Top Trade Ideas - October 30th

A busy week ahead includes several bank interest rate decisions, creating plenty of opportunity in the markets to capitalise on.

The headlines that closed out last week: S&P 500 Enters Correction.

Many well-known factors have been involved in bringing the US equity index down 10% from its year-to-date highs, such as geopolitical issues, US inflation, the Fed, and earnings.

This upcoming Wednesday brings us to the next Fed meeting, where we will find out the interest rate decision and hear comments from Fed Chair Powell afterwards. Friday then gives us the joys of Non-Farm Payrolls.

In FX, a bumper US GDP print helped to support the USD, but the DXY couldn’t break to fresh highs, leading us to think that a tactical pullback is coming. The ECB meeting on Thursday was fairly neutral, but central bank meetings in the US, Japan and the UK will be key this week.

Equities

US bond markets started last week strong as Bill Ackman announced he was covering his short trade. Was it just great timing on his behalf that the bond market rallied straight afterwards? Or did markets seriously rally off his tweet? Who knows.

But the beaten-down market looks like it may (potentially) find a bottom. We are sure plenty of traders/investors have been burned trying to do the same since the pandemic.

However, geopolitical issues mean that bonds may become attractive again, and price is making a constructive move. Higher lows were set this week. Can it break higher from here? We think this is a good play via TLT call options. Downside is then limited while keeping exposure to a potential rebound.

(The below chart is the Ultra US Treasury Bond Futures to show entire session movements, but our trade will be via the Ishares 20+ Year Treasury Bond ETF, ticker: TLT)

TRADE IDEA - DARE WE SAY IT… BOTTOM IN BONDS?

Dec 2023 $85 Call Options

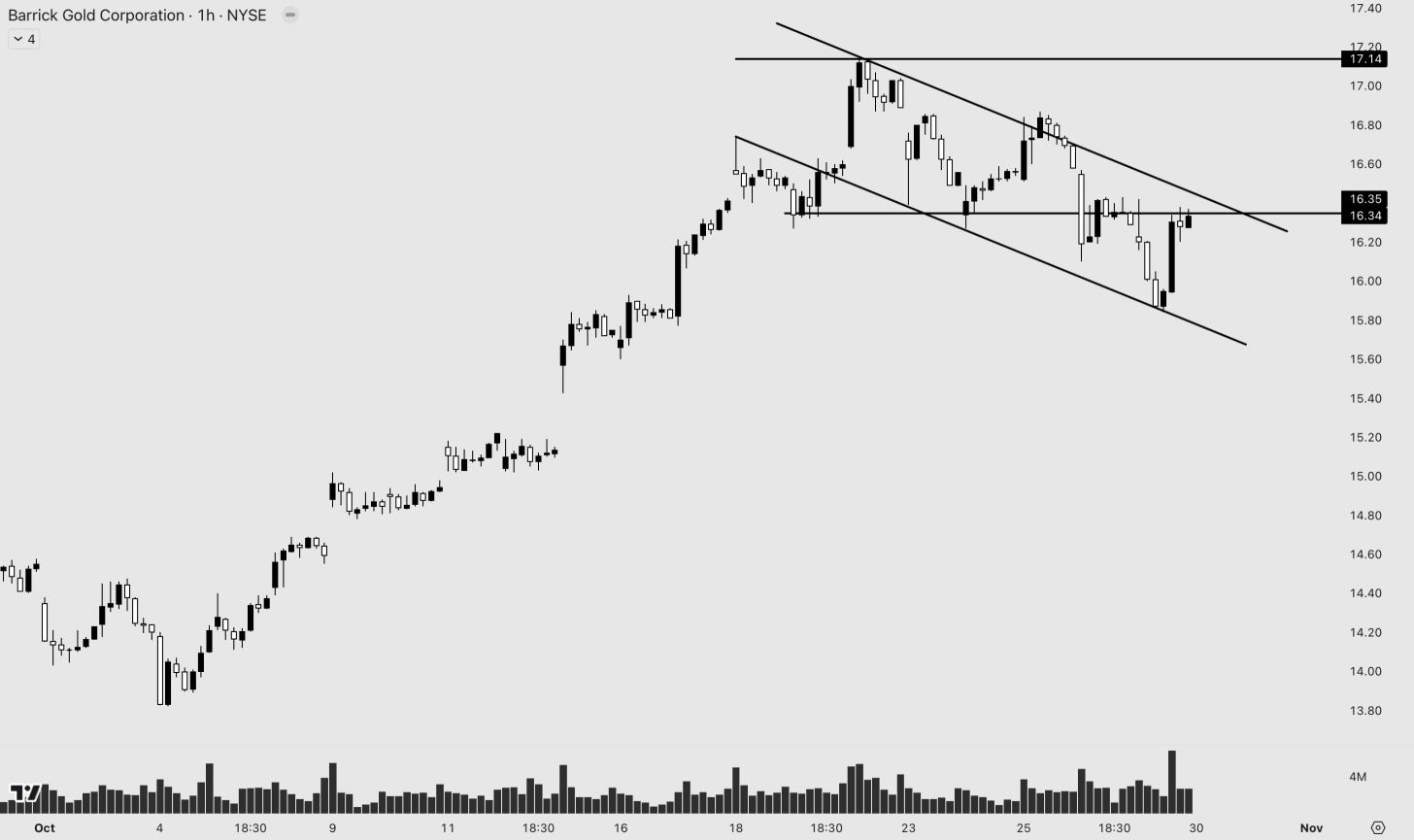

Gold has been one of the other asset classes that investors have been flocking to recently. One way we like this trade is via the stock Barrick Gold Corp, (NYSE: GOLD).

Gold itself made a big move higher on Friday. However, we may see a slight pullback before it can hold above $2,000, a key resistance level of recent months.

If the asset pulls back, Barrick Gold could be a good dip to buy.

TRADE IDEA - BARRICK CHANNEL

Entry: 15.80

Stop Loss: 15.30

Take Profit: 17.14

In the rest of our weekly preview, we take a look at:

One small-cap therapeutics company that looks likely to have another 20% move higher.

Two mega-caps to watch with the FOMC meeting on Wednesday.

Three FX pairs to watch as central banks release their rate decisions.

Two trades on commodities.

You can access a 7-day free trial to our premium content here. This includes full access to all articles, including our Monday week preview/ideas and all research articles.