We've Been Here Before

Is this the real break for gold, or are markets ahead of themselves?

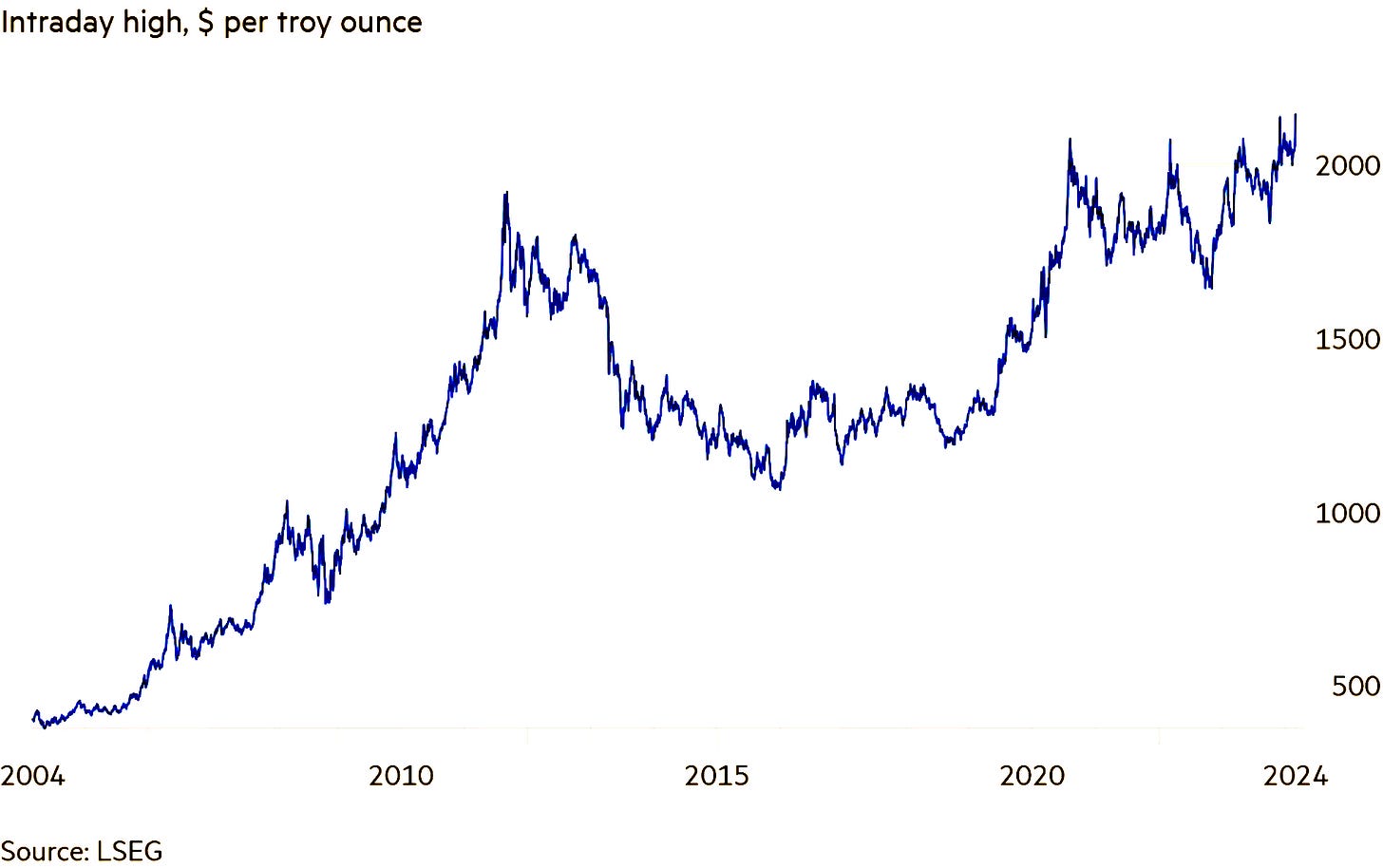

While Bitcoin, dubbed ‘digital gold’, soars to new highs, the precious metal itself is also making a move to new territory. If you ask any gold trader, they’ll tell you that we’ve been here before… maybe one too many times.

We’re here to look at both sides of the coin and present to the reader (yes, you reading this) with the information. Is gold finally making a break higher that will hold strong and continue? Or is the market getting ahead of itself… again?

A move higher

The price of gold reached an all-time high of $2,141 per troy ounce on Tuesday, surpassing the previous record of $2,135 in December. The surge has been fueled by a combination of factors including growing expectations of US interest rate cuts, increasing demand for safe haven assets, and a significant amount of buying activity from central banks and Chinese investors.

The rally in gold prices was triggered on Friday by weaker economic data, which led to growing hopes of a Federal Reserve rate cut in June. The ISM Manufacturing Purchasing Managers’ index indicated a far larger-than-expected contraction in US manufacturing activity in January. As gold is an asset with no yield, lower borrowing costs make it more attractive to investors who feel they are not missing out by not investing in bonds.

Gold has been on a 16-month rally, surging 30% from just above $1,600 per troy ounce in late 2022. This growth has been supported primarily by record buying from central banks in emerging markets after the US weaponised the dollar in its sanctions against Russia for its full invasion of Ukraine.

In recent months, there has been a notable surge in the demand for gold due to phenomenal purchases by Chinese consumers, who are looking for a safe asset to invest their money in after the local property and stock markets experienced a downturn.

It is worth noting that gold has reached a record high despite the rise in interest rates in recent years. The Fed's benchmark rate remains at a 22-year high of between 5.25% and 5.5%, which has somewhat diminished the appeal of gold. Nonetheless, it is remarkable that gold has still managed to reach an all-time high, although it is still a fair distance away from its inflation-adjusted all-time high of $3,355 per troy ounce in 1980. During that time, a nine-year bull run was capped by oil-driven inflation and turmoil in the Middle East.

The fluctuating perspectives on rate cuts, which have been oscillating throughout this year, may not be the primary reason behind gold's recent price movements. Instead, the current gold market has witnessed the entrance of new participants who are driven by uncertainty and seek refuge in gold as a safe haven asset. But this was a similar case in December, which eventually led to a third failed breakout above $2,100.

A move lower

A case for a move lower relies on data forcing the Fed’s hands to keep pushing back rate cuts, or at least the market’s expectation of them.