Why Nike Just Can't Do It

Falling market share, a failing re-org and hiked prices.

On June 28, following a dismal earnings call, Nike’s shares plummeted 20%, erasing $28 billion from its market capitalisation in a single day. Headlines implied this was the day that Nike lost its crown. Yet, in reality, the business has been struggling for some time.

It’s down 32% over the past year, and down almost 60% from the pandemic highs.

Today we flag up some of the key reasons why the business has stuttered in the recent past and whether it’s a growth stock worthy of inclusion in our portfolio going forward.

A QUICK REMINDER: Our prices for premium subscriptions will go up to $20/month from Monday (this only applies to new subscriptions, so if you are already a paying reader, you’ll stay on the same plan).

However, if you join now you can benefit from the current plan of just £10/€12/$13 per month forever (annual plans are even better value). To make the offer even sweeter, we’re offering a 7-day free trial as well. It wouldn’t be fair to ask you to sign up without letting you see what value we offer first.

The Problems at Nike

Losing Market Share

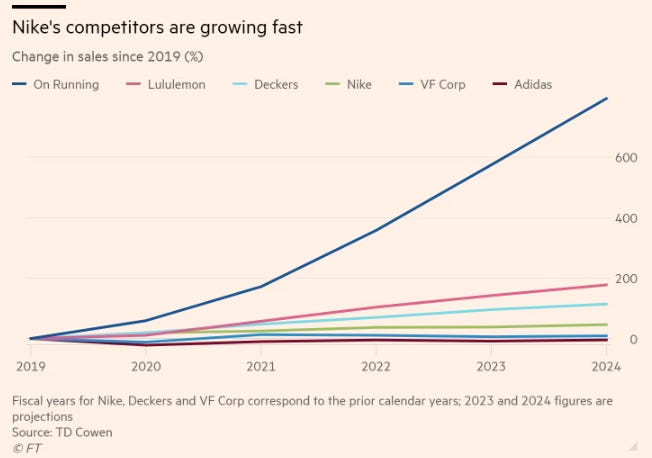

For a long time, Nike dominated store and online sales in the sport sector. However, in recent years several new companies (or existing ones that have innovated) have taken away a greater share of these sales. The growth in the revenue of these firms is shown this via the below chart from the FT:

Clearly, to talk about Nike we need to talk about On Running. On, a Swiss sportswear company founded in 2010, has rapidly grown into a significant player in the global athletic footwear and apparel market.

The company's distinctive cloud-like cushioning technology, known as CloudTec, has revolutionized running shoes and appealing to both professional athletes and casual runners. It’s clever marketing campaigns lean on innovation and high-quality Swiss engineering. Even though this might be more in line with Audemars Piguet and Richard Mille, this innovation-driven approach has resonated with consumers, leading to high sales growth.

Add into the mix partnerships with elite athletes and endorsements by prominent figures like tennis legend Roger Federer (ironically taking a leaf out of the marketing playbook from Nike) and On has grown rapidly to take market share away from Nike.

On Running might be hitting Nike in the shoe sales, but Lululemon is taking away sales from the clothing range. Lululemon isn’t a new kid on the block, having been founded in 1998. However, in the past decade it has become a lot more in vogue by carving out a niche in the athleisure market.

This combines high-performance athletic wear with stylish and comfortable everyday apparel. Expanding its product lines in recent years to include a broader range of athletic and casual wear, Lululemon has capitalized on the growing trend of fitness enthusiasts and those seeking stylish, functional attire for everyday use. People that used to buy Nike tops now often choose Lululemon, partly on the premium brand positioning alongside the better quality of produce.

Price Sensitivity

Despite the cost of living crisis and pressure on consumers wallets for discretionary spending, Nike hasn’t appeared to have noted this, with core products now more expensive than peers.

With the high price elasticity of demand in this market, we don’t think it’s a surprise that customers are shopping around more.

For example, Air Force 1’s now go for easily over £100 ($129), when just a few years ago these were closer to £80.

Of course, inflation costs have put pressure on Nike to raise the price to maintain profit margins. But clearly that isn’t the only factor at play here, otherwise the company wouldn’t have recently announced a new cheaper range in order to try and win back customers from elsewhere.

The CFO commented that the $100-and-under sneakers would be rolled out to countries around the world shortly. Time will tell if this idea works, but it’s a clear sign to us that it now recognises that consumers are more price sensitive than Nike perhaps thought.