Top Trade Ideas - September 4th

As your personal investment analyst, we're here to bring you the best ideas for the week ahead across equities, FX and commodities.

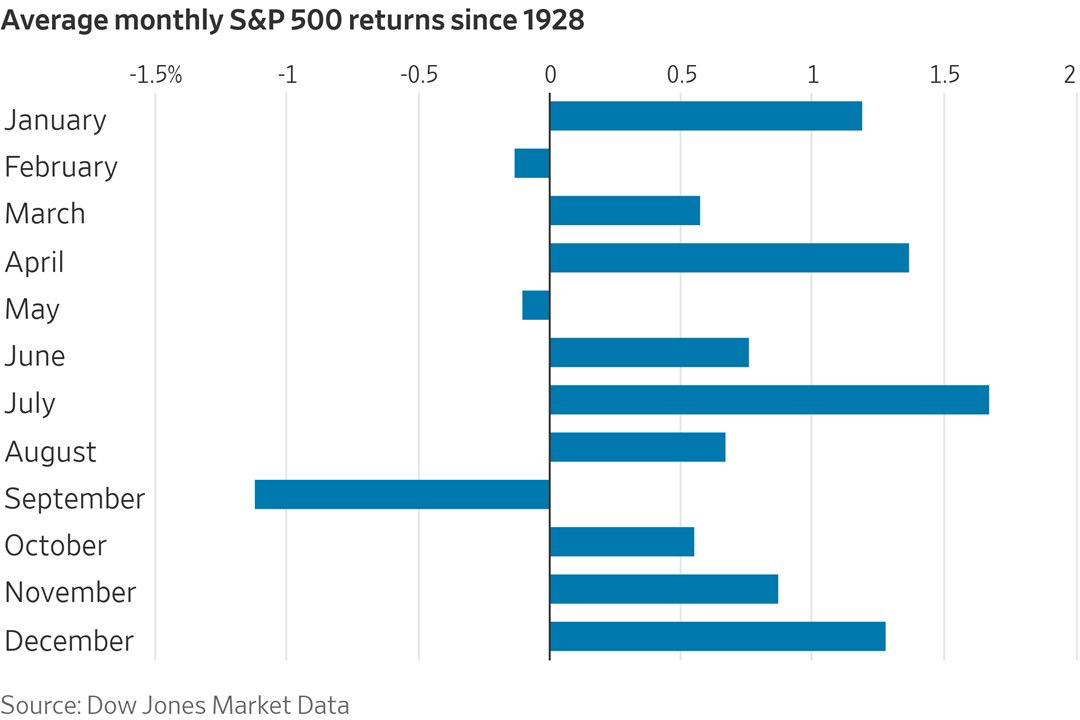

September got underway last week off the back of a positive end to August. Seasonally, September is the worst-performing month. However, we can’t help but feel that because everyone else is talking non-stop about this seasonality trend, maybe the markets may just catch some off guard.

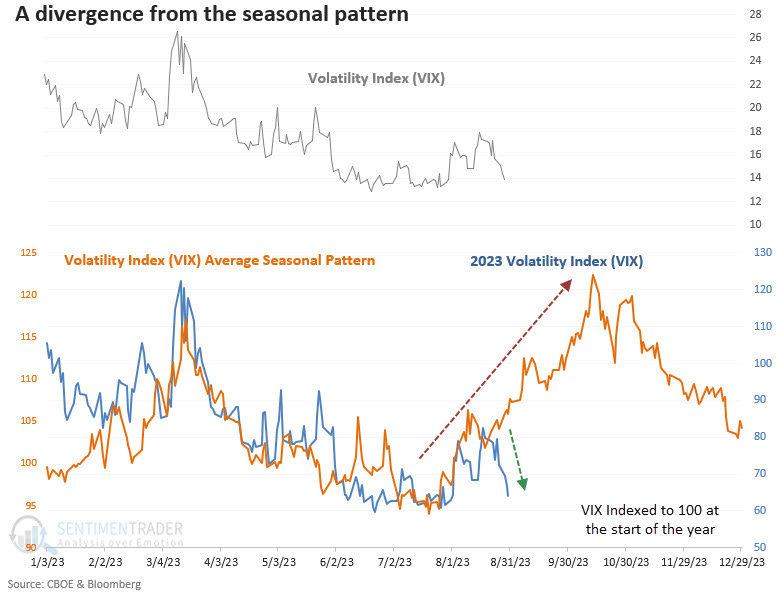

To note, if the VIX fell below 14 in August, the S&P 500 was higher 89% of the time over the next month.

In FX, we saw a big move on Friday following the better-than-expected headline NFP print and ISM Manufacturing numbers. This saw the DXY spike above 104.00 to close out before the long weekend. We watch for ISM Services data on Wednesday, along with the RBA meeting early Tuesday.

Equities

The first equity idea this week is a short idea. BABA and other China names have made a move up over the last two weeks. However, Alibaba printed an inverted hammer candle on the daily.

The sellers stepping in at the end of Friday may indicate a slight pullback. But after this pullback, there could be an opportunity to go long again on the trend line.

TRADE IDEA - BABA BACK BELOW

Entry: 95.00

Stop Loss: 96.70

Take Profit: 90.00

Lucid Group is flagging on the daily chart, right below resistance. This name could give a great breakout next week. We think the momentum could stay and set LCID up for a good swing trade.

TRADE IDEA - LCID BREAKOUT

Entry: 6.40

Stop Loss: 6.00

Take Profit: 7.70

Oil and gas names have been very strong as crude oil made a push above 85 last week. We scanned through a few energy names, and HES has the best setup.

The strong momentum should see price push through this resistance at 157.69 and make a move past ATHs at 160.60.

The rest of this article dives into more equity setups for the week ahead, as well as an FX breakdown and trades to watch, along with a summary of the indices.