Top Trade Ideas - October 23rd

Commodities continue to rise, equities face challenges, and FX sets up many opportunities. Here are all of our ideas ahead of this new week.

Oil has edged lower to start the week, as Israel held off on its ground invasion of Gaza. The other safe haven asset, gold, is holding up for now. Continued conflicts would cause both of these assets to continue higher for a third week running.

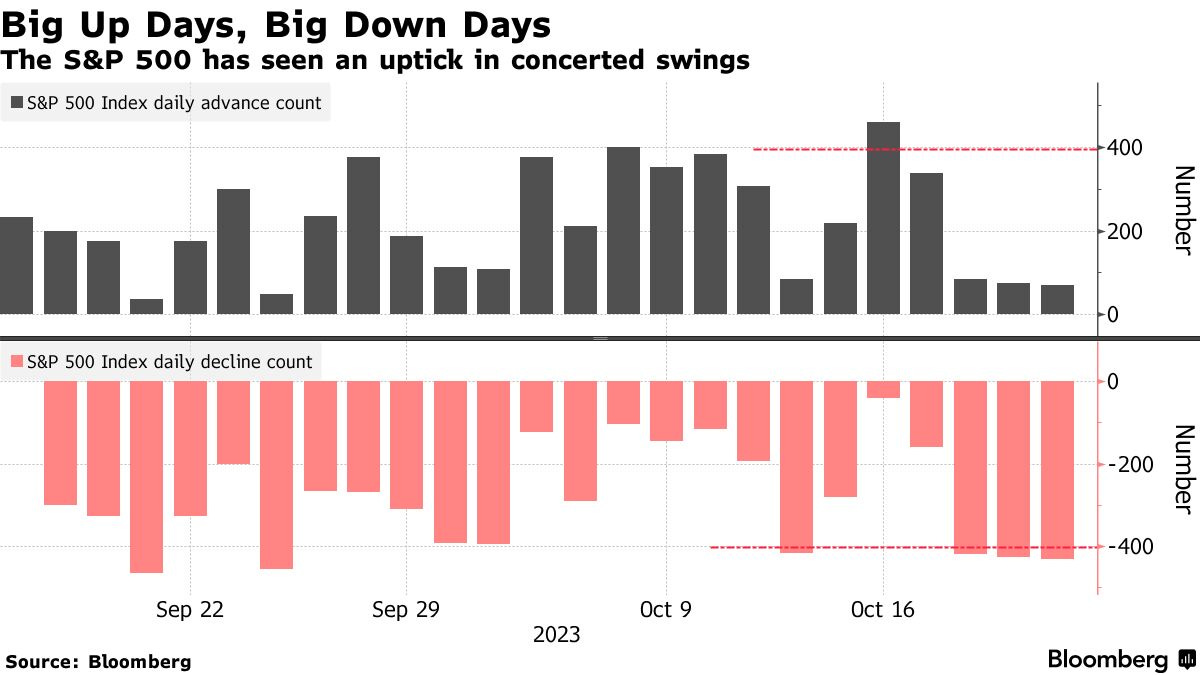

US equities had a tough week, falling 2.5%. The S&P 500 index closed just below the 200-d moving average, sending bearish indications to investors.

In FX, we finally got our chance to catch a breath after a busy couple of weeks. The bias was still to buy USD dips versus the rest of G10, but without any key pairs making fresh trend highs/lows. This week we’re watching out for the ECB on Thursday and US Core PCE print on Friday.

Equities

A quick rundown of S&P 500 futures: Price sits right on a daily trend line, but the 200-d MA has been broken on both SPX and futures.

The April-May consolidation zone (after the banking crisis pulled the S&P 500 down 6%) is where current prices sits above. We are likely to fall back into and stay in this zone (4166-4269) for prices to find equilibrium again.

Dow Inc, the materials science company, has been slowly falling down to the 50 level all year. Several attempts to take price higher have lost strength.

Earnings are due to be released tomorrow. Poor results could lead to a break down on this name, potentially seeing October 22 lows of 44 seen again before this current year is out.

TRADE IDEA - DOW DOWN

Entry: 48.80

Stop Loss: 50.80

Take Profit: 44.00

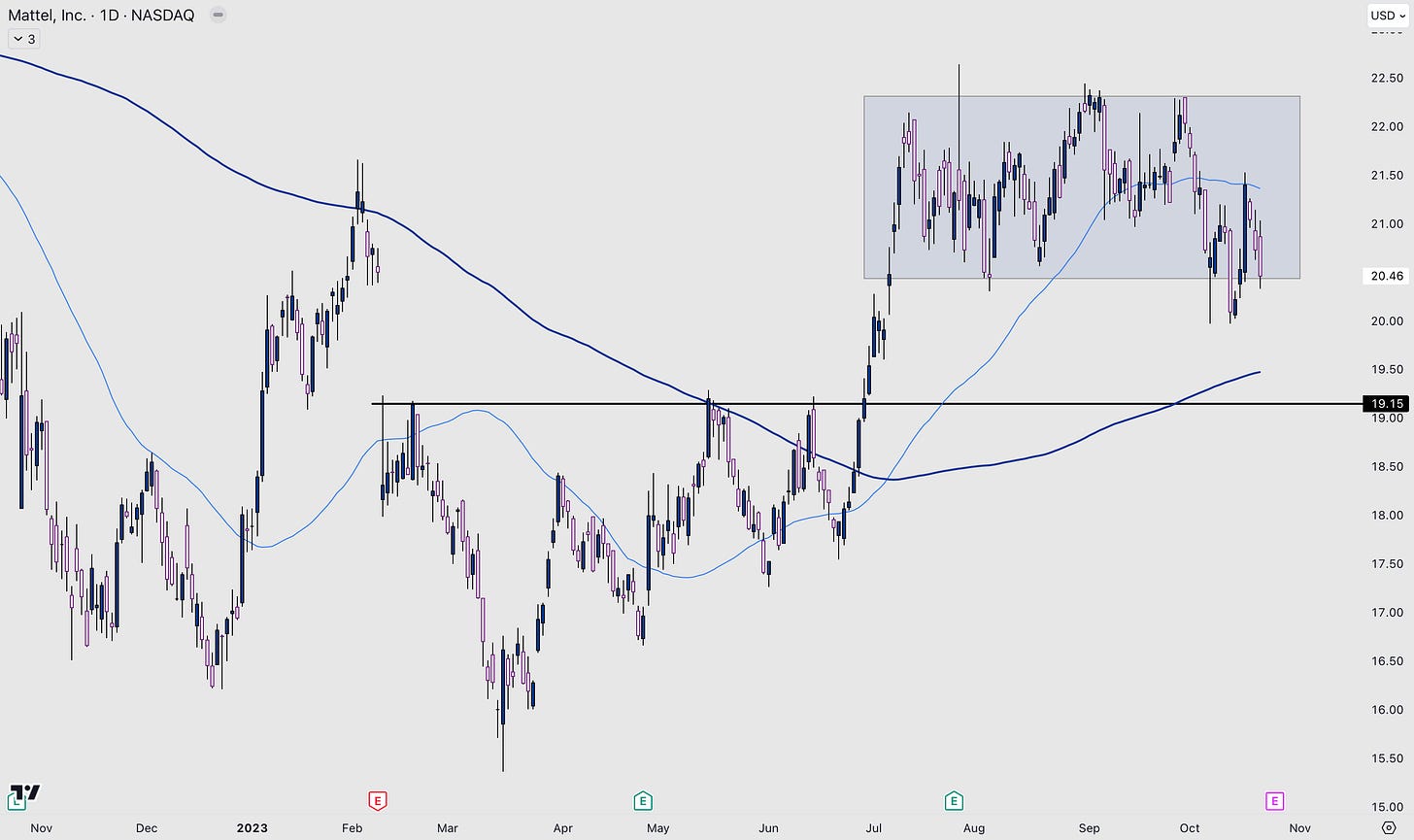

Mattel has been in consolidation for four months. But prices are testing the demand lower. Also to note, price made a strong rejection off the 50-d MA. This structure looks like it will break lower from here.

The 200-d MA below and a key pivot level of 19.15 look like areas to target.

TRADE IDEA - MATTEL STRUCTURE BREAKDOWN

Entry: 20.40

Stop Loss: 21.50

Take Profit: 19.00

We dive into two more equity ideas, before running down three FX pairings and sharing our view on world indices.

You can access all of the content below, as well as full access to our articles, by subscribing to AlphaPicks premium. A 7-day free trial can be viewed here.

The weekly preview continues…