Who Benefits From Nasdaq's Rebalancing?

The winners and losers of this "special event".

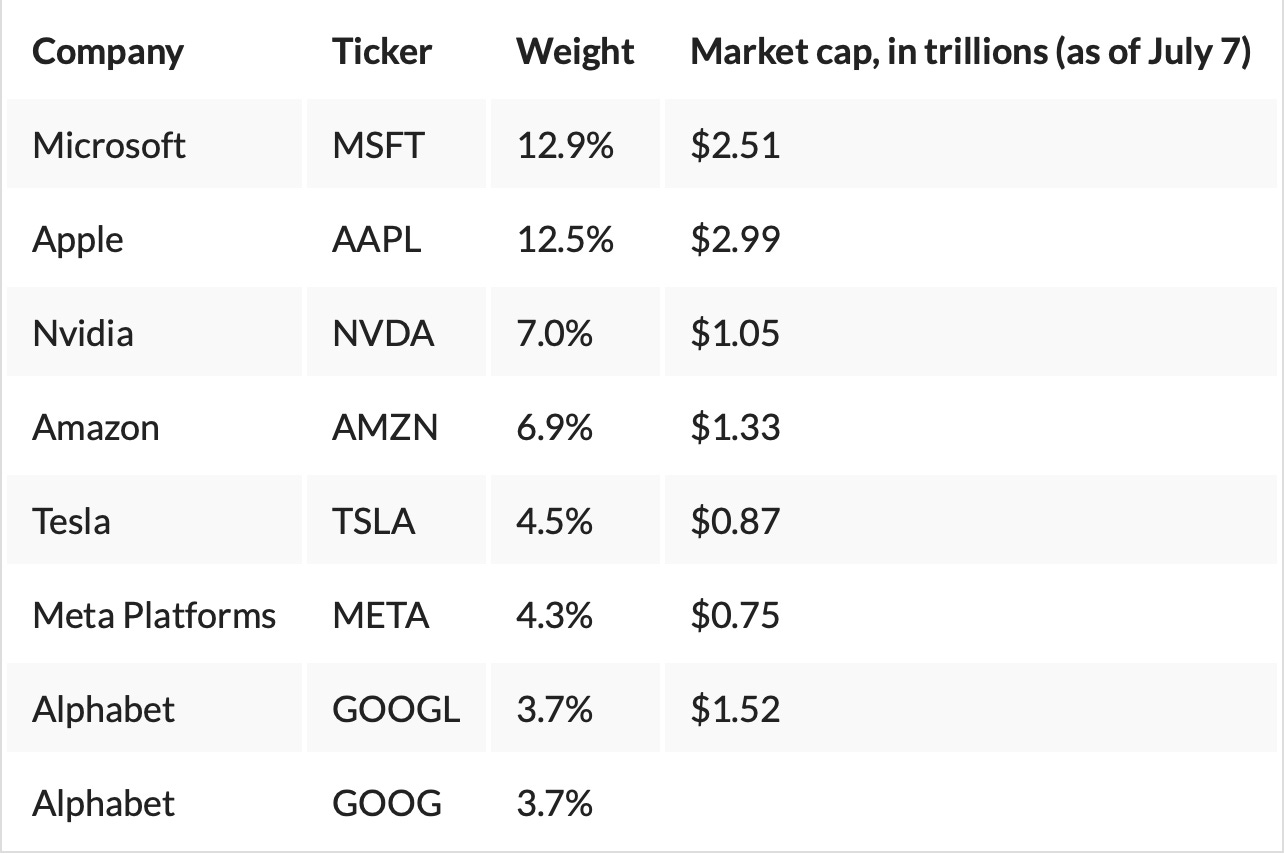

How the weighting of Nasdaq will change.

The regulations behind this decision.

Winners and losers of this special event.

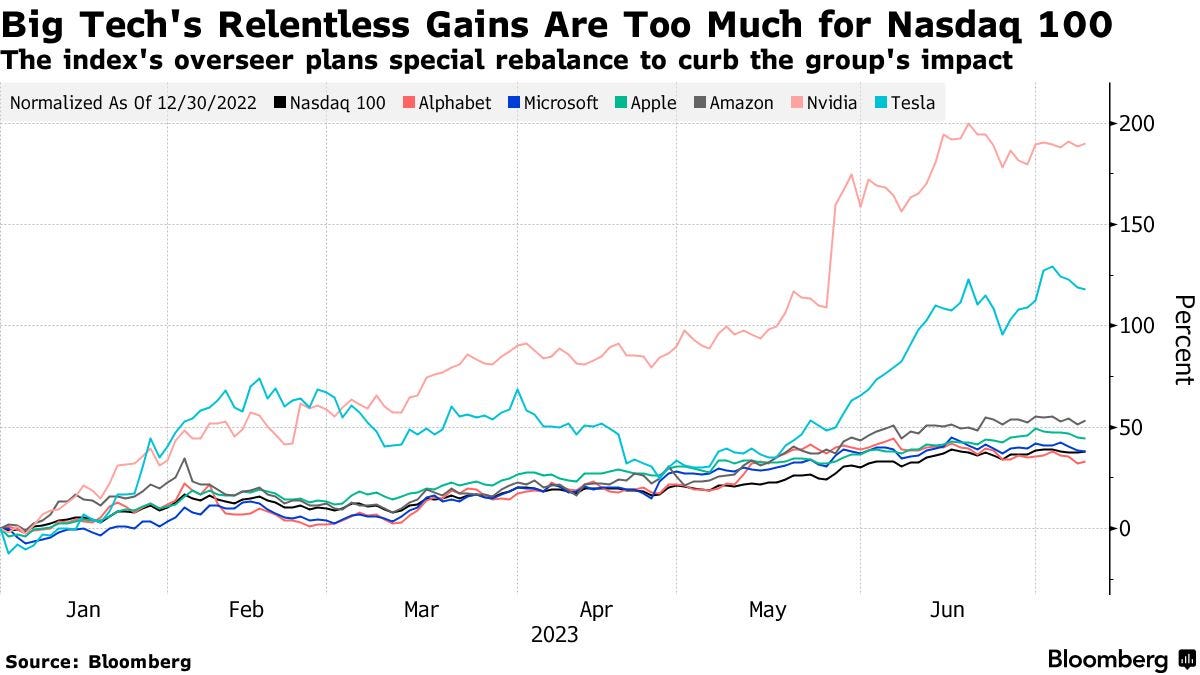

Whatever theories are being proffered as to why index overseers chose to cap the influence of technology mega caps in the Nasdaq 100, the real reason is simple.

The special rebalance, the first ever of its kind, is intended to prevent fund managers linked or benchmarked to the index from violating a Securities and Exchange Commission diversification rule. Specifically, it limits the aggregate weight of the largest stock holdings — those with a 5% representation or greater — to 50%, according to Cameron Lilja, vice president and global head of index product and operations at Nasdaq.

“This methodology rule is in place to ensure that any funds tracking the Nasdaq 100 remain in compliance with the Regulated Investment Company diversification rule,” he said in an interview.

The remark clarifies the extraordinary event that brought attention to the significant advances made this year by entities like Apple and Microsoft. Although it's tempting to portray the rebalancing as a reaction to predictions that the rally's narrowness had doomed it in the long run, the reality was a little more cold-blooded.

“From our perspective, the motivation to reduce index concentration is purely from the regulatory angle,” Lilja said.

The rebalance, scheduled to take effect July 24, is expected to reduce the influence of six tech giants — Microsoft, Apple, Alphabet, Nvidia, Amazon, and Tesla while boosting the presence of other members in the Nasdaq 100.

Apple, which touched $3 trillion in market capitalisation late last month, fell 1% on Monday following the news. Other mega-cap stocks, including Microsoft, Alphabet and Amazon, fell between 0.7% and 2.5%.

Changes to the index will force investment funds that track it to adjust their portfolios and sell shares of companies with reduced weight in the index.

The rebalancing will impact a host of funds that track the Nasdaq 100, including a popular exchange-traded fund, the $200 billion Invesco QQQ ETF.

Could the S&P 500 follow suit?

Rebalancing of weights in the S&P 500 takes place when the aggregate of companies, with each having a weight greater than 4.8%, exceeds 50% of the total index, according to S&P Dow Jones Indices.

Apple and Microsoft are the only firms weighing over 4.5% in the S&P 500. The top five firms with the most influence in the S&P 500, including Amazon, Nvidia and Tesla, make up 22.2% of the index's total market value.