Trading Lessons From Poker

From understanding randomness to emotional discipline.

We read an interesting post on X this week from Brent Donnelly, a former FX market maker at Citi, who in part quoted Phil Galfond (a pro poker play) discussing having a bad run. Donnelly noted how the same principle can be applied to trading.

It’s true that Wall Street does have a strong affinity to poker. We get a rare glimpse into the world’s colliding via ‘The Quants’, a book written by Scott Patterson:

“It was March 8, 2006, and the Wall Street Poker Night Tournament was about to begin. More than a hundred well- heeled players milled about the room, elite traders and buttoned-down dealmakers by day, gambling enthusiasts by night. The small, private affair was a gathering of a select group of wealthy and brilliant individuals who had, through

sheer brainpower and a healthy dose of daring, become the new tycoons of Wall Street.This high-finance haut monde—perhaps Muller most of all—was so secretive that few people outside the room had ever heard their names. And yet, behind the scenes, their decisions controlled the ebb and flow of billions of dollars coursing through the

global financial system every day.Muller, tan, fit, and at forty-two looking a decade younger than his age, a wiry Pat Boone in his prime, radiated the relaxed cool of a man accustomed to victory. He waved across the room to Jim Simons, billionaire math genius and founder of the most successful hedge fund on the planet, Renaissance Technologies. Simons, a balding, whitebearded

wizard of quantitative investing, winked back as he continued chatting with the circle of admirers hovering around him.The previous year, Simons had pocketed $1.5 billion in hedge fund fees, at the time the biggest one-year paycheck ever earned by a hedge fund manager

The next billionaire Muller spotted was Ken Griffin, the blueeyed, notoriously ruthless manager of Chicago’s Citadel Investment Group, one of the largest and most successful hedge funds in the business. Grave dancer of the hedge funds, Citadel was known for sweeping in on distressed companies and gobbling up the remains of the bloodied carcasses. But the core engines of his fund were computer driven mathematical models that guided its every move. Griffin, who sported a no-nonsense buzz cut of jet-black hair, was the sort of man who triggered a dark sense of foreboding even in close associates: Wouldn’t want to mess with Ken in a dark alley. Does he ever smile? The guy wants to be king of everything he touches.

Muller felt a jolt in his back. It was his old friend and poker pal Cliff Asness, manager of AQR Capital Management, among the first pure quant hedge funds. Asness, like Muller, Griffin, and Simons, was a pioneer among the quants, having started out at Goldman Sachs in the early 1990s.

“Decided to grace us tonight?” he said.”

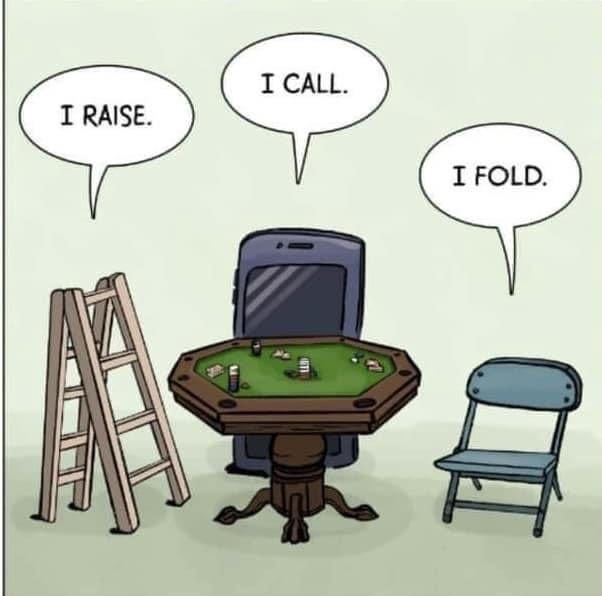

There are clearly similarities that make good traders and investors also good at playing poker (and vice versa). So for our weekend read, we muse over some of the traits and points which make them alike.

As a quick disclaimer, none of the information in this article is looking to encourage or endorse gambling in any form.

You can become a premium subscriber with us for just $20 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and full access to what we are buying and selling in our Global Asset Portfolio.

Risk Management

Arguably the most common trait between successful poker players and traders is their ability to manage their financial risk at any one time.

Let’s start by looking at poker. Controlling your risk via bankroll management is critical because it ensures that players can withstand the natural ups and downs of the game while avoiding unnecessary risk.

Even skilled players experience streaks of bad luck, but by managing their bankroll properly, they prevent a single losing session or string of bad hands from wiping out their entire funds. Effective bankroll management means allocating only a small percentage of available funds to any single game or tournament, which reduces the risk of ruin and allows players to continue playing over the long term. This approach increases a player’s chances of profiting from their skill and strategy rather than being derailed by short-term variance.

The same principle applies to trading. The ability to ‘full port’ on a particular position runs the risk of blowing an account very quickly, with an unacceptable risk tolerance.

In order to withstand getting stopped out of several trades in a row, allocating only a modest portion of total capital to each will ensure that a trader can live to fight another day.

In a nuance to poker, traders have to be even more careful with this due to the rise of leverage on trades, or via more inbuilt leverage via derivatives. This means that a trader can lose more than their initial capital pot if they do not manage their risk sensibly.

Evaluating Probabilities

To a certain extent, poker can be successfully played if one sticks to taking the high probability outcomes.

Let’s take an example…

Imagine a player is holding two hearts, and after the flop there are two more hearts on the table, giving them a flush draw. This means if one more heart appears on the fourth or fifth card, they will complete a flush, which is often a strong hand.

First, the player evaluates their outs (the number of cards remaining in the deck that will complete their flush). There are 13 hearts in a deck, and since the player knows 4 of them (2 in hand, 2 on the table), there are 9 hearts left, or 9 outs.

Next the player would calculate the probability of hitting one of these 9 hearts on the next two cards shown. The deck has 52 cards, and after seeing 5 (2 in hand, 3 from the flop), 47 remain unknown. The chance of hitting a heart on the next card is 9/47, or 19%. If they miss, they can still hit on the last card, where the probability would be 9/46, or around 20%.

The player then compares this probability to the pot odds, which refers to the ratio of the current pot size to the cost of a call. If the odds of completing the flush are better than the pot odds, the player can often make a profitable call.

For instance, if the pot is £1000 and it costs £100 to call, the pot odds are 10:1. If the probability of completing the flush is about 19-20%, the implied odds are around 4:1, which suggests the player should fold. As a note, this is purely talking about the probability element of poker, and discounts other factors in play.

This probability based decision making carries through strongly to trading. Let’s say that a trader was wanting to buy a Call option on the S&P500 with expiry in one week. Based on the implied volatility of the option price, the trader would need to see a move of 1% in either direction in order to be at a breakeven level.