Top Trade Ideas - September 11th

All markets reviewed. Here are the top 10 trades on our watchlist as we start a new week.

Markets have seen quite a bit of fluctuations in recent weeks as data continues to have big effects on price swings.

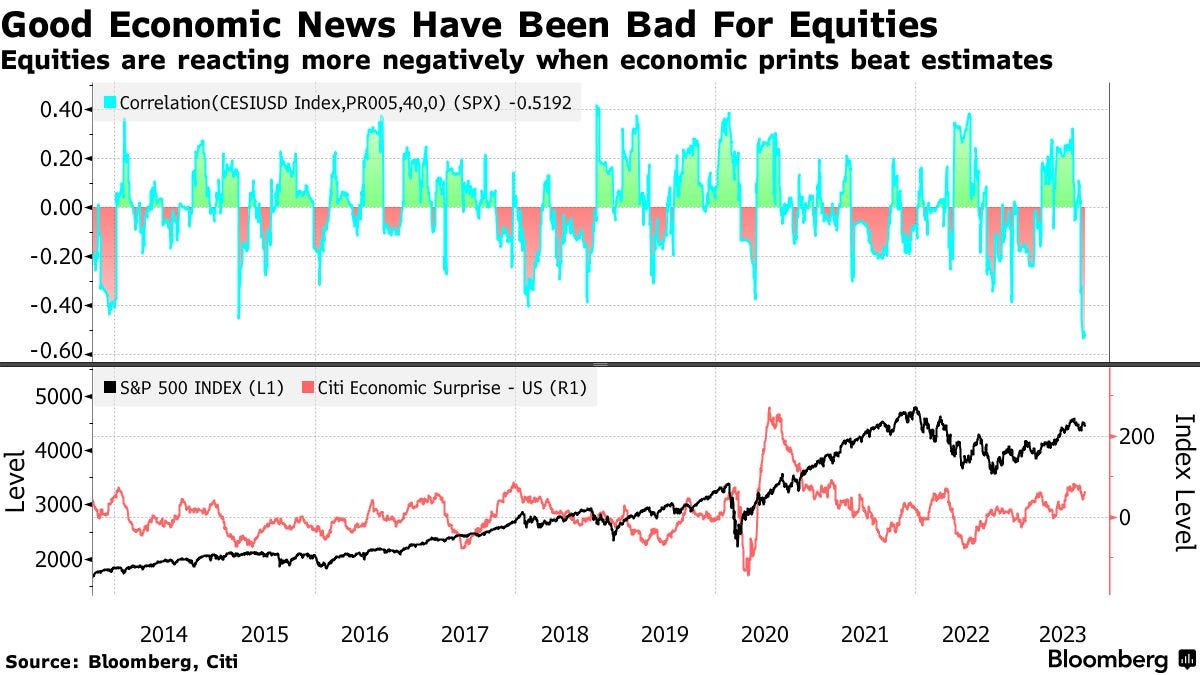

One way of thinking about just how sensitive the market is to fresh economic data: the link between the S&P 500 and Citigroup’s widely followed surprise index for the US economy.

That 40-day correlation has tumbled to the most negative on record, meaning that stocks fall when big-picture readings from employment to manufacturing come hotter than economists expect. Conversely, a downside surprise triggers a rally.

In FX, the US Dollar continued its march higher as investors currently see it as the best place to be. With EUR stagflation fears, GBP still a sell and JPY like a crazy ex-girlfriend, we think flows will continue to support the greenback this week.

Equities

Amazon was a strong name towards the end of last week. This week, we think it is setting up for $140 Friday calls.

A good entry would be on a retest of 137.77 and looking for a break above 138.80. A break above this level should see September’s high reclaimed.

TRADE IDEA - AMAZON 140 CALLS

Entry: 137.77

Stop Loss: 136.50

Take Profit: 141.00

Google is another name that has been trending higher and showing resilience to market pullbacks. Therefore, we have this name at the top of our watchlist if the market makes the next leg higher.

The daily chart has flagged and, on Friday, broke higher. We now expect this move to continue, and would once again play it similar to the Amazon trade via calls. However, we think more time on the expiration would be better for this name. September 22nd, $140 calls.

TRADE IDEA - GOOGLE CALL SWING

Entry: 137.25

Stop Loss: 135.50

Take Profit: 141.00

Our next idea turns to a short one. The Dow Jones has been relatively weaker than the S&P 500 and Nasdaq in recent weeks. The lack of tech names have limited gains and some consumer stocks have had a tough time.

The rest of this article highlights:

Three equity plays, both long and short

Three FX trades, alongside some data highlights to watch for

Two index trade ideas

You can sign up below for just £5, €6 or $7 per month, which isn’t much more than we’re currently paying for a latte in the city on the way to work.