"Value Investing Is The Marriage Of A Contrarian Streak And A Calculator"

We run through the life and investing history of US-billionaire value investor Seth Klarman.

When we think about famous value investors, we naturally think of the likes of Benjamin Graham and Warren Buffett. This is for good reason, but even if we discount these two legends, there are plenty of others that have added their own spin on picking stocks that are undervalued.

This weekend we focus in on Seth Klarman. He is the co-founder and president of The Baupost Group, a Boston-based investment firm, with a personal net worth of $1.5bn.

Who is he?

Seth Klarman was born on May 21, 1957 in New York City. Although we can’t verify the story, he’s reported to have given a presentation to his fifth grade class about the logistics of buying a stock.

He bought a single share in Johnson & Johnson when he was 10 and engaged in various side hustles in his teenage years.

He attended Cornell University, where he earned a degree in economics. After graduating, he went on to study at Harvard Business School, where he received his MBA. Incredibly, one of his classmates was a certain Jamie Dimon, who went on to become JP Morgan CEO.

After finishing his MBA in 1982, he co-founded The Baupost Group with the goal of implementing a value investing strategy.

Success of Baupost

From co-founding Baupost with a relatively modest injection of $27m from the partners, the firm has grown significantly over the decades.

As of the latest 13F filing, the company has $27.7bn of assets under management.

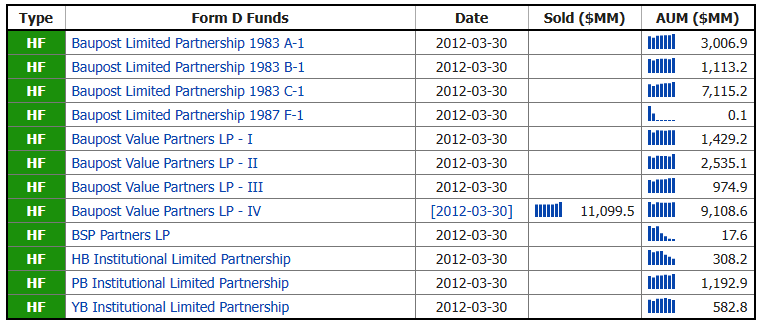

The firm has a variety of different funds (shown below) and invests in a broad range of different assets. The key to the success though is focusing on a value investing strategy.

This approach involves identifying undervalued securities and patiently holding them until their intrinsic value is recognized by the market. For Klarman, this revolved around having a “margin of safety”.

The Margin of Safety

Klarman wrote a book around this topic, highlighting how it was the core concept to his investment approach. It can be summarised in the below thoughts:

Most investors are primarily oriented toward return, how much they can make, and pay little attention to risk, how much they can lose.

A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and do make mistakes. This includes making allowances for human error, bad luck, or extreme volatility in a complex world.

Value investors invest with a margin of safety that protects them from large losses in declining markets.

By investing at a discount, he knew that he was unlikely to experience large losses. The discount provided the safety margin.

Whenever the financial markets fail to fully incorporate fundamental values into securities prices, an investor’s margin of safety is high.

With credit to the Book Summary: Margin of Safety by Seth Klarman (jamesclear.com)

Incredibly, the book has become somewhat of a collectible in having cult like status. When we checked on Amazon, there’s only one hardback copy for sale right now, at a cost of £1,800:

Quotes To Think On

"Value investing is at its core the marriage of a contrarian streak and a calculator."

Klarman highlights the essence of value investing, which involves going against the crowd (being contrarian) and using analytical tools to calculate the intrinsic value of an investment.

"Risk is not inherent in an investment; it is always relative to the price paid."

He points out here the idea that the perceived risk of an investment is closely tied to the price at which it is acquired. A low priced asset may have less risk, while a high priced one could be riskier.

"The future is uncertain; when you have all the answers, you are destined to be wrong."

This quote underscores the unpredictability of the future in financial markets. Any of us that have been in the market for any period of time can firmly agree with this…

"The single greatest edge an investor can have is a long-term orientation."

Unless you’re a day trader, short-term market fluctuations and noise should not drive investment decisions.

"In investing, the winning strategy is not to be smarter than others, but to be more disciplined than others."

This is something that we regularly bring up when talking to new investors. Consistently following a well-thought-out strategy, even if it seems less exciting than chasing the latest market trends, can lead to long term success.

"The more you do to your portfolio, the more you're likely to do damage."

Klarman cautions against excessive trading and unnecessary tinkering. Overactivity can lead to higher transaction costs and potential mistakes.

"The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions."

Here Klarman acknowledges the cyclical nature of the stock market and how human emotions can lead to exaggerated movements.