Trading: Why Volmageddon Is Unlikely Despite The Rise In Retail Option Buying

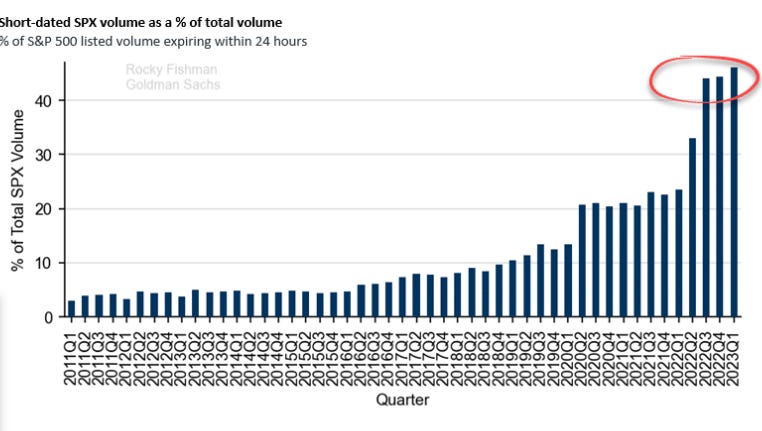

With zero-days-to-expiry options making up an estimated 40-45% of the daily trading volumes on US stock markets, many are getting concerned on the volatility impact.

Rising short-term Option volumes means higher intraday volatility

Interday volatility remains manageable, reducing the long-term impact

Volumes also take both sides of volatility, meaning we don’t read too much into the concerns

To finish out the week, we wanted to add our musings to a report from J.P Morgan last week that spoke of the dangers associated with the rise in short-term Options, and the impact this could have on the stock market.

Before we get into it, here’s a brief summary of some of the jargon we’ll be talking about:

Call and Put Options = these are derivatives of the cash market, which allow an investor to take a speculative view on if the market will go up (Call) or down (Put) during a certain time period.

0 DTE Options = this refers to zero-days-to-expiry Options. If I buy a 0 DTE position, it only is relevant for that particular trading day.

Volmageddon = a not-so-technical term used to describe high volatility in the market.

What did J.P Morgan say about Volmageddon?

The bank put out a note that warned we could see much higher levels of volatility going forward, due to the rise in investors buying 0 DTE positions. This is shown in the below graphic, highlighting the surge in such short dated trades.

The concern here is that the tail wags the dog when it comes to the market. Instead of the stock market moving and people buying options as a result, the tail (the option) can effectively move the market instead.

For example, let’s say that one morning we see a huge amount of Call options bought by investors. Option dealers at banks and brokers have to purchase the stocks in the cash market in order to hedge their risk. If enough size comes through, the purchases related to the options actually can move the market.

We’re talking about ‘size’ here. J.P Morgan modelled the movements, suggesting that on a down day, intraday selling could be as high as $30bn.

Intraday versus interday

Although we note the validity of the report, we do stress some points to be aware of. Firstly, there’s a key difference between volatility during a day (intraday) and volatility interday (outside of a single day).

Given these are 0 DTE trades, all expire at the end of the day. No exposure is carried through to the next day. As a result, the actual impact on the market is contained to a relatively short period of time.

Put another way, these options can influence the short-term price movements, but are very unlikely to influence the long-term price movements. Therefore, the impact on investors that target 12 month+ targets should be low.

A good gauge showing this is the VIX. The volatility index for the S&P 500 is based on Options, but uses a 30-day implied projection when spitting out a figure. The higher the number, the more volatile the index is expected to be and vice versa.

As can be noted, there was a large spike at the start of the pandemic back in 2020. Yet since then, levels have moderated. Even during the past few months when 0 DTE option volumes have surged, the VIX has remained range bound. This is the indication we would cite as to why Volmageddon is unlikely.

Two sides to every trade

Another point we raise is that while the volumes associated with short-term options has spiked, not all of these are long volatility. Below is a table that visualises whether you are long or short volatility based on if you are buying or selling a Call or Put:

The takeaway is that not all the volume is contributing to pushing volatility higher. If I feel the index is going to fall today, I could buy a Put. However, I could also sell a Call. If the index did fall, I’d profit from either position.

My volatility profile could be either long or short, with my impact on the market potentially offsetting.

Granted, most retail traders will prefer to buy an option rather than sell one, due to the known risks. Yet we shouldn’t get blindsided by the fact that all options benefit from higher volatility.

Musings from here

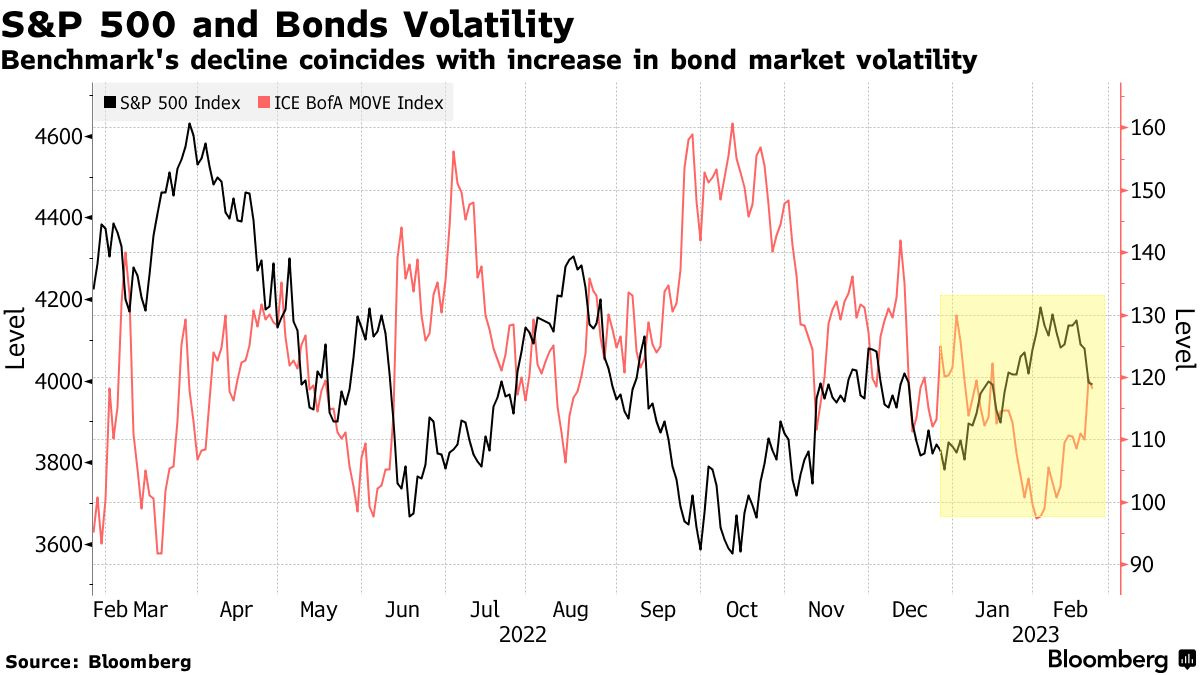

If you want to get the grey cells activated even more, we leave you with the below takeaway. What’s the rationale behind bond market volatility increasing with the fall in the S&P 500?

Nice write up and some cool graphs included