What It Will Take To "Make Oil Great Again"

Ahead of the key OPEC+ meeting on Sunday, we consider the factors that could help inspire a rally in oil from here.

The double-digit percentage decline in oil YTD reflects investor risk-aversion.

Another OPEC+ cut this weekend, along with stemming Russian oil supply would help to push the price higher on lower supply.

A demand driven push could come from the China resurgence, with technical traders quick to jump on the bandwagon.

WTI currently trades at $70.70 per bbl, down 11.8% year-to-date. We briefly traded down to $65.64 back at the beginning of May, with the 52-week highs of above $120 now seeming a distant memory.

Although we struggle to see it reaching back to such unique event-driven highs, here are several factors that are at play that could push the black gold up.

All eyes on OPEC+

On Sunday we get the latest information out from the OPEC+ meeting. Last month, the consortium revealed a surprise cut in output of 1.16 million barrels per day. Saudi Arabia took the bulk of this, with the split being shown below.

The oil price rallied sharply from this decision last month, but since has lost all gains.

We feel there’s a good chance that another cut is due this weekend. This follows Saudi Energy Minister Prince Abdulaziz bin Salman warning short sellers against betting against the commodity.

Given the natural process of oil demand versus supply, a aggressive production cut following the April one should help to provide a more long lasting support for the price.

Russian sanctions hurt revenue, but not supply

We feel there has been some confusion amongst some as to the supply of oil to the market from Russia since the outbreak of the war in Ukraine.

Certainly, price caps imposed mean that the revenue Russia receives from oil and gas exports has dropped. In the monthly report from the International Energy Agency (IEA), revenue for Russia is down 43% from a year ago.

Yet when it comes to actual supply, the countries crude oil and oil product exports rose last month to the highest level since April 2020. This was at 600,000 barrels per day.

Therefore, in order to see oil substantially move higher, we feel that Russian supply needs to diminish (not accelerate) from the sanction impact.

Whether a blind eye by the West is being shown here or simply ignorance is at play remains a question for another day. Yet ultimately as long as the supply is on the market, oil will struggle to rally.

China will bounce back

There have been concerns over recent months about the China slowdown.

We don’t really buy this story, and feel the China slowdown narrative has been peddled for years now.

Over the space of the next year, we expect China to have rising demand, buoyed by the post-pandemic customer led expansion. For example, GDP growth for Q1 2023 impressed at 4.5% (annualised), up from previous two readings of 2.9% and 3.9% respectively.

Services PMI has remained above 50 since the start of the year, and Manufacturing PMI had a May release of 50.9.

Given the sheer amount of consumption of oil and gas products, a strong China is a thumbs up for the oil price having a good summer.

It’s not just our opinion either. Here’s what the IAE say about it:

“World oil demand will climb by 2 mb/d in 2023 to a record 101.9 mb/d. Reflecting the widening disparity between regions, non-OECD countries, buoyed by a resurgent China, will account for 90% of growth.”

Technicals giving us the nudge

Aside from the above fundamental factors, traders that form decisions around the Techs should also be starting to lick their lips:

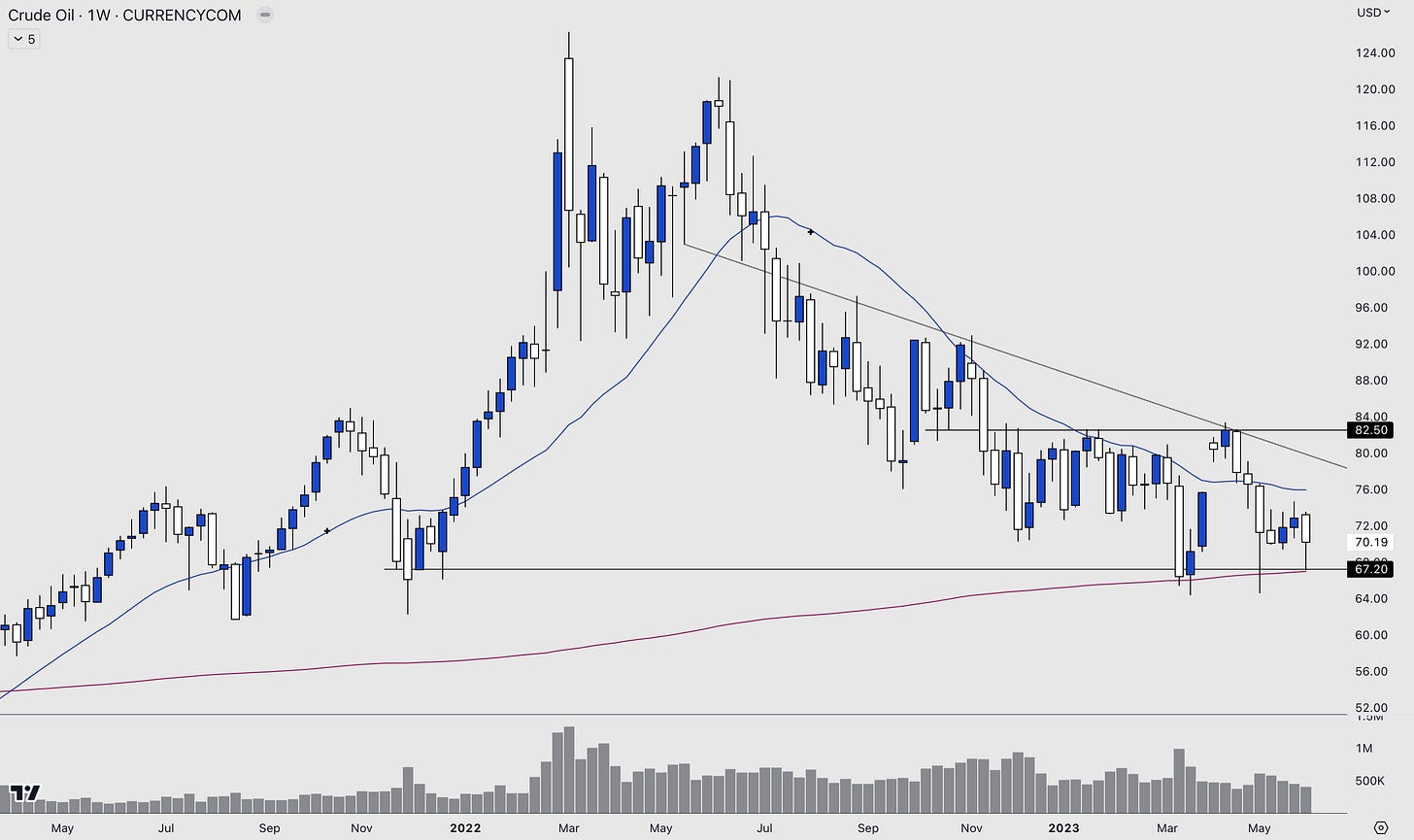

Any 200-period averages are strong support or resistance. For oil, the 200-week MA has held up as support on the previous two tests. Price also sits below the 200-day MA, which would be the first resistance level to note, currently around $75.70.

Above that, we note a resistance level and supply around 82.50, where the price reached its swing high after the April OPEC meeting.

The weekly chart gives more insight into previous support levels before oil started its 2022 rally, which was helped along by the war in Ukraine.

This broader view also helps to see the supply at 82.50 and the long downtrend that has acted as resistance over the past 11 months.

For those interested in more charting based trade ideas, we publish our top trades each Monday morning to subscribers.

We hope you enjoyed this investing article written by us, AlphaPicks. Feel free to reach out if you have any questions or feedback. Subscribing, sharing and liking this article is greatly appreciated as it helps us grow as a page. The more people reading our articles, the greater the compounding effect.