Why We'll Never See Another Black Monday

The ins and outs of how the most memorable market day of the last century unfolded, the reasons that caused it, and why we'll never see it happen again.

Monday, October 19th 1987. It started as a reasonably normal Monday on Wall Street. Traders came to the floor after having experienced a tough Friday trading session the previous week. Even off the back of a significant decline, what was to come caught everyone off-guard. It became one of the most defining days on Wall Street of the last century.

The day caused a global, severe and largely unexpected stock market crash. Market participants were caught off-guard as losses reached $1.7 trillion.

The Dow Jones Industrial Average fell 22.6%.

The severity of the crash sparked fears of extended economic instability, with many even concerned about a repeat of the Great Depression. Before this day, such a massive drop in the market wasn’t considered possible because statistics put such a decline at an impossibly rare twenty-two standard deviation event.

“Economists later figured that, on the basis of the market’s historical volatility, had the market been open every day since the creation of the Universe, the odds would still have been against it falling that much in a single day. In fact, had the life of the Universe been repeated one billion times, such a crash would still have been theoretically ‘unlikely.’” - Roger Lowenstein of the Wall Street Journal.

But it happened.

Why?

Contributing factors

Several theories are plausible. Firstly, economic growth had slowed in the first three quarters of 1987, and inflation was rising. Given the recent stagflation experience from the 1970s, investors were jittery. Secondly, fears were already heightened. The stock market had declined nearly 10% the week prior to Black Monday. Thirdly, program trading using computers was relatively new and not sophisticated. The losses in the week prior to Black Monday and the losses at the open triggered computer program trading with little or no human intervention.

“Portfolio Insurance”

Now would be a good time to bring up the portfolio insurance strategy.

A portfolio could be insured against losses while still enjoying gains by employing puts and calls. Managers of portfolios had to adjust the hedges as the market rose and fell in order to maintain portfolio insurance. In the years preceding Black Monday, portfolio insurance became more widely used, and by October 1987, tens of billions of dollars were being managed through the portfolio insurance scheme.

For each individual investor, using portfolio insurance to hedge against losses was entirely rational — benefitting from gains while limiting losses sounds great. But system-wide, deploying that much capital using an identical strategy was catastrophic.

In the weeks prior to Black Monday, volatility had been on the rise. Asset managers were obliged to hedge more of their portfolios. This meant raising more cash, which was done by selling more. It created a vicious cycle.

The more hedge funds sold into the decline, the more the markets fell. As markets fell, hedging priority rose. As hedging priority rose, more selling was needed for cash. You get the picture.

A quote that always sticks in mind: “The backside of a trade happens ten times faster.”

Markets are always quick to sell off. This time, it just happened to be an outlying example.

“If one small portfolio uses this sort of strategy, liquidity will not be an issue. If everyone in the market is trying to do it, it can become a nightmare, a little like everyone on a cruise ship trying to pile into a single lifeboat: it won’t float.” - Richard Bookstaber, head of risk management at Morgan Stanley, 1987.

Doomsayers are quick to ignore the differences

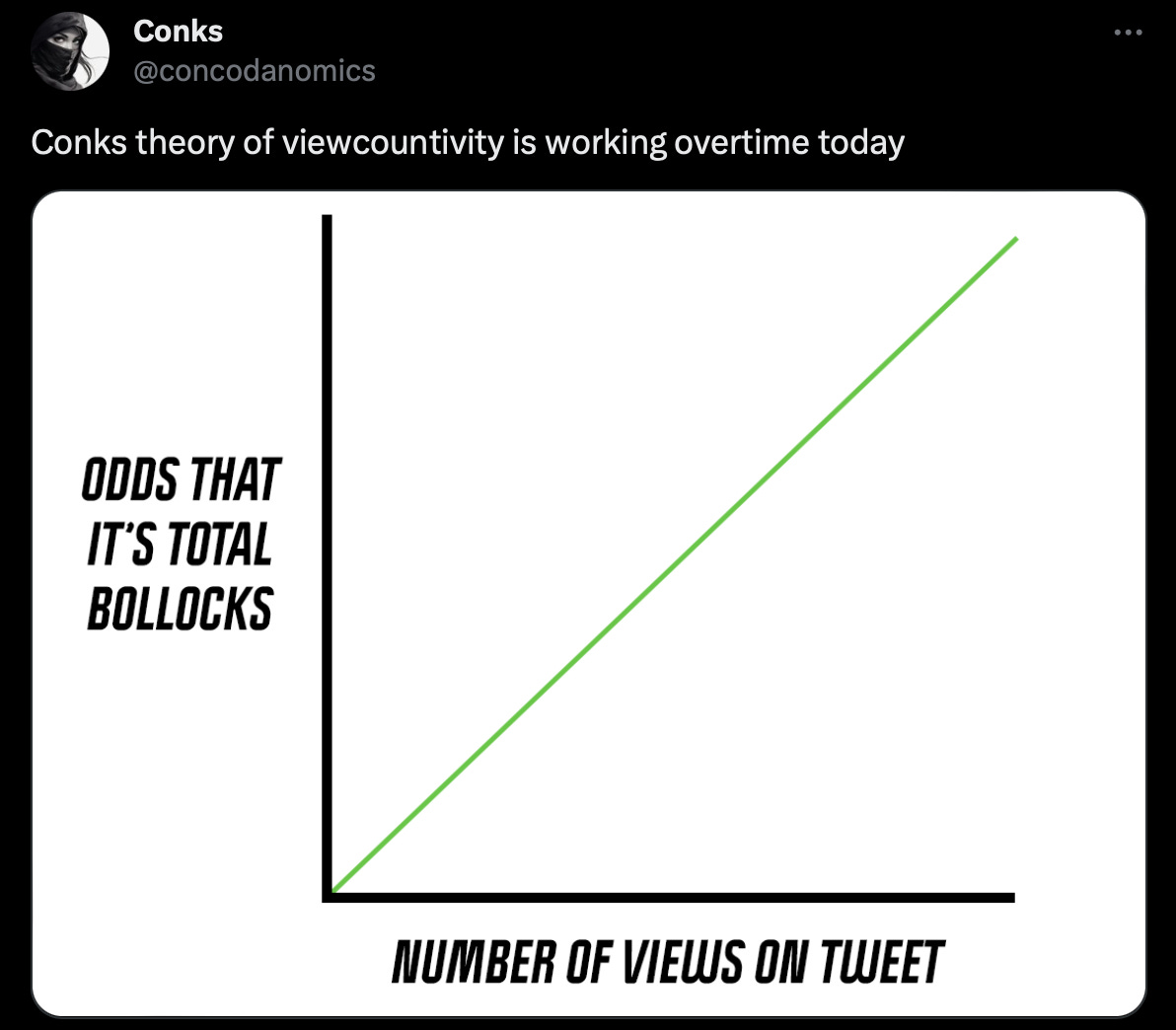

It’s easy to get caught up in fear. It’s a strong emotion. It also doesn’t help that fear-mongering gets easy views.

put it well:But all the doomsayers quickly ignore the differences between today (Monday, 23rd October 2023 at the time of writing) and Black Monday.

In the rest of this article, we highlight:

Reasons why we’ll never see another Black Monday event.

Extra info about how the notorious day of October 19th, 1987, unfolded.

Let’s start off with the first reason that makes it impossible to happen again: