Top Trade Ideas - September 16th

There's one significant event that has market attention this week.

Last week, US equities teased a further decline. But a wild Wednesday saw indices, down 1% on the day, shift gears and close 1% higher. It’s a risk-on sentiment into the upcoming week.

Semiconductors had a good week as Nvidia’s Huang gave a positive outlook at a conference hosted by Goldman Sachs. Demand for Nvidia’s high-tech products is “so great” that its customers are “tense,” spurring a more than $200 billion jump in market value for the volatile Nvidia.

In G10 FX, we saw erratic price action in the USD following the US CPI print on Wednesday, with the DXY ultimately closing the week where it began. EUR barely reacted to the ECB meeting, with central bank meetings from the US, UK and Japan this week now in focus.

The Week Ahead

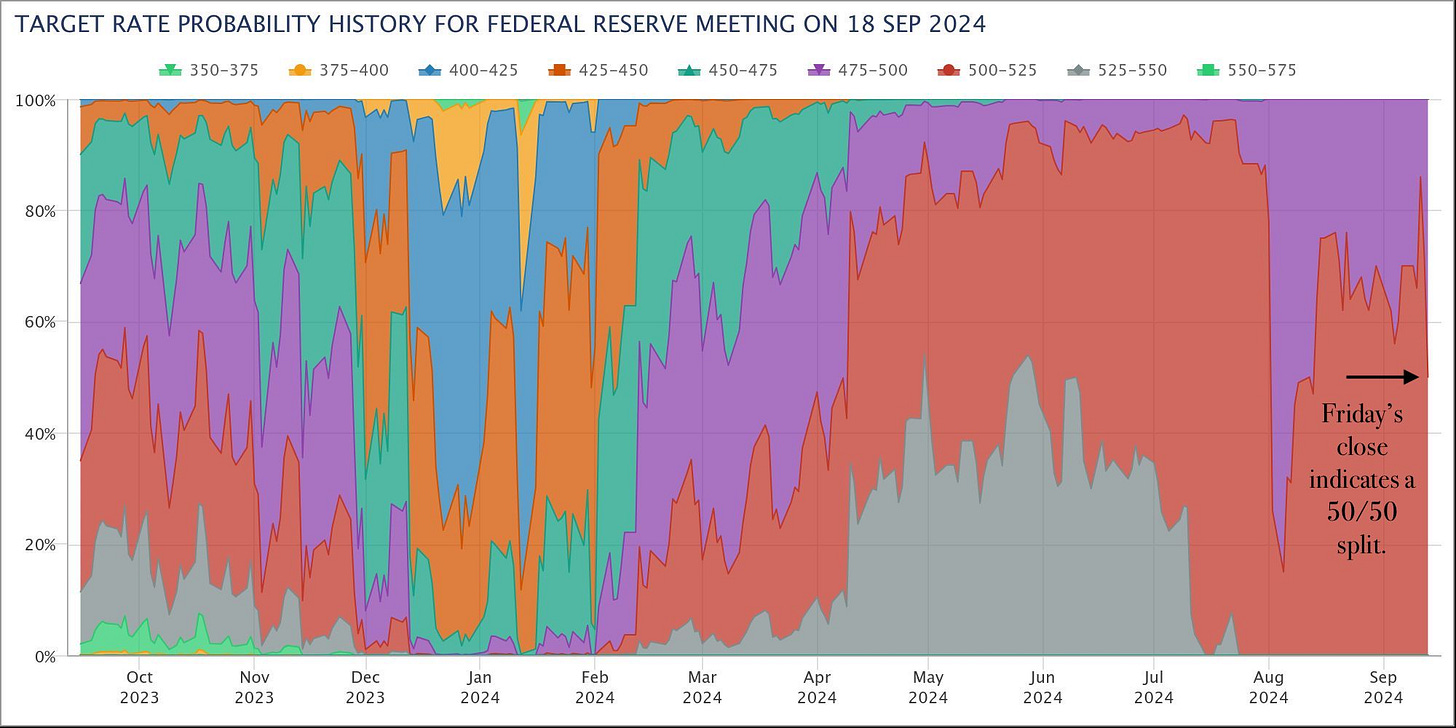

The upcoming meeting of the Federal Reserve is widely anticipated to usher in the first interest rate cuts since 2020. The question at hand is whether the cut will be a traditional 25 basis points or a more substantial 50 basis point reduction. According to CME’s FedWatch tool, U.S. money markets currently reflect a 50% probability of either decision.

Of particular interest to investors are the Fed’s new interest-rate forecasts, known as the dot plot. This is especially significant as markets are currently pricing in a total of 109 basis points of rate cuts across the final three meetings of 2024 in September, November, and December. The dot plot should weigh in on market expectations through year-end.

Rate decisions are also due in the U.K., Brazil, Norway, Turkey and South Africa, while in Asia, announcements from the Japanese and Chinese central banks take centre stage, alongside decisions in Taiwan and Indonesia.

Equities

We feel that a bull flag is forming on Just Group shares. The UK stock popped higher in mid-August following stronger-than-expected results.

Although it has been correcting lower in recent weeks, it had a strong close to end last week. A break above 140p would indicate to us that the start of another leg higher is beginning.

TRADE IDEA - KEEPING AN EYE ON JUST

Limit Order: 140p

Take Profit: 170p

Stop Loss: 126p

Along with reasons that gold will see a rally in the coming months (more on that later), gold miners will also be a beneficiary of macro events.

Gold mining stocks have encountered a challenging period in the past 18 months, notably trailing behind the performance of bullion prices. This divergence from the strong gains in gold itself has been evident. Nonetheless, there are indications that the situation is changing for gold miners.

A key factor contributing to the recent upturn in gold mining stocks is the decline in crude oil prices. The reduction in oil prices has led to lower operational costs for mining companies, which represents a significant advantage in an industry where energy expenses constitute a substantial component of overall costs.

There is no gold bull market without the participation of gold miners.

TRADE IDEA - GET LONG MINERS (GDX)

Entry: 40.0

Stop Loss: 37.5

Take Profit: 46.0

FX

Ahead this week our focus is mainly on the Fed and whether they decide on 25bps or 50bps, along with the guidance from here for the next few months (remember there’s 109bps worth of cuts priced through to year end).