Trading: Stories From A Crazy Week In The Trenches

From a Credit Suisse options surge to a 12:1 payoff on Euribor futures, here's what went in in a whacky week.

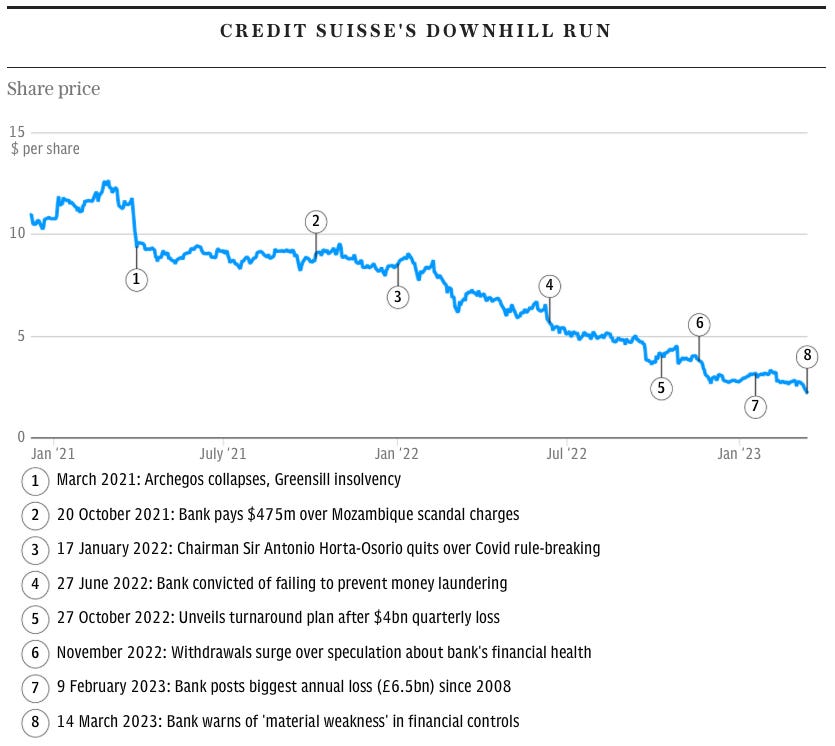

Surge In Credit Suisse Option buying

Wednesday saw huge flow by institutional options desk in Credit Suisse shares. We don’t even touch on the CDS market here, which could be another article in it’s own right.

597,000 contracts on Credit Suisse options were traded on Wednesday, 27 times the daily average. Naturally, the favour was to buy puts over calls, with 1.7 puts bought for every 1 call bought.

Incredibly, even with such a jump in volume, it was only the fourth most heavily traded single-stock name in the U.S. options market.

The interest in options makes sense, given the large share price swings making it risky to take an outright position by either buying or selling shares directly.

Below is a chart we shared in our more detailed Credit Suisse article on Wednesday:

Using WeChat For Bond Quotes

Issues cropped up in China on Wednesday, when the local regulator issued a strange request to money brokers to stop providing quotes on a score of bonds.

Whether this was due to the market volatility in Europe is unknown, but the shuttering of using conventional methods to feed through prices to traders and investors was shuttered.

In order to get prices and mark-to-market existing positions, several traders resorted to using WeChat and QQ instant messaging in order to provide quotes to others.

There was a reported drying up of market liquidity, which would be fairly clear given the issues involved in trying to buy or sell bonds via your broker being online on WeChat…

A 12x Return Betting Against Europe

News broke earlier this week on a trader that has put on a large position in the interest rate space.

The trader bought put options on the three-month Euribor futures, an expression of the Euro funding rate. They paid a premium of $13.2m, but stands to gain a 12x pay out if the target level is reached.

What level is being targeted? We don’t know for sure, but the barometer being looked at is that if the base rate in Europe falls below 1% next year, the payoff would be 12x. The current % expectations can be seen in the below chart.

The trade is already in profit, given the move lower due to the Credit Suisse debacle. However, the ECB meeting yesterday (with rates raised by 50bps) does provide more food for thought regarding if the central bank will blink anytime soon.

Where Did All The NFT Traders Go?

Data released at the start of the week showed that there were around 12,000 Ethereum NFT traders active last Saturday, the lowest figure since Q4 2021.

The volume of NFT trades also hit the lowest level this year. There were still some sales to note, for example a $366k sale of a set of nine Qing Dynasty plates. An example of a conventional Qing Dynasty plate is below, but we won’t get pulled into the utility value of NFT’s right here…

The data (released by DappRadar and CryptoSlam) does highlight the sensitivity in the market to the failings over the past week of crypto-favoured Silvergate Bank.

How we navigated the week

In our trade ideas released on Monday, we thought that the risk-off move could win-out, and went long the US Dollar Index (DXY) as a way to express this.

Further, we also went long gold at $1866, targeting $1920 as another way to express our cautious view on global markets.

Both trades have yielded strong returns this week.

As a reminder, you can access our top 10 weekly trade ideas each Monday as a paid subscriber, all for just £4.99.