Where Did The Money Go? (Bank Earnings Preview)

Everything you need to know on upcoming JP Morgan, Citi, Wells Fargo and Bank of America earnings.

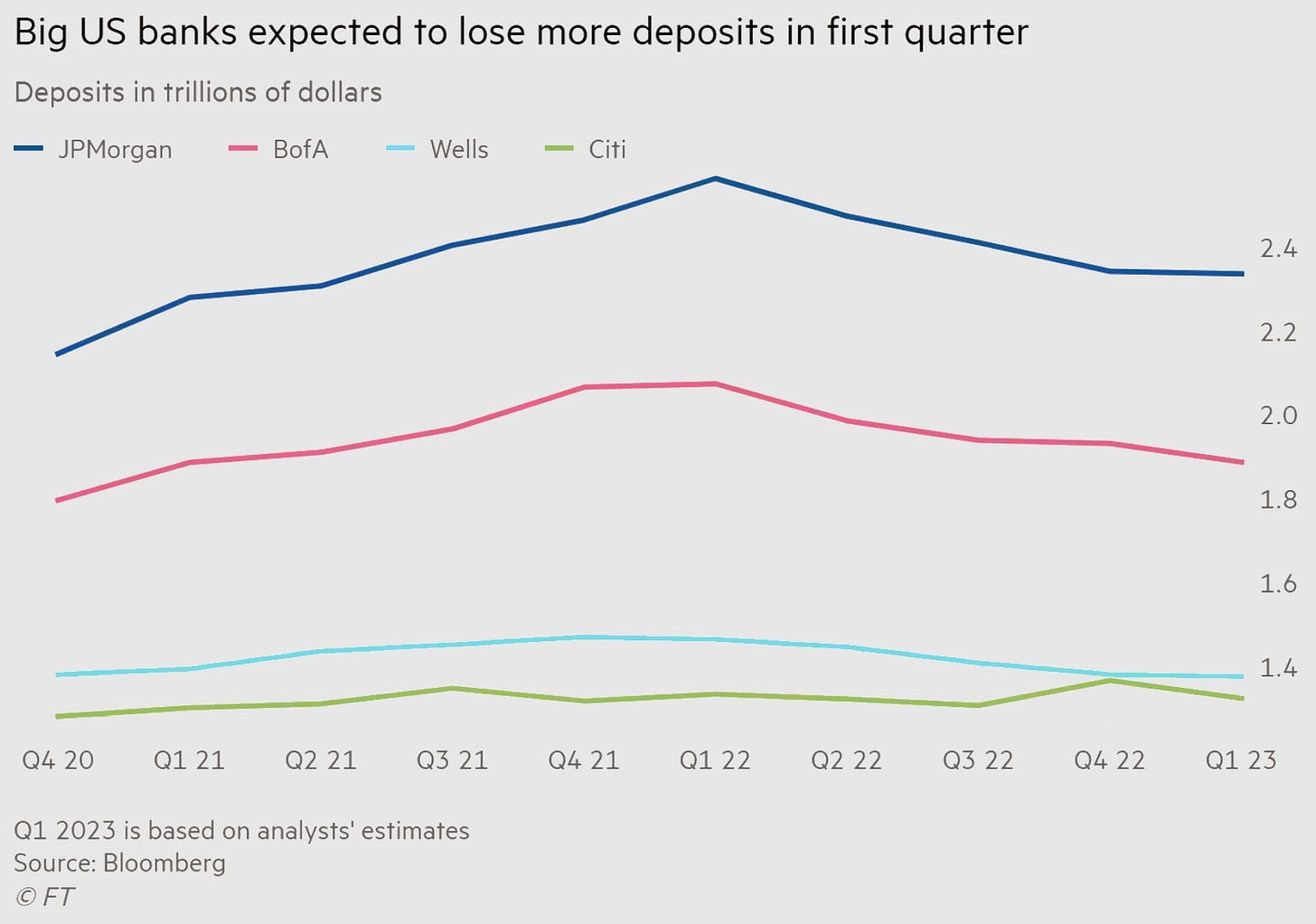

There will be only one figure that investors look for in the upcoming bank earnings reports. Deposits.

This week sees the earnings release from JP Morgan, Citi and Wells Fargo on Friday, while Bank of America releases their report on Tuesday next week.

Q1 2023 has been an important one in the history of US banks. The failure of Silicon Valley Bank and Signature Bank will not be forgotten. This event shot fear into the markets, with JP Morgan and Bank of America dropping 10% and 15% over a few days, respectively.

How much money depositors withdrew from banks is only estimated, with analysts suggesting $100 billion in aggregate figures. This is the estimated figure despite the banks mentioned above gaining customers after the regional bank crisis. Many will be watching intently to see if the actual figures for the period come in higher or lower than expected.

Deposits are typically banks’ cheapest source of funding, and a reduction could constrain lending.

It’s not just an issue that has arisen this year. The big banks have steadily lost deposits for the past 12 months as the Federal Reserve has raised rates.

Last week, JPMorgan Chase CEO Jamie Dimon warned the turmoil that has engulfed the financial sector in the wake of recent bank collapses is not over and will ripple throughout the economy for many years.

Analysts expect revenues to rise most at the banks with large retail operations. However, investment banking, such as Goldman Sachs, Morgan Stanley and BlackRock, is expected to have suffered another challenging quarter as Wall Street grapples with a prolonged dealmaking slowdown that is expected to hit hard.

JP Morgan JPM 0.00%↑

Revenue estimate: 36.173 billion

EPS: 3.414

We don’t know if Jamie Dimon was scaremongering with his recent comments. It could be that he’s trying to lower the bar of expectations for upcoming earnings. The EPS estimates already suggest a lower result than the previous quarter but higher for last year's period. JPM has outperformed analysts' earnings predictions by 8% in the third quarter of 2022 and by 16% in the fourth quarter of 2022.

We’re fairly neutral on JPM for upcoming results. The large private bank should have benefitted from inflows from Credit Suisse, but the problems in the investment bank are well known and will weigh on the earnings report.

Of note - the company's average analyst price target is $152.4 per share, 19% higher than current market levels.

Wells Fargo WFC 0.00%↑

Revenue estimate: 20.09 billion

EPS: 1.13

If the revenue estimate is hit, it would mark the best quarter for the bank since Q4 2021. Part of this growth can be attributed to the make up of the company. It doesn’t have a large presence on equity or debt capital markets, or investment banking. Therefore, the slowdown in these areas isn’t going to have impacted Wells Fargo to any major degree.

The concern some will have is that even though Wells Fargo is technically a global brand, it’s very reliant on US business. We’re of the opinion that a US recession is still at 50/50 for this year. Slowing US growth and higher rates will put pressure on the US consumer, something that could weigh on Wells Fargo performance later this year.

Citi C 0.00%↑

Revenue estimate: 20.058 billion

EPS: 1.643

Citi is one of the Tier 1 banks with a large retail base. As such, even if deposits fall, focus could shift more towards the profit being made via the net interest margin (NIM). This reflects the difference between the rate paid on deposits and the rate charged on loans. This stood at 2.39% in Q4, and we feel it should rise further from Q1.

We also expect strong revenue from FICC, particularly from the bond trading teams. The volatility thrown up by other banks (e.g Credit Suisse) saw large volumes being traded during the quarter. So far, Citi hasn’t come out with any realised losses from these event driven volatility.

Bank of America BAC 0.00%↑

Revenue estimate: 25.249 billion

EPS: 0.812

Last quarter, 61% of revenue from the bank came from net interest income. This helps to identify how crucial deposits are for the second-largest bank in the US by market cap.

We’re slightly concerned about how the outflow in deposits will be offset by the higher net interest margin, and what the overall result will be. The market revenue estimate for Bank of America is 8.7% higher than in Q1 of 2022.

Over the last four quarters, the company has beaten consensus EPS estimates three times. However, if results come in at expectations, this shows no growth from the year-ago quarter.

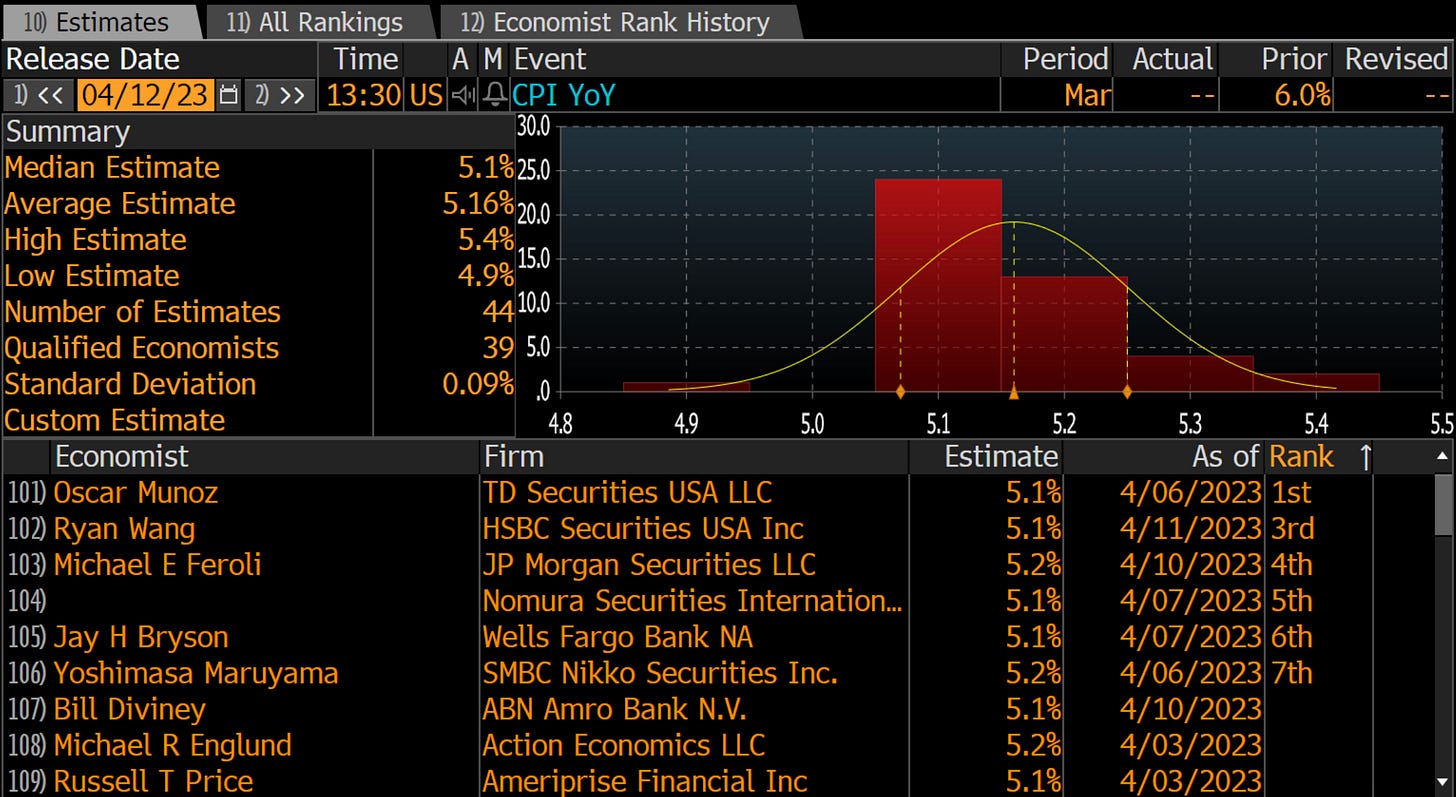

Today also is the day for the latest CPI print.

The estimates are as follows:

Average: 5.16%

High: 5.4%

Low: 4.9%

Prior: 6.0%

Goldman Sachs has released a game plan for various outcomes. These are good to factor in but are not often the exact reactions the market sees.

5.1% or below, market up. 5.2% or higher, market down.

We hope you find our latest article helpful to you. If you have a moment, please drop a like to show your support.