Top Trade Ideas - September 2nd

Jobs data is the final test.

NVDA earnings were unable to produce the wow factor of previous quarters but markets continued without them. However, US indices remain very restrained as investors await some more labour market data in the build-up to the next Fed meeting.

Other assets were also quiet last week, with oil giving back its early gains and gold waiting patiently at ATHs.

In G10 FX, we had a month-end rally in the US Dollar and a strong signal of a double bottom. Even though we have a quiet start with Labor Day, global PMIs and US NFPs will be hot topics for currency traders later in the week.

Week Ahead

Federal Reserve Chair Jerome Powell’s recent comment at the Jackson Hole symposium that the “time has come for policy to adjust” leaves an interest-rate cut at the Fed’s next meeting on September 18th looking certain. The question is whether rates will be cut by 25 basis points or a larger 50 basis points.

Powell stressed that the Fed doesn’t want to see further cooling in the labour market, which means Friday’s nonfarm payrolls data for August could be crucial in determining Fed rate expectations. Very weak data could make a 50 basis-point rate cut more likely, while robust data would rule out that larger cut. JOLTS job openings data for July on Wednesday, ADP private payrolls figures for August on Thursday, and weekly jobless claims figures could give advance clues on the health of the jobs market.

ISM purchasing managers’ data for August on the manufacturing sector on Tuesday and the services sector on Thursday will also be watched closely after particularly weak figures the previous month as investors assess the severity of the US economic slowdown.

US markets are closed today for the Labor Day holiday.

In Canada, the central bank looks set for a third consecutive rate cut.

In Asia, purchasing managers’ surveys and inflation data are in focus as investors look for more assurance that the region’s manufacturers are recovering and that price pressures are converging on central banks’ targets. Australia’s second-quarter growth data is also in the spotlight, alongside an interest-rate decision from Malaysia.

Equities

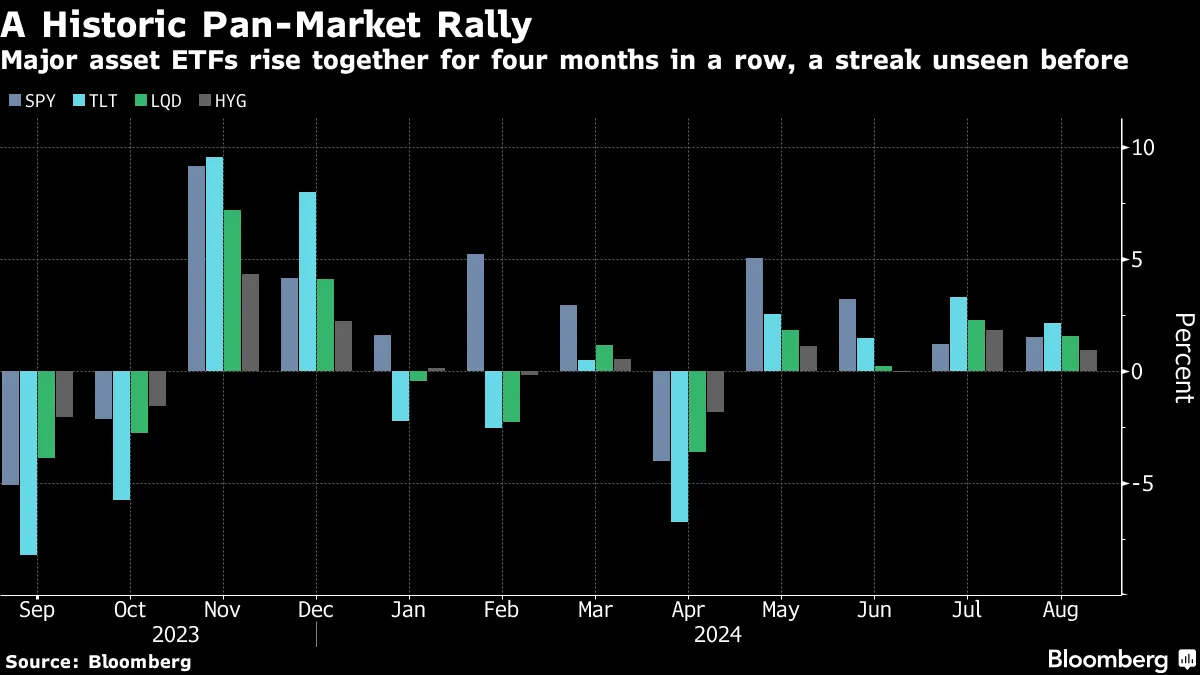

US equities are comfortably past the August shock sell-off. Risk assets are back in favour. Inevitably, that means that AI-related names will continue higher.

While NVDA did actually close last week lower following their earnings report, ARM Holdings is one chip name that held its price in the week. The disconnect from NVDA is good. ARM may get a push higher in the week to come if US equities can breeze past UER data.

TRADE IDEA - ARM ASCENSION

Entry: 133

Stop Loss: 125

Take Profit: 150

If you would like to try our premium offer out, you can access a 7-day free trial. This gives you complete access to all articles.

Let's move on to the rest of the team’s thoughts for the week.