Why The VIX Is So Relaxed

With the VIX having closed below its historic average for 99 straight sessions, nothing seems to be wanting to wake it up.

On Wednesday, the US Fed met and updated everyone on their guidance for monetary policy. Typically seen as one of the major events for volatility in a typical month, US equity markets jumped in response to what was perceived to be confirmation that rate cuts are coming shortly.

Yet despite this whipsaw price action, the VIX actually fell. Currently sitting just above 13, it’s continuing a downward trend that has existed for much of the past year. So we thought it interesting to outline some of our reasons as to why the VIX is so calm despite what many see as uncertain global markets ahead.

What is the VIX?

At AP, we like to try and make investing and trading education more straightforward that trying to read a Lehman Brothers Options textbook. So what exactly is the VIX?

The VIX, short for the CBOE Volatility Index, is a widely used measure of market volatility and investor sentiment in the United States stock market. It is often referred to as the "fear index" because it tends to spike during periods of market uncertainty or fear and decrease during calmer market conditions.

The VIX is calculated by the Chicago Board Options Exchange (CBOE) based on the prices of options on the S&P 500 index. More specifically, it’s derived from the prices of a specific set of options with 30 days left to run. Therefore, the VIX reflects the anticipated magnitude of fluctuations in the S&P 500 index over the next 30 days.

It's important to note that the VIX is not a direct predictor of market direction; rather, it reflects investors' expectations of future volatility.

Understanding implied volatility

A key factor within analysing the price of an option is backing out the implied volatility. After all, the implied volatility can be thought of as another way to express the VIX.

Implied volatility gets dampened when the stock market rises. So immediately, we can correlate the move higher in US equities with the move lower in the VIX.

Why?

A rising market often suggests stability and confidence in economic fundamentals. As uncertainty decreases, investors become less inclined to hedge their positions through options, leading to reduced demand for options contracts. With lower demand for options, their prices, and hence implied volatility, tend to decrease.

The rise in ETF pressure

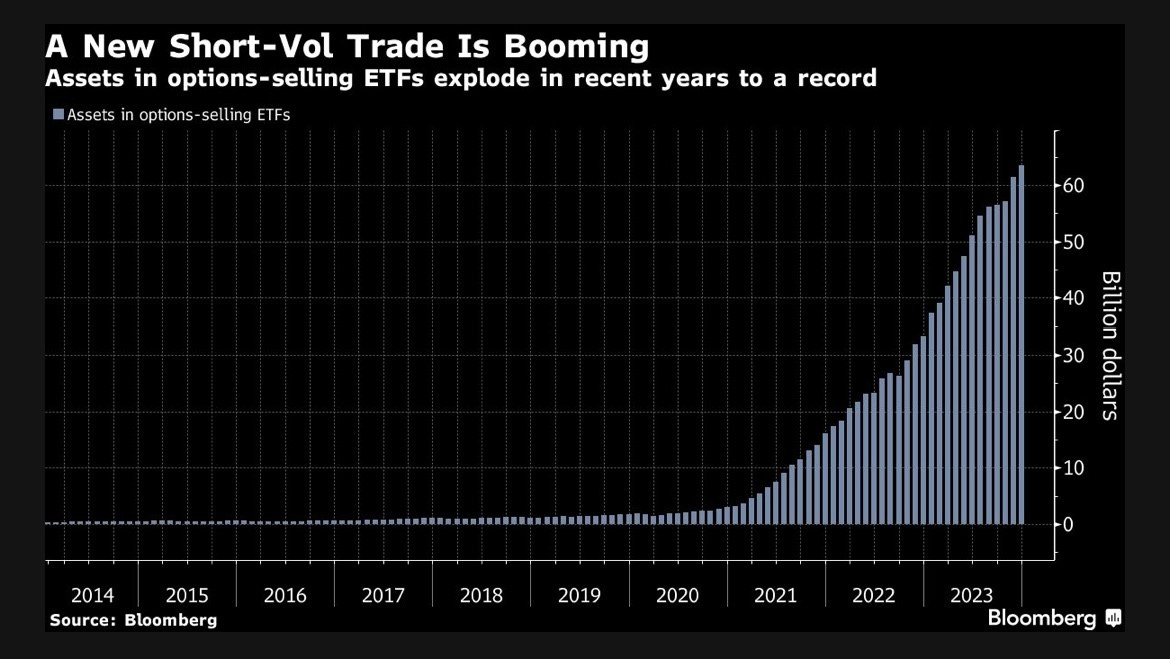

Another influence that has been impacting the VIX is the rise in option selling ETF’s.

In the old days, a US focused ETF would simply hold the portfolio of underlying stocks. Some Put option buying might be used to try and protect some extreme downside risk, but that would be it in terms of using derivatives within the fund.

Yet in recent years, funds are enhancing the return on a portfolio by actively selling options to garner yield. The rise in this can be seen from the below chart: