When Scarcity Sets the Price

A weekly look at what matters and how to trade it. (December 29th)

The last Week Ahead of the year is upon us. 2025 was a year that rewarded high conviction and fast reversals, and punished complacency almost immediately after. The trades that defined it were rarely subtle and never patient.

From Tokyo rates desks to Istanbul FX books, markets oscillated between windfall and whiplash. Politics proved catalytic but not curative. Donald Trump’s return to the White House set off violent repricings across assets: crypto surged and collapsed, European defence re-rated from pariah to public good, mortgage giants traded like meme stocks, and fiscal anxiety flirted with debasement before retreating in the face of old-fashioned demand for safety. Even the most powerful stories (AI dominance, crypto inevitability, fiscal reckoning) learned again that momentum is not immunity.

Some long-dormant trades finally paid. Japanese bonds shed their widowmaker status. Creditor-on-creditor skirmishes rewarded aggression over cooperation. Others failed in familiar ways: carry trades undone by politics, leverage exposed by liquidity, premiums evaporating once confidence wavered.

We enter 2026 with a rewritten playbook.

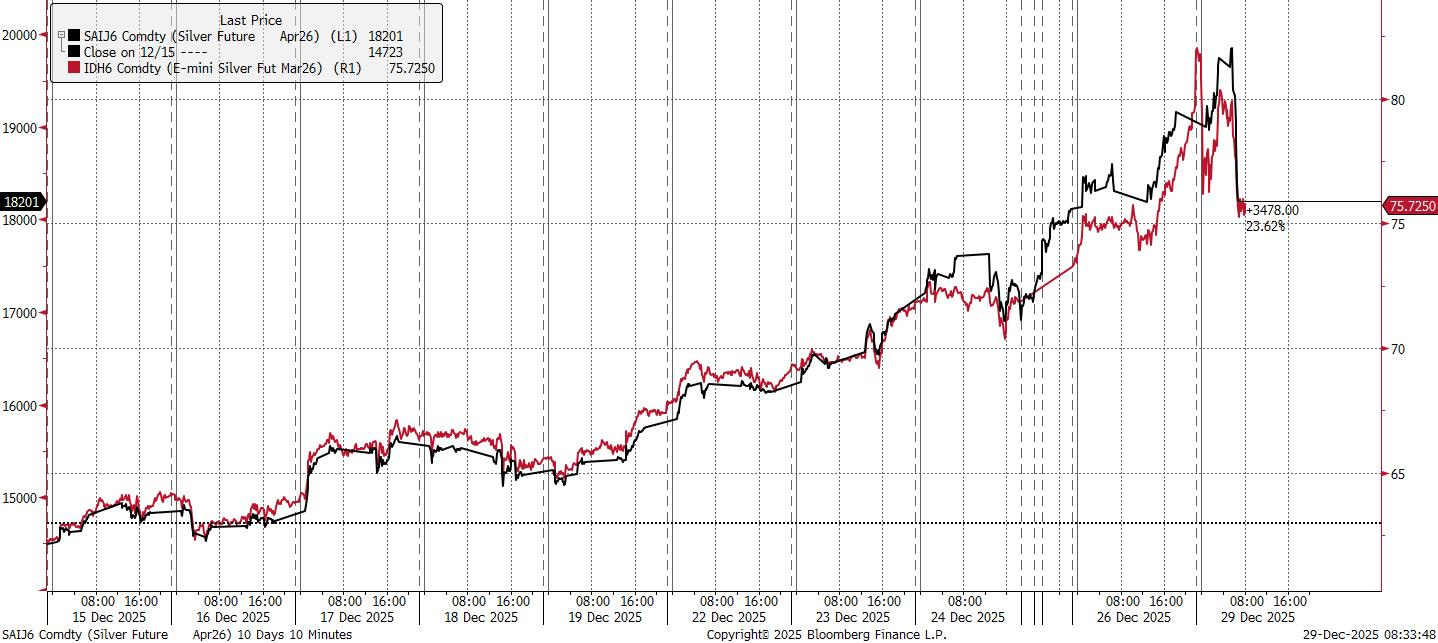

As for the week that has just gone, US equity markets drifted higher into year-end despite characteristically thin holiday liquidity, finishing the week near record highs. AI-driven equity leadership remained intact, with technology among the better-performing sectors. Elsewhere, mining stocks outperformed as several precious metals hit record highs, providing broad support to the materials complex. Among that, silver really caught the headlines.

Midweek momentum was reinforced by the strongest US GDP print in two years. However, the composition of growth revived discussion around a K-shaped economy. Strong headline activity masked uneven distribution beneath the surface, with consumption and government spending doing the heavy lifting, a profile that supports equities tactically but complicates the longer-term policy backdrop.

In FX, a clear bias toward USD selling emerged. USD/JPY led the move lower, while EUR/USD again tested the 1.1800 area without a decisive break. Dollar weakness earlier in the week coincided with comments from Treasury Secretary Bessent supporting the idea of shifting the Fed’s inflation target to a band once inflation is deemed re-anchored, a signal markets interpreted as structurally dovish.

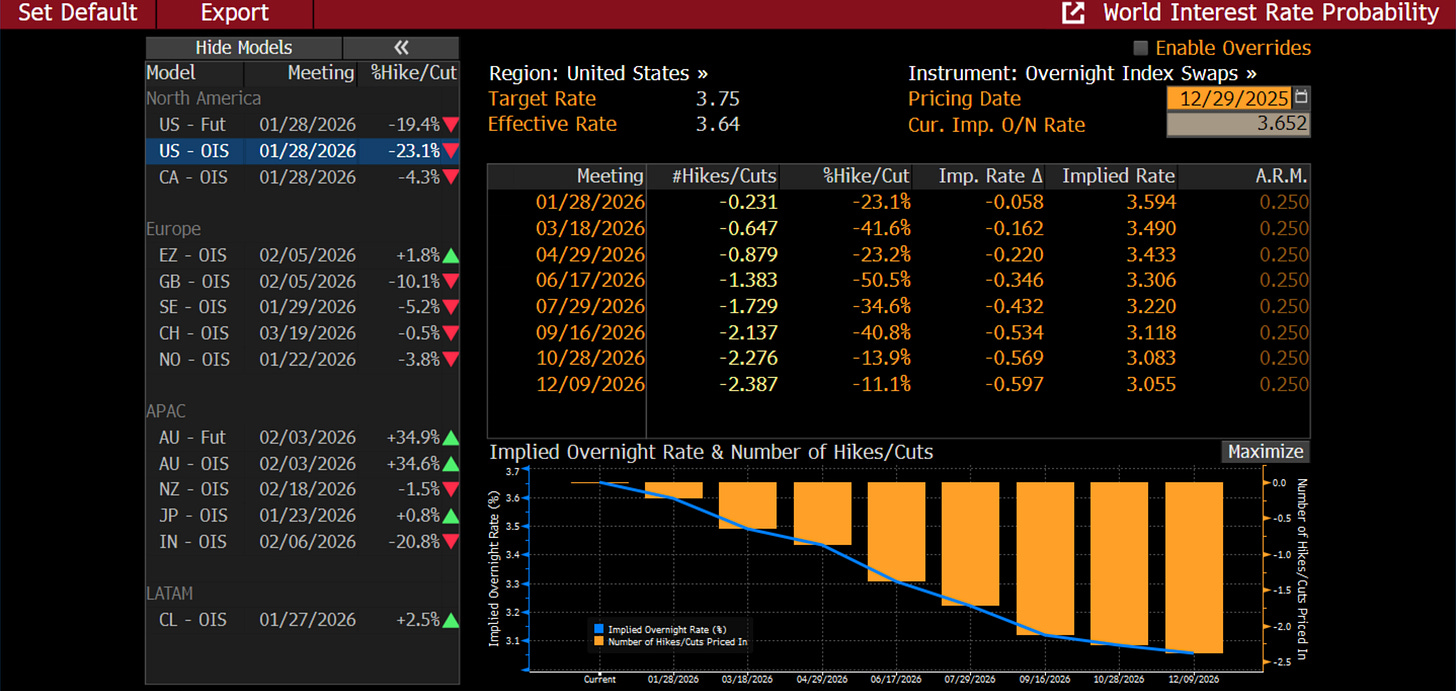

Treasuries were largely unchanged on the week. OIS pricing continues to anchor expectations around the June 2026 FOMC meeting for the next rate cut, with roughly 34bp priced.

To access the full slate of research and commentary, consider becoming a paid subscriber.

The (Short) Week Ahead

There are a few topics to run through today, even if we do have a short week ahead of us.

Silver and the commodity space will be mainly in focus, and likely the most significant talking point in market commentary.

BTP/Bunds spreads and a changing stance in Europe.

Trump praises Zelenskiy, but no final peace deal is made just yet.

A few shorter points to end on.

Silver

Silver’s move last week was about plumbing. China’s decision to impose export licensing from January reframed silver as a strategic material rather than a passive commodity, tightening a market where physical availability was already strained. The response showed up immediately in price dislocations: Shanghai and Dubai traded at double-digit premiums to COMEX, while the London forward curve remained in backwardation—the market paying more for metal today than for promises tomorrow.