Word on the Street

Goldman sees a step-up for BoE cuts, Howard Marks’ latest investor letter, SocGen find FX proxies for oil, and pricing oil-related Iran risks.

Markets are never short on noise. The challenge is knowing what matters and what merely fills the air. In our Word on the Street, we filter the institutional signal from the speculative static, drawing on the most thoughtful commentary from banks, fund managers, and strategists.

This weekend, we look at:

Goldman Sees Step-Up For BoE Rate Cuts

Howard Marks’ Latest Investor Letter

SocGen Find FX Proxies For Oil

Pricing Oil-Related Iran Risks

To access full articles and research, manage your account here.

Goldman Sees Step-Up For BoE Rate Cuts

Following the latest Bank of England (BoE) meeting on Thursday, the Economics Research team at GS noted how the communication reinforces their expectation that the MPC will cut the Bank Rate again in August. They said that the MPC’s guidance remains consistent with continued quarterly cuts, with GS expecting further labour market weakening, a slowdown in pay growth and inflation progress in the upcoming data round.

Looking beyond August, their forecasts point to rising pressures for Bank Rate to fall in H2, and forecast a step-up in the pace of cuts to sequential moves from September to a terminal rate of 3% in February.

To balance out the somewhat aggressive view, the team notes that the risks around our baseline remain skewed towards a continued quarterly pace given the MPC’s ongoing concerns around inflation persistence and the possibility of second-round effects from further upward pressure on energy prices.

The pace of cuts beyond August will depend on the data. On the activity side, GS look for payback in Q2 GDP from the strength earlier in the year and subdued growth in H2 in light of softer global growth. Moreover, they expect a further weakening of the labour market with the unemployment rate rising to 4.9% in Q4 (above the MPC’s May projection of 4.7%). While the employment indicators remain hard to read, the weaker PAYE payroll and survey data point to further softening ahead.

To add to the mix, the team look for further progress on pay growth normalisation with private sector pay growth slowing to 3.5% by year-end (vs 3.8% in the May MPR) given labour market loosening and slowing pay surveys. They likewise expect more progress on services inflation as domestic price pressures normalise, with services inflation at 4.6% in September (below the MPC’s 4.9% projection).

Howard Marks’ Latest Investor Letter

In his latest memo to Oaktree Capital investors, More on Repealing the Laws of Economics, Howard Marks returns to a familiar theme: governments often try to bend or override economic fundamentals, and the costs are mounting. Marks walks through case after case where political goals clash with market realities, arguing that “free-market economies don’t produce perfect solutions, but efforts to significantly control them make things much worse.”

He begins with rent control, where “governments are choosing winners and losers.” Elected officials, eager to appease tenants, cap rents, which serves to only disincentivise landlords, kill new supply, and lock up mobility. “You can limit the rents landlords can charge for their apartments,” Marks writes, “but they can’t make developers build new ones.”

He then dives into the California wildfire insurance crisis, a more visceral example. State regulators, in the name of consumer protection, prohibited insurers from pricing based on forward-looking risk, causing most major insurers to pull out just before devastating fires. “Just as with rents, you can limit the price insurers can charge for coverage, but you can’t make them provide coverage at that price.” The result? Widespread underinsurance and catastrophic losses.

Next, Marks shifts to tariffs, which he refers to as “a tax,” plain and simple. The Trump-era push to reindustrialise America via trade barriers may appeal politically, but it runs up against both historical precedent and hard math. “Tariffs are like a wall,” he notes, artificially propping up domestic producers at the expense of consumers. Over time, this protection breeds complacency, higher prices, and “inferior goods.” As Niall Ferguson explains, every industrial economy eventually shifts from manufacturing to services once it hits a certain income level: “We cannot go back to the 1950s... it is way more expensive to do manufacturing in this country than it is to do it practically anywhere else.”

Marks concedes there are valid cases for targeted tariffs, such as national security, unfair trade practices, and iconic industries, but warns against the sweeping impulse to insulate domestic markets. “Governments can’t require everything to be made at home without consequences.”

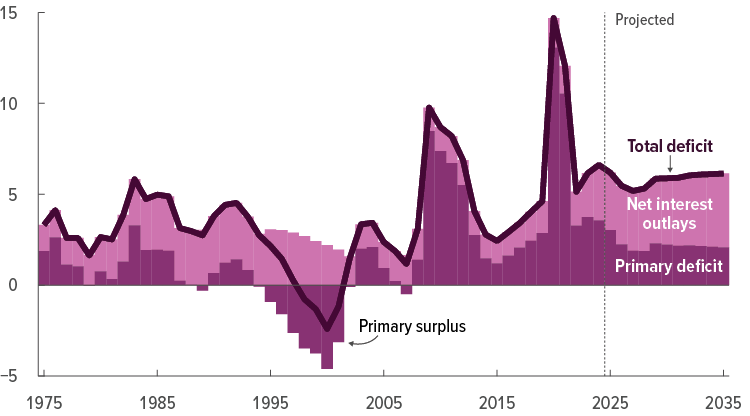

The memo closes with two warnings on fiscal irresponsibility. First, the US deficit is spiralling—“41 of the last 45 years have seen deficits, and trillion-dollar shortfalls are now routine.” Despite this, politicians continue cutting taxes and increasing spending. Warren Buffett put it bluntly: “We’re operating at a fiscal deficit now that is unsustainable over a very long period of time.”

Second, Social Security is running out of road. The Trust Fund will be depleted by 2035 unless painful fixes—like raising taxes or cutting benefits—are enacted. But as Marks notes, both parties are politically allergic to action. “Hands off Social Security” is the one bipartisan mantra that sticks.

Ultimately, Marks’ message is clear: policies that try to sidestep supply and demand may deliver short-term political wins, but they come with long-term economic pain. “The only way to strive for universal prosperity and ‘fairness’... is for government to mandate it. But the efforts to do so have never been successful.” Reality always reasserts itself.

SocGen Find FX Proxies For Oil

Kit Juckes on the FX strategy desk at SocGen is one of our favourites for FX and cross-asset musings. His team put out a piece with some great visuals that are worth highlighting.

One aspect was flagging up CAD strength and the potential for more appreciation going forward. CAD has done even better than SocGen expected this year, which the team remarks as being frustrating because they should not have been surprised by how much it bounced once the tariff outlook became a little clearer.

USD/CAD is, however, reacting to oil prices now. Given that the US and Canada are both big oil exporters, Kit prefers to express Middle Eastern uncertainty with CAD/JPY longs. CFTC positioning shows the market still short CAD at the last look (though it’s a shrinking short) and very long JPY (though that too is shrinking slightly now). As the chart shows, CAD/JPY has lagged the oil spike by a big margin, and thin markets could see a change in that.

For much of the past year, the CAD and oil prices were disconnected as yield dynamics dominated FX markets. However, the resurgence of geopolitical risks has rekindled the correlation between FX and commodity markets. As a result, USD/CAD is now facing selling pressure amid surging oil prices.

Kit notes that the SocGen commodity strategists have raised their Q3 oil price forecast by $4/bbl to $66.3/bbl, reflecting the persistence of risk premia until tensions between Israel and Iran are resolved. This leaves USD/CAD vulnerable to further declines.

SocGen also like being long NOK as a proxy for further oil moves, but prefer to pair it up against being short GBP, rather than playing it on NOK/SEK. This is mostly because NOK/SEK has done a much better job of tracking the oil price than CAD/JPY has done.

Pricing Oil-Related Iran Risks

Another great visual piece was put out by the commodity research team at Goldman as the week ended. It focused on oil and the impact of the ongoing conflict between Iran and Israel.

Following the rise in Brent to $76-77/bbl, they estimate a geopolitical risk premium of around $10/bbl. While their base case is that Brent declines to around $60/bbl in Q4, assuming no supply disruptions, this premium appears justified in light of their lower Iran supply scenario where Brent spikes just above $90, and tail scenarios where broad regional oil production or shipping is negatively affected.

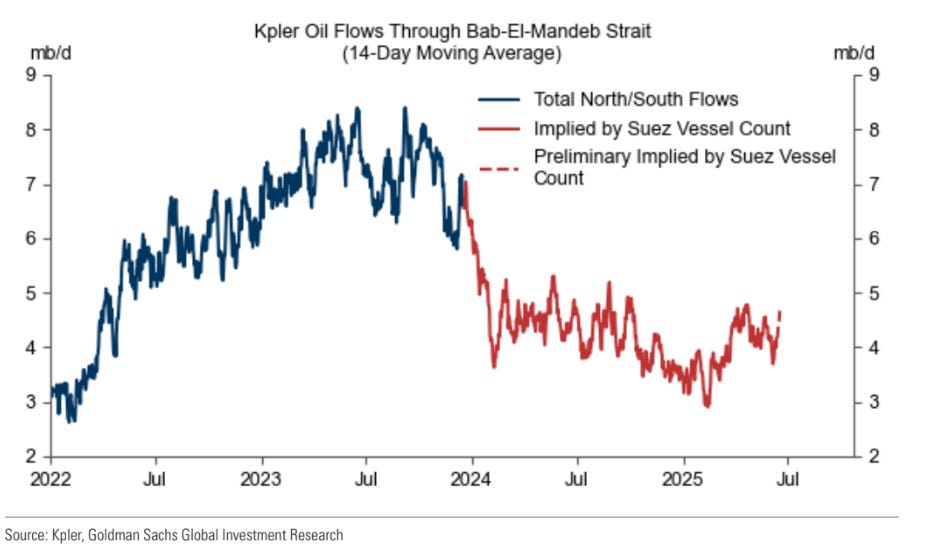

On Friday, we discussed in detail why we don’t think Iran will close the Strait of Hormuz. Although GS don’t directly offer an opinion on this, they do flag up the 45% (or 3.3mb/d) decline in oil flows through the Bab-El-Mandeb Strait (which connects the Red Sea to the Indian Ocean) in 2025 vs. 2023 and use it to illustrate the vulnerability of shipping to attacks from Iran-controlled Houthis.

In terms of price action from here, the team flag up shifts in the futures curve, the term structure of implied volatility, and call skew in order to suggest that oil markets believe that much higher prices are likely in the next few months, but see limited changes to the long-term outlook.

Interestingly, the Polymarket prediction market suggests probabilities of US military action against Iran by July of 65%, but of a US-Iran nuclear deal in 2025 of 50%.

That’s all from us today. See you in the morning for the weekly rundown and ideas.

AP