What To Know Ahead Of Today's Fed Meeting

A 25bps hike is all but confirmed. Investors are waiting patiently for the comments that follow.

The rate decision for today’s Fed meeting is all but confirmed. Markets have priced in a 98.9% chance of a 25bps hike, raising interest rates to the highest level in 22 years. Where the uncertainty lies is in the comments after. Will Powell be hawkish or dovish? And how convincing can he be to investors, who have previously shrugged off some of his words?

What to look out for

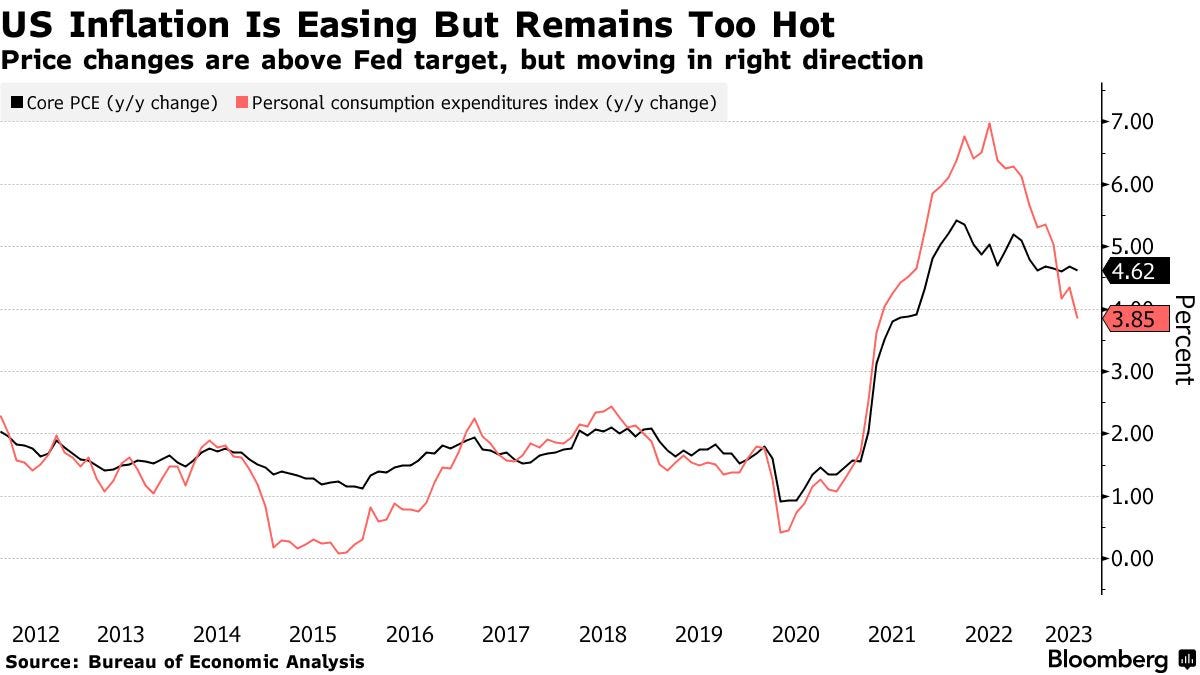

Investors will be watching Powell for hints about the central bank's commitment to raising interest rates once more in 2023. Investors anticipate no future hikes, despite the FOMC's June projection of a last boost later in the year since inflation pressures have subsided during the past month.

They will likely be cautious with what they say, leaving as many doors open to themselves in the future. Although inflation is easing, Powell and the Fed will not believe the job is done just yet.

“They want to avoid the mistakes of the 1970s and ’80s when they took their foot off the brake prematurely,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co.

The statement is likely to leave in place its guidance that hints at possible “additional policy firming.” It’s also expected to continue to describe economic growth as “modest” despite mostly upbeat data ahead of Thursday’s gross domestic product release. The committee could debate whether to acknowledge recent inflation progress or simply say it remains elevated.

Powell will likely be asked in the press briefing whether the FOMC’s forecast in the June “dot plot” in the Summary of Economic Projections calling for another hike is still intact in light of better-than-expected inflation news in June.

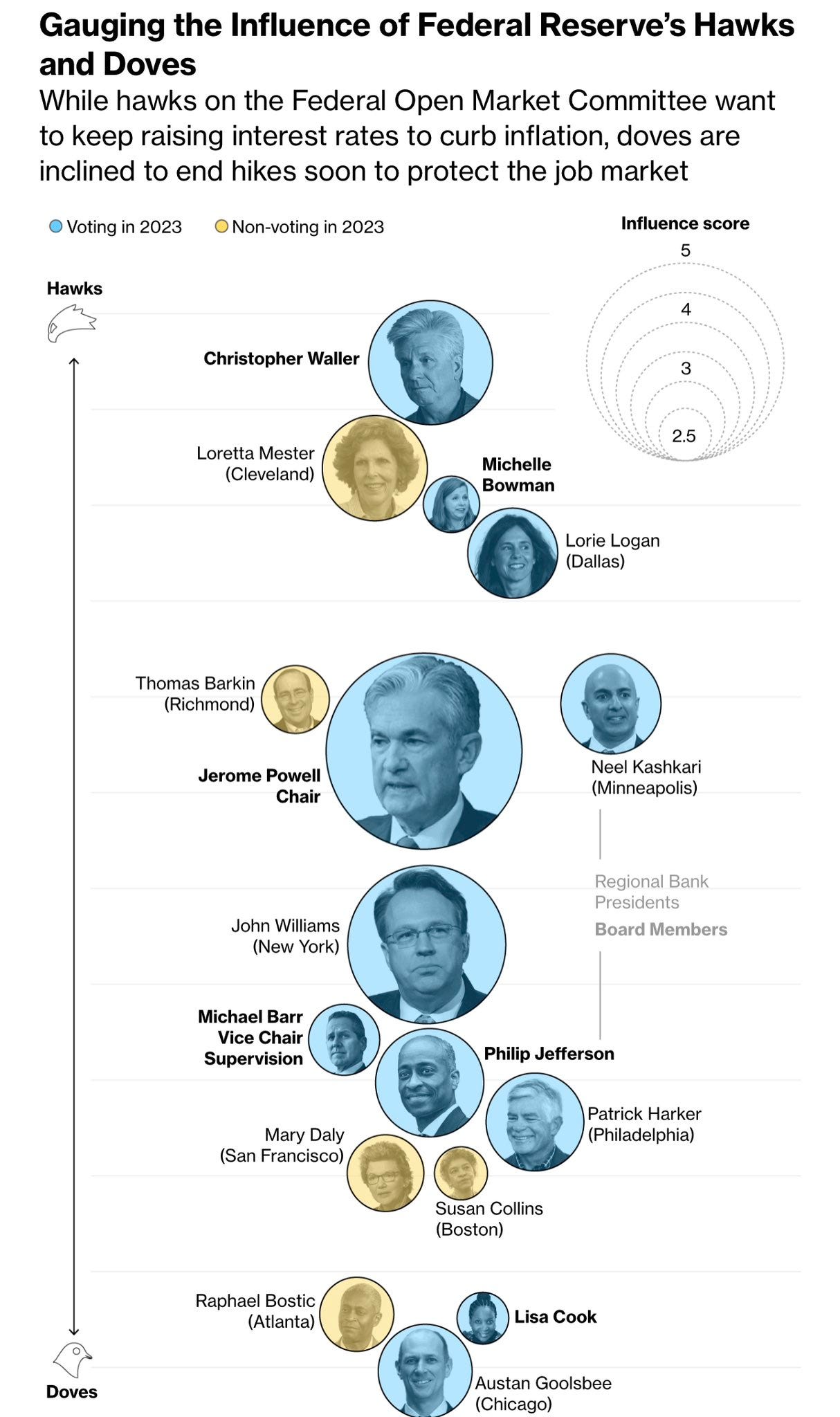

Influence of Fed speakers

After more than a year of solid agreement that higher interest rates were needed, differences among policymakers have started to deepen as they weigh when to stop hiking and how long to keep rates elevated.

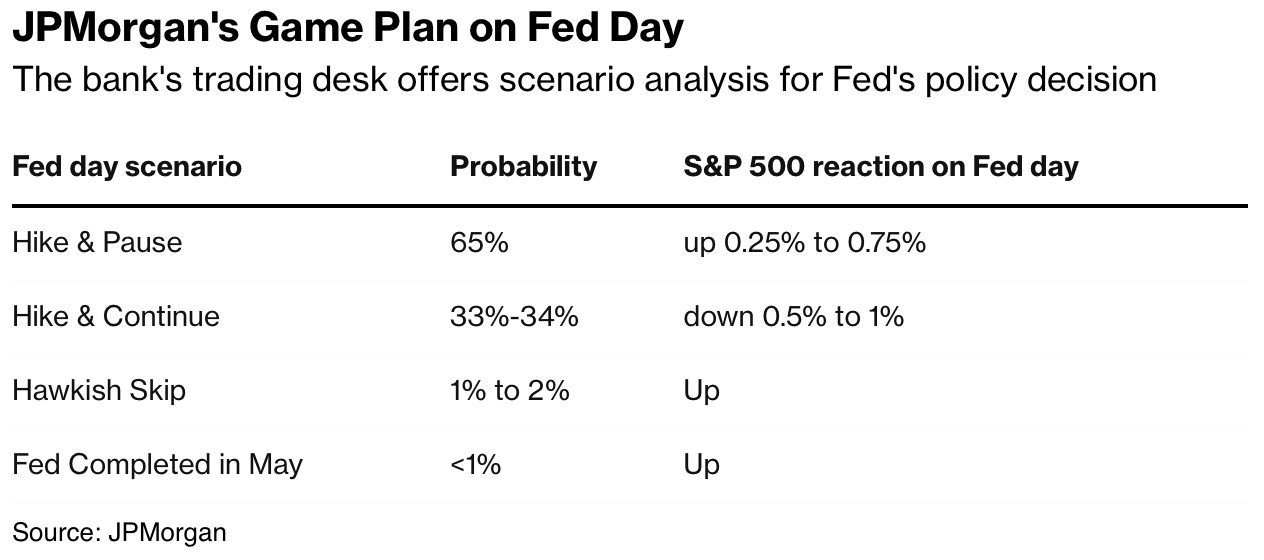

Outcome predictions

In the scenario that this is the last Fed hike, the JPMorgan team expects the S&P 500 to rise 0.25% to 0.75% during the session. Should the Fed stay on its hawkish path, they say, the index will drop as much as 1%.

There is a 65% probability for the central bank to raise interest rates this time and then stop.

We think the Hike & Pause scenario is more likely, with potential upside risks that the Fed may confirm the end of the cycle earlier at Jackson Hole.

Trade ideas

Idea for a Hike & Pause

With an expected move of 0.25% to 0.75% on a Hike & Pause, we feel it makes sense to go long on August SPX calls. This way, you capitalise on an initial move higher but also a continued trend into next month.

TRADE IDEA - LONG SPX 4600 AUGUST CALLS

Entry: 37.5 (current pricing on the release of the article)

Idea for a Hike & Continue

In this scenario, we feel there will be a knee-jerk higher move in the US Dollar. We like to pair being long USD against NZD, given that the RBNZ has finished their hiking cycle. Therefore, the shift in yields (higher) post-Fed meeting should raise the differential between US and NZ, causing the pair to rally.

TRADE IDEA - LONG USD/NZD

Limit Order: 0.6215

Take Profit: 0.6375

Stop Loss: 0.6150