Top Trade Ideas - September 25th

A tough week for equities and a strong performance for the dollar. Last week had it all, but what is in store for this week?

US markets took a beating last week. Some would say this pullback was healthy. It was needed. But what will the sentiment be through to the end of the year?

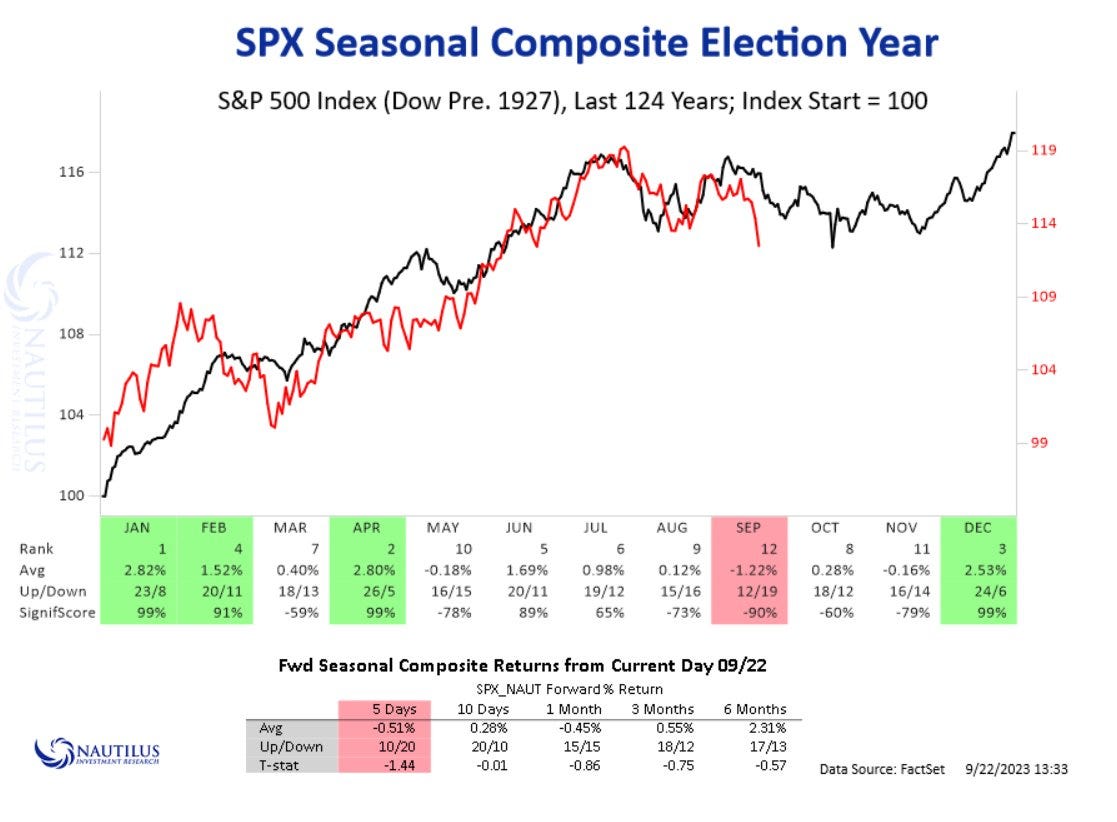

Seasonality is fairly on track. Markets have pulled back through September’s notoriously weak performance. There are 10 more trading days before the negative seasonality ends on October 9, and we revert to bullish seasonals. That’s still a long time. More damage could be done in the markets.

In FX, the US Dollar kept marching on thanks to the Fed’s ‘higher for longer’ rhetoric. With both the Bank of England and the Bank of Japan disappointing investors later in the week, the shine of the greenback versus major peers became very apparent.

Here is our rundown for the week:

Equities

NVDA has been weak. The euphoria of this year’s rally is starting to fade. No doubt that Nvidia will have another rally before the year-end, but for now, the trend is down, and price is retesting the previous trend line.

We are looking for a $400 psychological retest.

TRADE IDEA - NVDA 400

Entry: 418

Stop Loss: 425

Take Profit: 400

IBM has been a strong name despite the market turnaround. After pulling back to this trend last week, this may be a name to go long on. Above 150 has seen sellers step in, but it looks likely we will at least get a retest of this zone.

TRADE IDEA - IBM ABOVE 150

Entry: 146.20

Stop Loss: 144.00

Take Profit: 150.50

MongoDB. Can it fill the gap? Price is now trading below the 50-day MA, and there is a strong price gap fill until 300. This could be a trend to jump in on and ride the selling down.

There are three more equity trades we are keeping a key eye on this week. We also bring you some FX insights as well as a run-through of the indices.