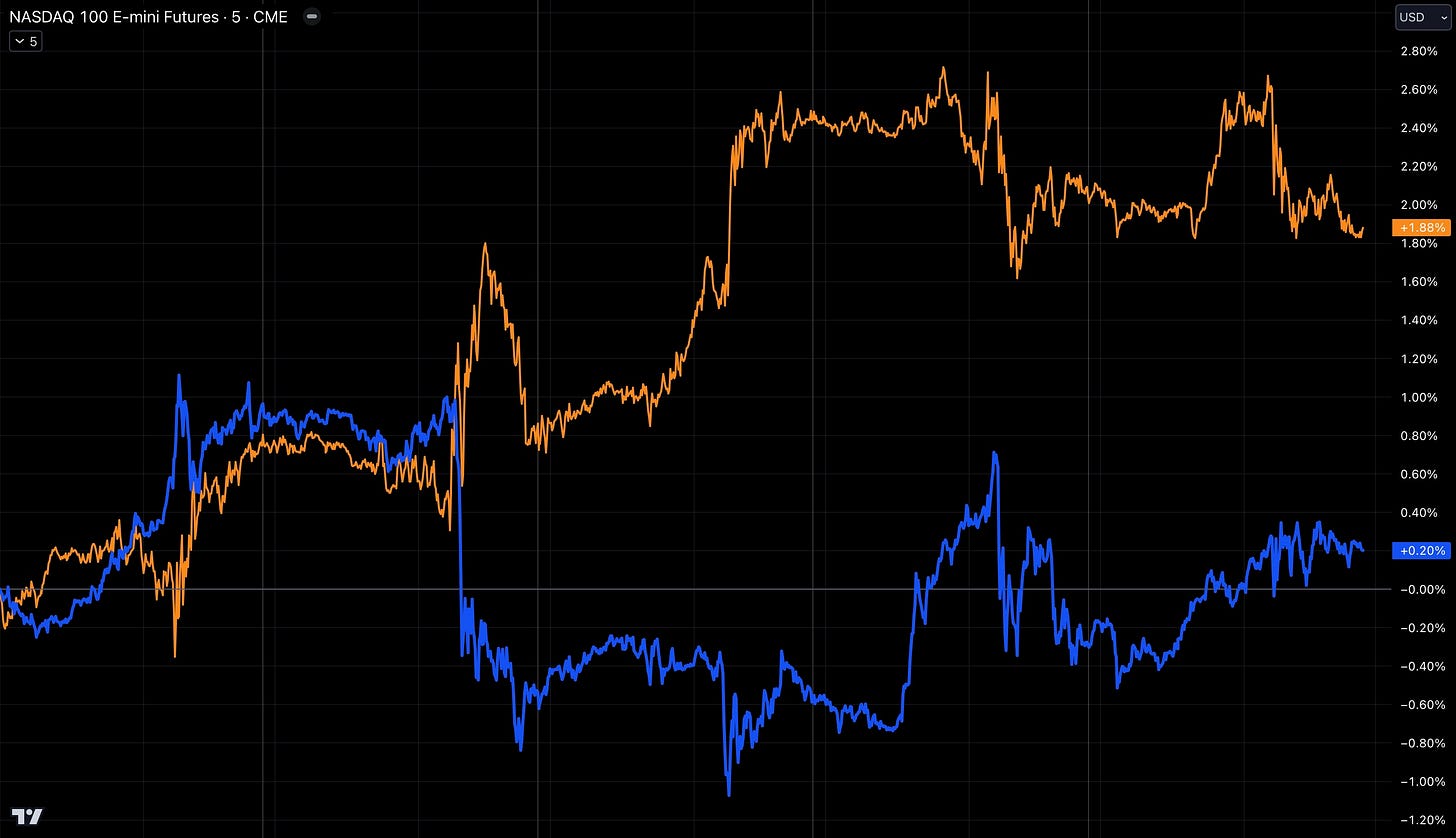

One standout from last week: The rotation trade is back. A few factors are at play here. Firstly, tech faced heavier selling after an ASML-led semiconductor shakeout. Ultimately, strong reports from TSMC helped to reduce the volatility around chip makers. But it was enough of a shake to see small caps rally harder than tech again, a dynamic that has been back and forth over the past few months.

Healthcare and financials were among the strongest performers. Interestingly, the HC industry has historically delivered gains seven out of eight times in the six months after the Fed’s first rate cut and outperformed the S&P 500 by an average of 16% over the following 12 months. More on a healthcare sector name later.

The first idea for the week ahead turns to crypto. A risk-on environment is creating a move for Bitcoin. As they say, it may well and truly be so back. Last week saw the first close above this trend line, potentially signalling a breakout from here. There are also tailwinds in the pipeline, such as a rising potential for a Trump win, who has been publically pro-crypto—more on that in an upcoming election trade article.

With a thesis that Bitcoin will break higher from here, we look towards the miners. There are always some explosive moves in the related names. MARA Holdings (NASDAQ: MARA) is a popular turn-to for traders. And maybe MARA has shown its cards already.

The stock closed at its highest price since the end of July and now looks to move into a previous balance. A Kamala win in the U.S. election may see a sell-off in Bitcoin and, therefore, miners. So we flag Nov. 5th as a date to watch on this idea. End of November calls with $22 strikes. Depending on the move over the next two weeks, we’ll either look to hold over the election or de-risk for the event. We’ll keep subscribers updated through our chat.

TRADE IDEA - MARA $22 NOVEMBER CALLS

In the bio space, two companies are getting our attention.