Word on the Street

JPM's retail flows, GS global rates, Citi raise gold targets, BofA bullish bond thesis.

In our Word on the Street series, we share a summary of intriguing insights and perspectives that have come across our desk from various banks, investment managers, and research teams. We also inject our own thoughts to provide a well-rounded, chart-packed view on multi-assets.

This weekend, we take a look at:

Goldman and JPMorgan Retail Inflows

Global Rates and QRA

Citi and BofA Raise Gold Targets

BofA Bullish on Bonds

To access full articles and research, manage your account here.

Inflows

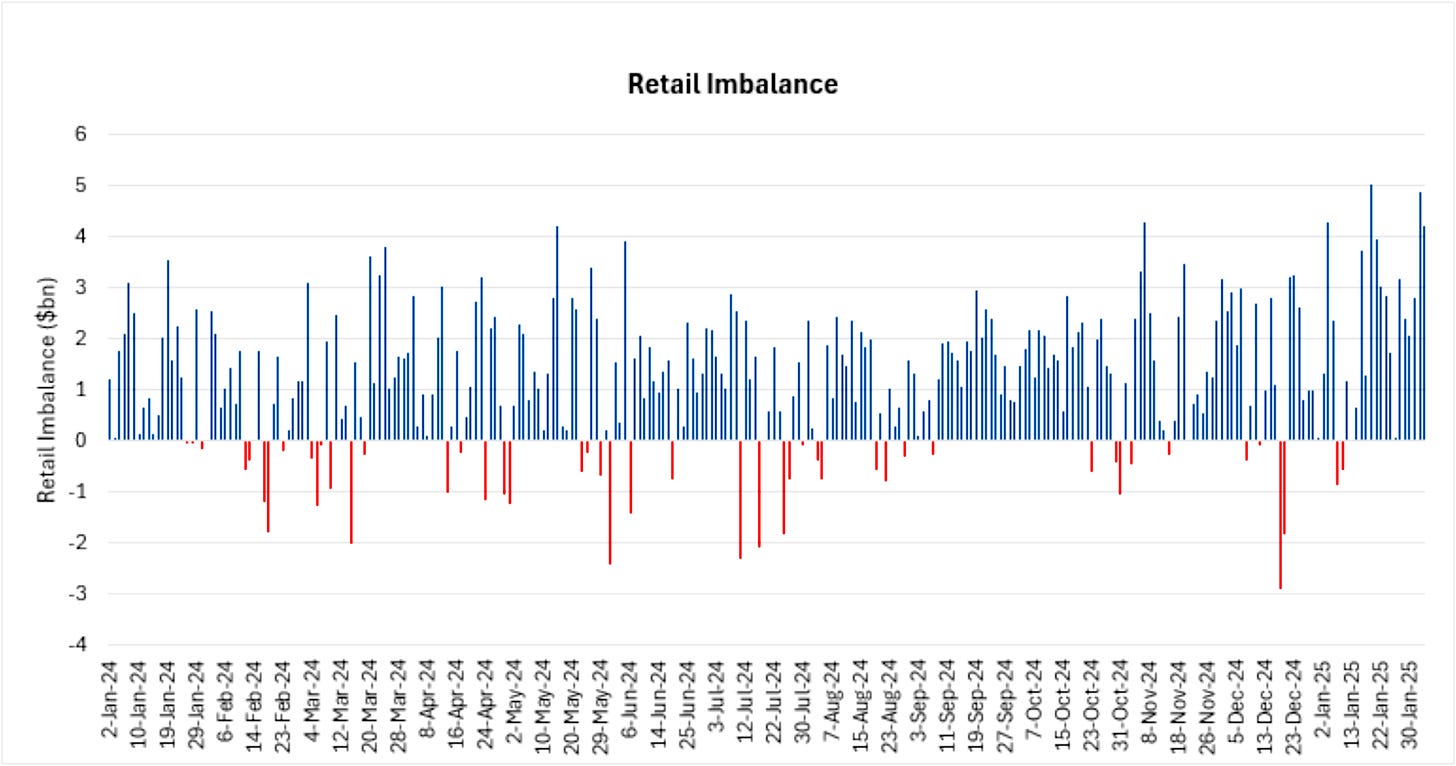

The largest retail buy imbalance in the history of GS dataset (starting in 2019) took place on 1/17/25 +$5.03bn. This dataset includes coivd times. The second largest retail imbalance took place on Monday 2/3/25 +$4.89bn. Tuesday (2/4/2025) was the fifth largest retail imbalance in our dataset of +$4.23bn. Four of the top five retail imbalances in the dataset took place in the last two weeks (i.e. buying the dip).

It’s no surprise that around 70% of the inflows on Tuesday were directed towards the Mag7 stocks, setting a new record, according to data from JPMorgan. Notably, Nvidia Corp., which saw a 3% decline the previous day, emerged as a top choice among retail investors.

Goldman’s Global Rates

At the quarterly refunding decision, the Treasury kept auction sizes unchanged outside of $1bn increases to 10y TIPS (reopening) and 5y TIPS (new issue). The guidance that “based on current projected borrowing needs, Treasury anticipates maintaining nominal coupon and FRN auction sizes for at least the next several quarters” remained in place.

We think there are a couple of reasonable interpretations of the decisions to leave the guidance. One is that the Treasury has a relatively sanguine deficit assumption that implies lower overall funding needs and affords more patience in deciding eventual coupon size adjustments. The other is that the Treasury is comfortable sustaining a slightly higher-for-longer bill share.

The market reaction aligned with the interpretation that the Treasury will lean more on bills. We’re inclined to take a balanced read, putting some weight on the possibility that the deficit assumption may also be a differentiating factor here. Still, today’s outcome does raise the prospect that Treasury is willing to let the bill share run higher-for-longer. GS pushed out their baseline expectation for coupon auction size increases from November 2025 to February 2026, which would see the bill share remain around 21.5% through 2026 before declining to 20% by mid-2027 under our deficit profile.

BofA Yen Call

BofA’s signals are broadly bullish JPY vs global currencies. Option flow showed rising demand for JPY calls last week and trend analysis shows several bearish signals for cross-JPYs.

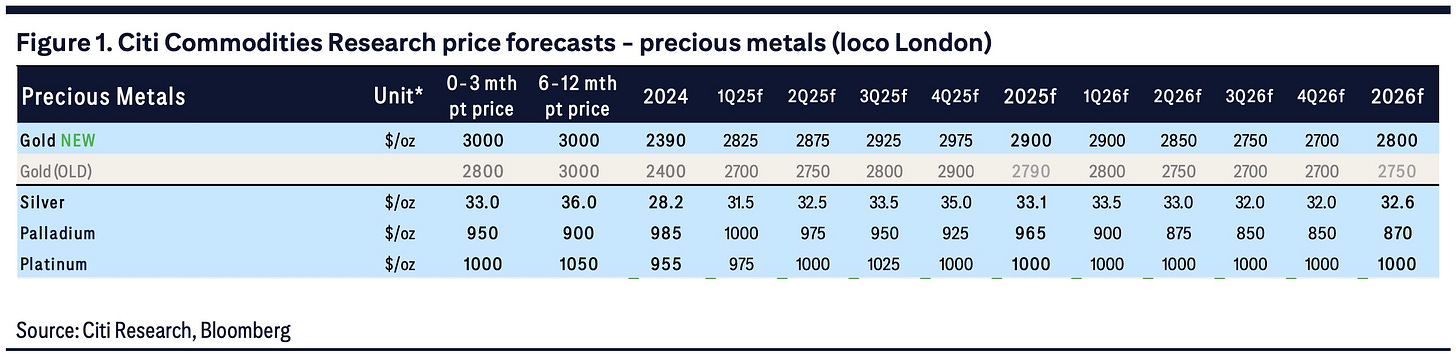

Citi’s Gold

Following a strong 27% annual gain in 2024, gold has rallied another 10% YTD, outperforming all major asset classes, breaching Citi’s 0-3m point-price target of $2,800/oz. This week, Citi upgraded its 0-3m target to $3,000/oz while keeping its 6-12m target unchanged at $3,000/oz (in-line with BofA targets), and also upgrading its 2025 average forecast from $2,800/oz to $2,900/oz.

Citi update:

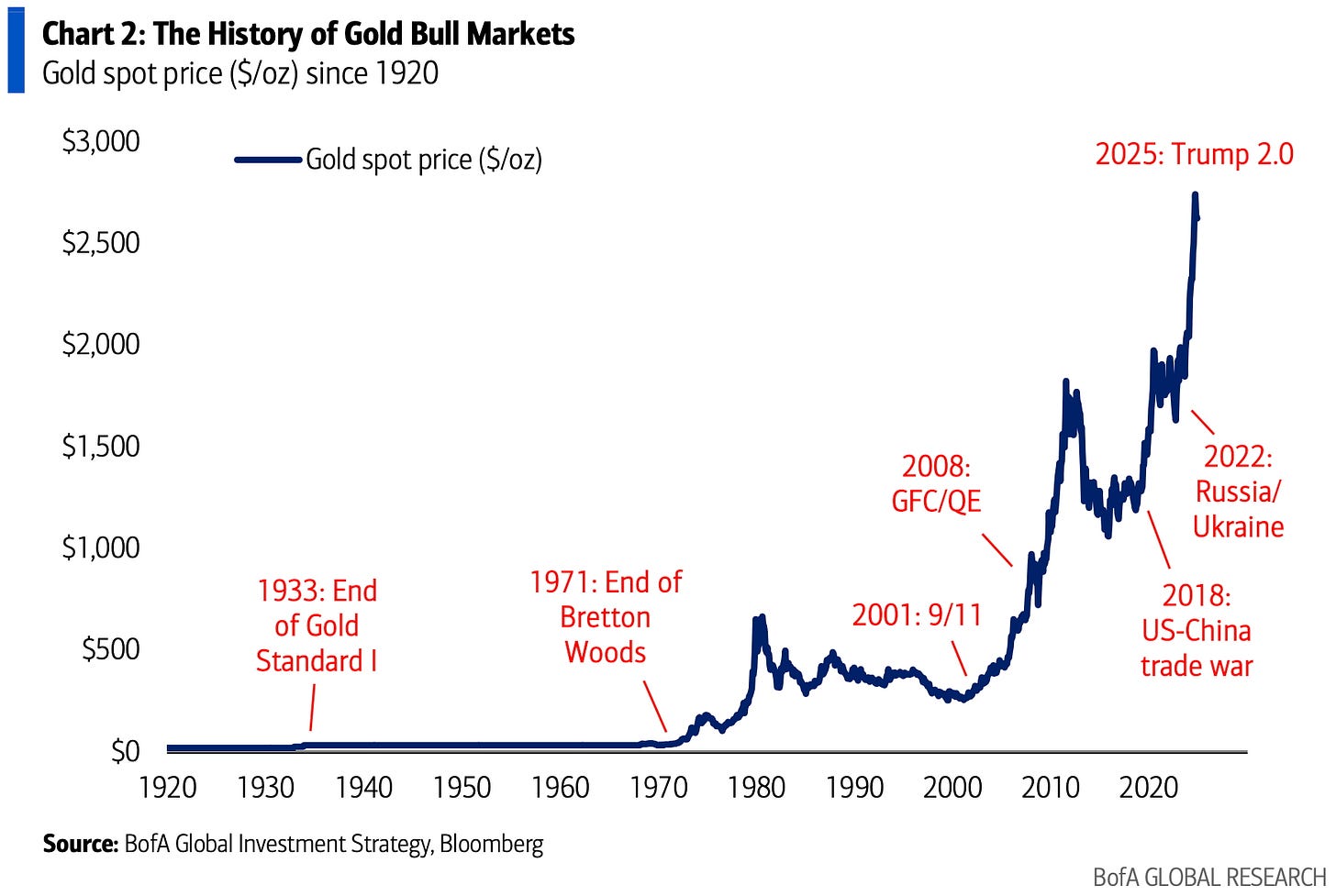

BofA: 1930s depression, 1970s stagflation, 9/11, GFC, populism in 2020s, and regime change Trump 2.0 determined to make history.

Ongoing trade wars and geopolitical tensions are strengthening the trend of reserve diversification and de-dollarization, which, in turn, is driving gold demand from emerging market official sectors. Additionally, concerns about global growth—related to tariffs and economic cycles—are likely to boost investment demand through ETFs and over-the-counter markets. If a peace deal is reached between Russia and Ukraine, and we find out whether gold will be exempt from broad tariffs, we could see a prime buying opportunity in the next couple of months.

We anticipate that global gold ETF holdings will experience their first annual inflow in 2025, breaking a streak of four consecutive years of outflows. Even with a soft landing scenario for the U.S. factored into our base case, we expect gold ETFs to remain appealing due to an uptick in macroeconomic and geopolitical uncertainties. These include ongoing trade tensions, escalating risks in the Middle East, persistently high interest rates impacting growth, a declining U.S. labor market, potential drawdowns in equity markets, and an increasing need for portfolio hedging and diversification.

BofA Bonds

Bank of America predicts that U.S. Treasury yields are likely to dip below 4%. With $37tn in government debt and a budget deficit averaging 9% of GDP over the past five years, these factors have significantly contributed to a remarkable 50% increase in U.S. nominal GDP since 2020. The $7tn U.S. government now stands as the third-largest economy in the world, and both Trump and Musk are counting on a U.S. government recession to help mitigate the spiraling national debt. Interest payments are expected to surge by $100-300bn in the coming 12 months, which poses challenges (as shown in Chart 5). To push through Trump’s proposed tax cuts, they will need the support of the GOP’s deficit-conscious Freedom Caucus, possibly through budget reconciliation.

The newly established Department of Government Efficiency (DOGE) aims to achieve $1tn in public sector savings. While BofA Global Research Economics estimates the base case for savings to be around $150-300bn, this figure could potentially rise to $500 billion (which is about 1.5% of GDP) if the administration successfully implements spending cuts and deals with layoff-related litigation. With the U.S. defense budget projected to exceed $900bn in ‘24, up from $630bn in ‘19 (see Chart 6), cutting back in this area could be a tempting opportunity for savings, especially as “forever wars” come to an end. Overall, a U.S. government recession could have a positive impact on bonds.

“All great bull markets begin with a bear market rally.” Currently, Treasuries, which have been overlooked, are staging a bear market rally in 2025 and are still the best hedge against peaks in asset prices. The risk-reward dynamics for bonds are looking more favorable. BofA analysis suggests that a ‘low-risk’ bond portfolio—comprising 20% T-bills, 20% 30-year US Treasuries, 20% investment-grade bonds, 20% high-yield bonds, and 20% emerging market bonds—could yield 9-10% if U.S. Treasury yields retreat toward 4%, which they anticipate yields will do in 2025.

Top 5

While the dominance of a select few stocks is often noted as a problem for the U.S. index, throughout history, many of the globe’s major indices have remained heavily focused on a select basket. This metric alone does not call for a major correction. However, the heightened volatility of these stocks does lead to the S&P 500 and the Nasdaq seeing some bigger moves (think back to DeepSeek’s effect on tech just a few weeks ago).

However, the continued growth of this dominance is an interesting one to see. A great visual came across our desk, with annotations on historical scenarios.

APFX Research

The new APFX branch of AlphaPicks has set up a macro heatmap. The 5-day moves of multiple assets are below.

Hang Seng was big green despite being hit with tariffs to start the week, as was natgas and copper as commodities had a strong week (the Bloomberg Commodity Index closed the week up 188bps). Yen strength saw USDJPY the biggest loser among G10 pairs, while crude continued to sell-off.

Hope you’ve had a great weekend. We’ll leave it there for this week.

See you Monday,

AP

great rundown