Top Trade Ideas - October 9th

Investors turn to safe-haven assets as new tensions rise in the Middle East. Here are our thoughts ahead of the week.

Much of this week will be filled with talks about the most recent conflicts that have started up in the Middle East. Oil jumped more than 5% after Hamas’s surprise attack on Israel raised fears of a wider conflict. Investors shunned traditionally risky assets such as stocks and instead bought gold, bonds and the dollar.

In FX, better risk sentiment for much of the week saw the US Dollar pull back from recent highs. The NFP figure from Friday saw a quick bid which faded over the afternoon, giving the DXY the largest weekly loss since July.

Equities

Oil futures have jumped higher overnight with the latest tensions between Palestine and Israel. Although neither country is an oil exporter, the concern is that tensions could expand to other areas in the region, which in turn, would have an effect on supply.

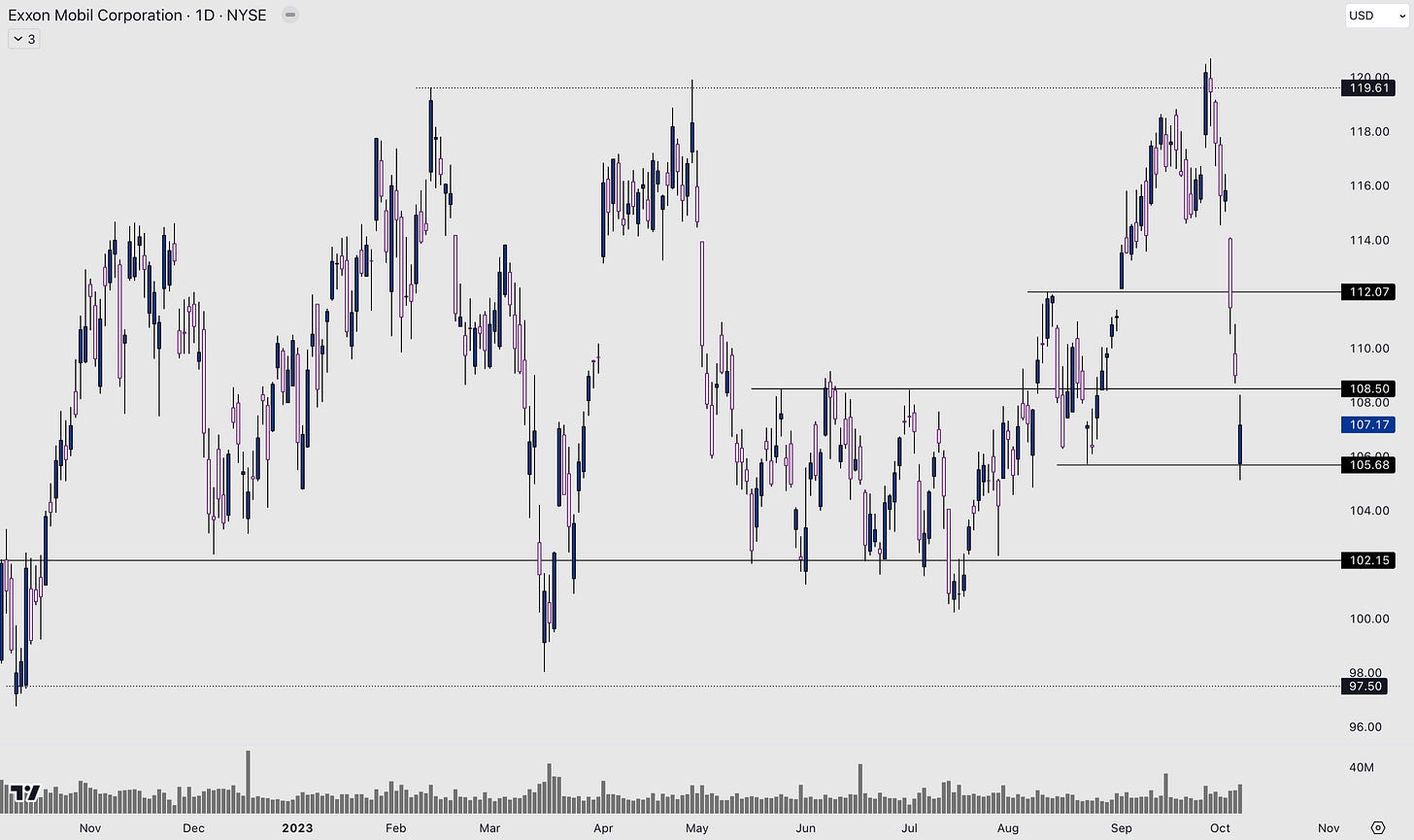

Exxon sold off heavily with the oil reversal last week, but we think the trend may change this week. It is hard to know how much higher oil will open up, so we have given an entry price for our idea on a key level.

TRADE IDEA - XOM HIGHER WITH OIL REVERSAL

Entry: 108.50

Stop Loss: 105.00

Take Profit: 116.00

Coinbase has been consolidating between $72 and $84 for two months. Updates on ETF news have bounced prices around, but nothing has taken it out of range. Bitcoin itself looks like it is structurally making a move higher. Maybe we will see $30k by year-end. If so, Coinbase will see some Q3 losses pared.

TRADE IDEA - COIN BASING

Entry: 78.50

Stop Loss: 69.00

Take Profit: 100.00

You can access the full article by becoming a premium subscriber. You’ll access:

Our full ideas for the week as we dive into FX and commodity markets

In-depth articles on the markets released every Wednesday and Friday

All this for just over £1/week.

Now onto the rest of the article…