Ueda's Policy Problems

The BoJ faces an impossible challenge.

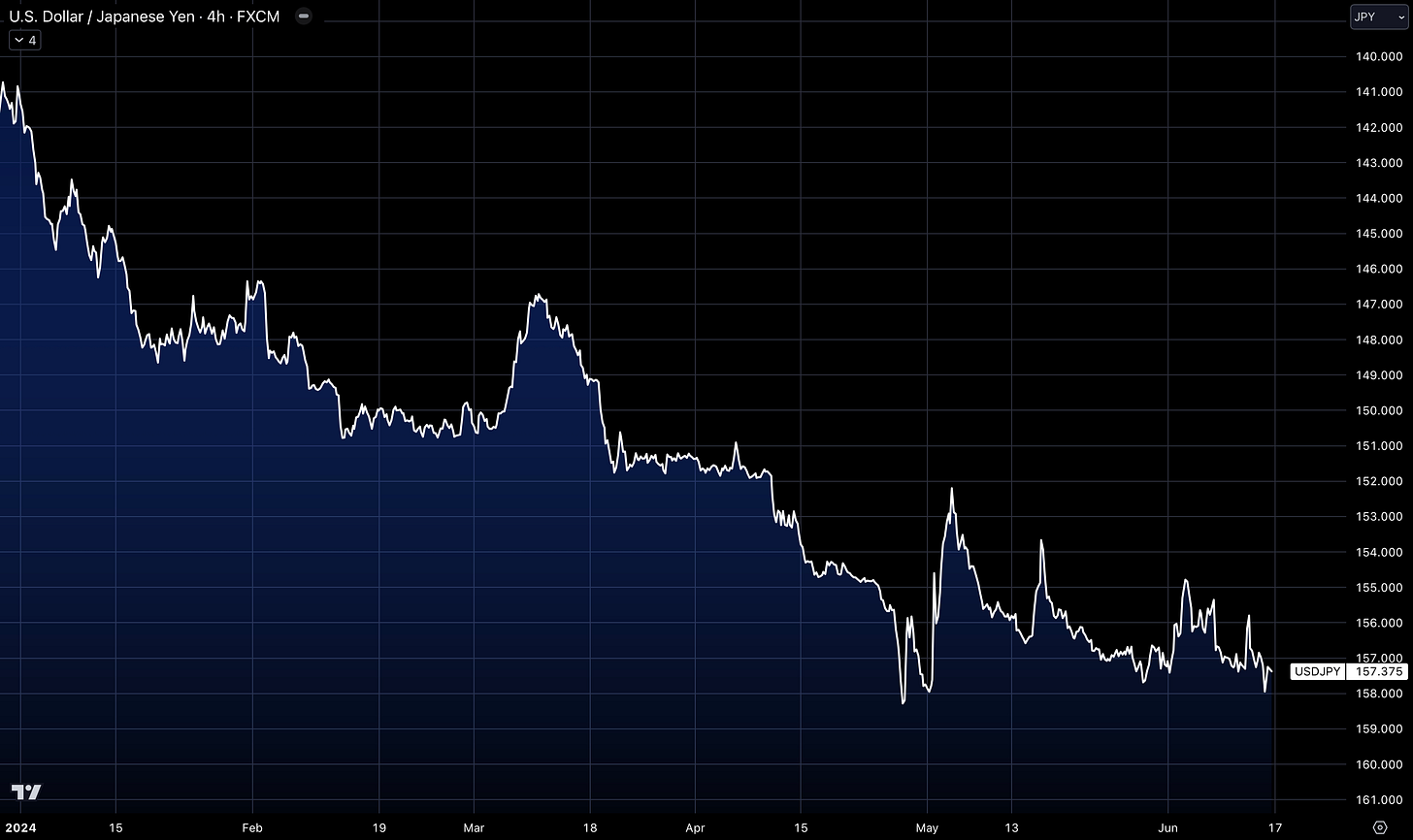

Friday’s market action in Tokyo reminded us that the historically weak yen is unlikely to strengthen significantly unless the interest-rate gap between the US and Japan narrows.

Policy Problems

The yen, which is near its lowest levels since 1990, experienced a brief selloff after the Bank of Japan decided to keep rates unchanged and postponed a decrease in its government bond purchases until the next meeting.

Reducing the number of bond purchases is seen as a form of tightening. As a result, the BOJ’s balance sheet will begin to shrink as new purchases are outweighed by maturing bonds.

BOJ Governor Kazuo Ueda also mentioned that the reduction would be “considerable,” but the markets did not react positively. The significant difference in policy rates between the US and Japan will continue to put downward pressure on the yen. The Federal Reserve has set its policy rate between 5.25% and 5.5%, while Japan’s policy rate ranges from 0% to 0.1%.

Just before the conclusion of the BOJ’s meeting last Friday, the yen was trading at around 157 to the dollar. After the meeting, it briefly weakened beyond 158 before rebounding to remain roughly flat.

The central bank’s decision to keep its benchmark rate unchanged was widely expected, yet the lack of guidance left traders uncertain about future policy action. Swaps-market pricing shows reduced bets for a rate hike by the BOJ next month. Ueda said that the bank could lift rates in July if economic conditions warrant such a move.

The BoJ continues to be very conservative in terms of removing monetary accommodation, notwithstanding this fuelling a weaker yen and driving up inflationary pressures. In the short term, renewed hopes for lower US rates are the only factor offering the yen some support. The bias remains short yen for now.

Japan & Inflation

In the back of the minds of most in Japan is the trade off between inflation and interest rates. Even though most of us in the West are used to the dynamic of trying to keep inflation under control, in Japan, the past memories are of deflation.

During the 1980s, Japan experienced a massive economic boom, characterized by rapid growth in asset prices, including real estate and stock markets. The bubble burst in the early 1990s, leading to a sharp decline in asset prices. The collapse of asset prices resulted in significant financial losses for banks and corporations, leading to a banking crisis. The collapse triggered deflation.

Japan then entered a period of economic stagnation known as the "Lost Decade" in the 1990s. GDP growth slowed dramatically, and the country faced persistent deflationary pressures.

In an effort to combat deflation, the BoJ introduced a zero interest rate policy in 1999, attempting to stimulate borrowing and spending. This was coupled by large stimulus measures too, but into the 2010s (along with Abenomics) it failed to really kick start growth and healthy inflation.

During the pandemic, again Japan posted deflation:

Why this is all relevant is that over the past year, somewhat welcome inflation is now starting to move lower. So at a time when the country finally has inflation around the 2% target, raising interest rates (which would curb inflation further).

Is this really something that the BoJ wants to do? It’s a pickle.

Currency Interventions

Authorities have indicated that they are prepared to intervene in the market to support the yen if it continues to weaken. Earlier this year, Japan spent a record ¥9.8 trillion ($62.1 billion) to bolster the currency after it dropped to a 34-year low against the dollar.

With the Yen above 157, it won’t take much for a renewed test of 160, which prompted intervention the last time this was reached.

The yen has been the weakest among Group-of-10 currencies against the US dollar so far this year, dropping more than 10%. This is due to the Federal Reserve’s decision to not reduce its benchmark interest rate, as the US economy continues to show strong growth and persistent inflation. Fed officials have projected only one interest-rate cut for this year and indicated multiple cuts for 2025, as they unanimously voted to maintain the benchmark rate earlier this week.

Market Expectations

What’s interesting to note is that the market is expecting further hikes, which has the potential to reprice lower (and trigger further losses for the Yen).

Below, you can see various forward rate swaps. You can think of a forward swap as a way of judging the market expectations of the base rate at a period of time in the future, starting in the future. For example, a 3-month swap is a proxy for where investors think the base rate will be in 3 month’s time.

A 3m3m swap is where investors think the rate will be in 3 months, starting in 3 months time. So if we teleported 3 months into the future, it would then become a normal 3 month swap.

So below, you can see the JPY 5y5y (a 5-year swap starting in 5 years), a 1y3m (a 3-month swap starting in 1 year) and a 2y1y (a 1-year swap starting in 2 years).

From the current base rate, it’s clear that the swap market is pricing in several interest rate hikes over different tenors. Take the 1y3m, for example, which is priced around 65bps. This implies 55bps worth of hikes within the next 18 months.

To support these expectations, the BoJ needs to commit to a long-term vision of tightening.

Ultimately, they’re in a pickle

It was widely expected that Ueda would move Japan out of negative rates, but he has played it too safe. Now, as Japan veers toward recession, Ueda’s tightening options are even more limited.

The approval rating of Kishida, the Prime Minister, has dropped to about 21%, creating challenges for Ueda as Kishida considers calling a snap election to maintain the Liberal Democratic Party’s power. (Just one more election to throw into the 2024 mix.)

Ditto for Toshihiko Fukui, who is remembered for his failed attempt to end QE in 2006-2007. During that time, then-Governor Fukui managed to raise official rates twice. The resulting recession sparked a harsh political backlash. Within a couple of years, rates were cut back to zero. Is Ueda headed to the same fate?

A friendly reminder: if you enjoyed this article, please leave a like ❤️

We will see you tomorrow with our week ahead rundown.

Nice write up! It’s amazing how Japan hasn’t had an inflation problem even though they’ve maintained yield curve control for so long.

Also amazing the levers we can pull to help each other out globally, like the US giving Japan an infinite line of credit so they don’t need to sell US treasuries.

These ideas get made up in real time, and it’s amazing how “clever” Central Banks can be.

Lovely piece on the history of Japan markets and what led us to today's situation. Cheers!