Vol On The Rise

All the key charts for increasing volatility... and how we're positioning ourselves.

Global markets spent the first quarter of 2024 in a relatively calm mode. US equity markets continually stepped higher, powered by good earnings and shrugging off a change of tone in rate markets. Europe’s STOXX 600 had a similar story. Oil stayed quiet and rangebound as no major changes to its supply materialised. Gold was constrained to a tight range. Currency desks spent most of their time twiddling their thumbs during a particularly quiet few months.

However, as March unfolded, the landscape started to shift, with signs of volatility becoming more pronounced. Now, in mid-April, the situation has escalated, and markets are talking. As concerns grow, investors are showing an increased inclination towards protection, resulting in a rise in volatility across various markets. Cross-asset benchmark volatility has climbed higher.

“I think volatility is so widely used as a risk-metric simply because it is easy to measure, not because it is a good gauge of risk of permanent loss of capital. Downside volatility is merely one aspect of risk, not necessarily the most important, while upside volatility isn’t much of a risk at all - unless you are short.” - Joel Greenblatt

Volatility is on the rise, but not necessarily risk. Here’s a rundown of the markets…

Equity markets

The premium for one-month put options to protect against a pullback in US equities reached the highest since October.

The 1-month vs. 3-month S&P 500 implied volatility gap reached its narrowest point since late October as investors sought hedges against short-term swings.

Nasdaq 100 volatility index to S&P VIX ratio has dropped to the lowest level in recent times, indicating that the hedging interest is more concentrated on the broader market.

Outside of the US, the 3-month implied volatility of India’s Nifty 50 index has dropped below that of the S&P 500 for the first time since December, one of the few areas of the markets where volatility is still contained.

Meanwhile, the Stoxx 50 volatility have been trending higher. This increase in volatility has resulted in a rise in the 3-month 90%-110% skews of all indexes, indicating higher hedging interest. However, the current skews are still below their historical averages.

Currency markets

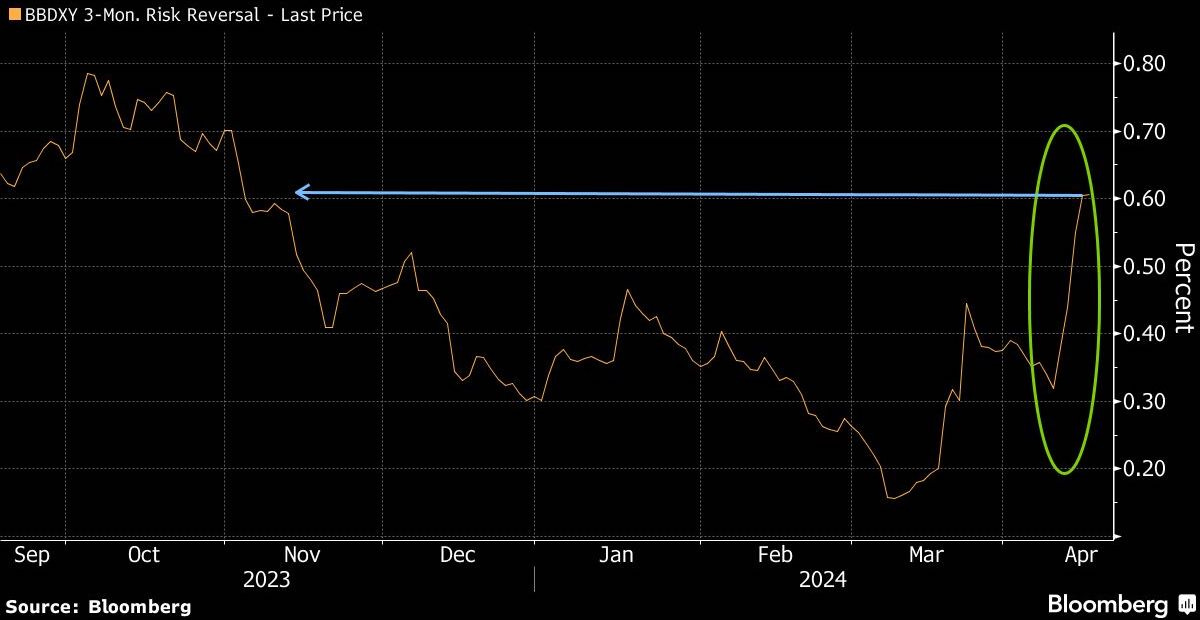

Currency-options volatility is climbing from multiyear lows. Demand for the high-yielding, haven dollar reshapes options outlook.

The premium to speculate on the dollar rising over the next three months compared with it falling has risen to the highest level since November.

Currency option turnover remains high, driven by a surge in demand for the US dollar as a safe haven from geopolitical tensions. Trading volumes are currently exceeding the recent daily average.

Rate markets

Rates volatility has surged since the middle of last week, shown by the ATM 3 month-10 year swaption. The move is supported by flows in Treasury futures targeting higher yields over the coming weeks as strong US growth continues and further Fed rate cuts are priced out.

Commodity markets

Brent crude oil 2nd-month 25-delta call skew is near the highest level since late October, even as prices slipped back from last week’s highs. Concern over the possibility of a broader Middle East conflict adds to existing bullishness from reduced OPEC+ supplies.

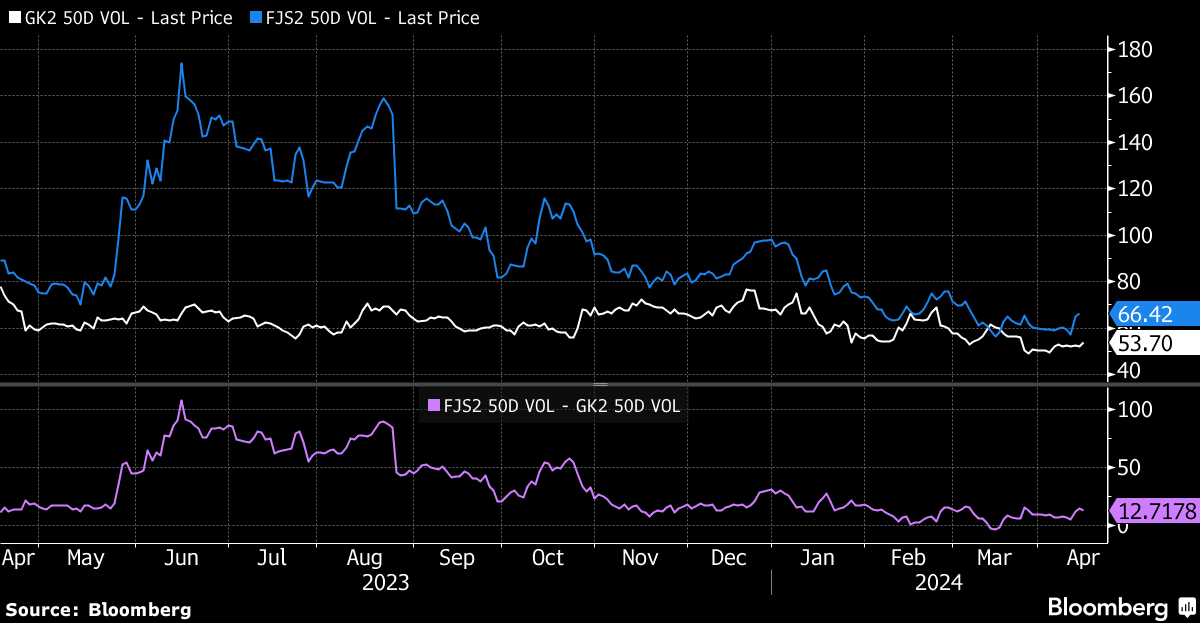

The implied volatility for natural gas in the US and Europe is one of the few that remained stable, but European markets showed a slight increase due to the possibility of supply disruptions from a wider conflict in the Middle East. In the US, the natural gas industry is currently facing a challenging situation, with spot prices in some basins dropping below zero. As a result, producers are holding back on production, leading to a sluggish market.

If you would like to access a 14-day free trial to read all of our premium content, click the button below:

It’s all about positioning

Enough of the chart overload. How are we positioning our cross-asset portfolio? What areas of the market are we looking to capitalise on with increasing volatility? How can an equity investor position themselves?