A $292bn Swing

Nvidia and Huang's last hurrah of 2024.

We’re in for a quiet week as the economic calendar is light and markets digest a post-election rally. However, one particular event stands out, and it is one that markets will be watching closely (the most important earnings event of our lives until the next one): Nvidia earnings.

Nvidia earnings have become the biggest equity event each quarter as the semiconductor giant has risen in market cap from $350bn to 3.6tn over the last 24 months.

The company stands on the brink of a $292B swing during tonight’s event. Options markets are pricing an 8.5% move on the stock and a 0.9% move in the S&P index. That’s more than the entire market cap of companies like Chevron, Wells Fargo and even fellow semiconductor competitor AMD.

This has the potential to be the biggest earnings move compared to fellow heavyweights. Amazon and Microsoft both closed just over 6% higher following earnings. The former moved higher, while the latter declined.

We could mention Tesla’s 20% move higher, but at the time, its market cap was $700bn, which Nvidia dwarfs.

Nvidia is in the midst of a historic run, but it wouldn’t be surprising if the company follows up its record-setting 2024 season with continued strong growth in 2025 and 2026 as the AI revolution powers on.

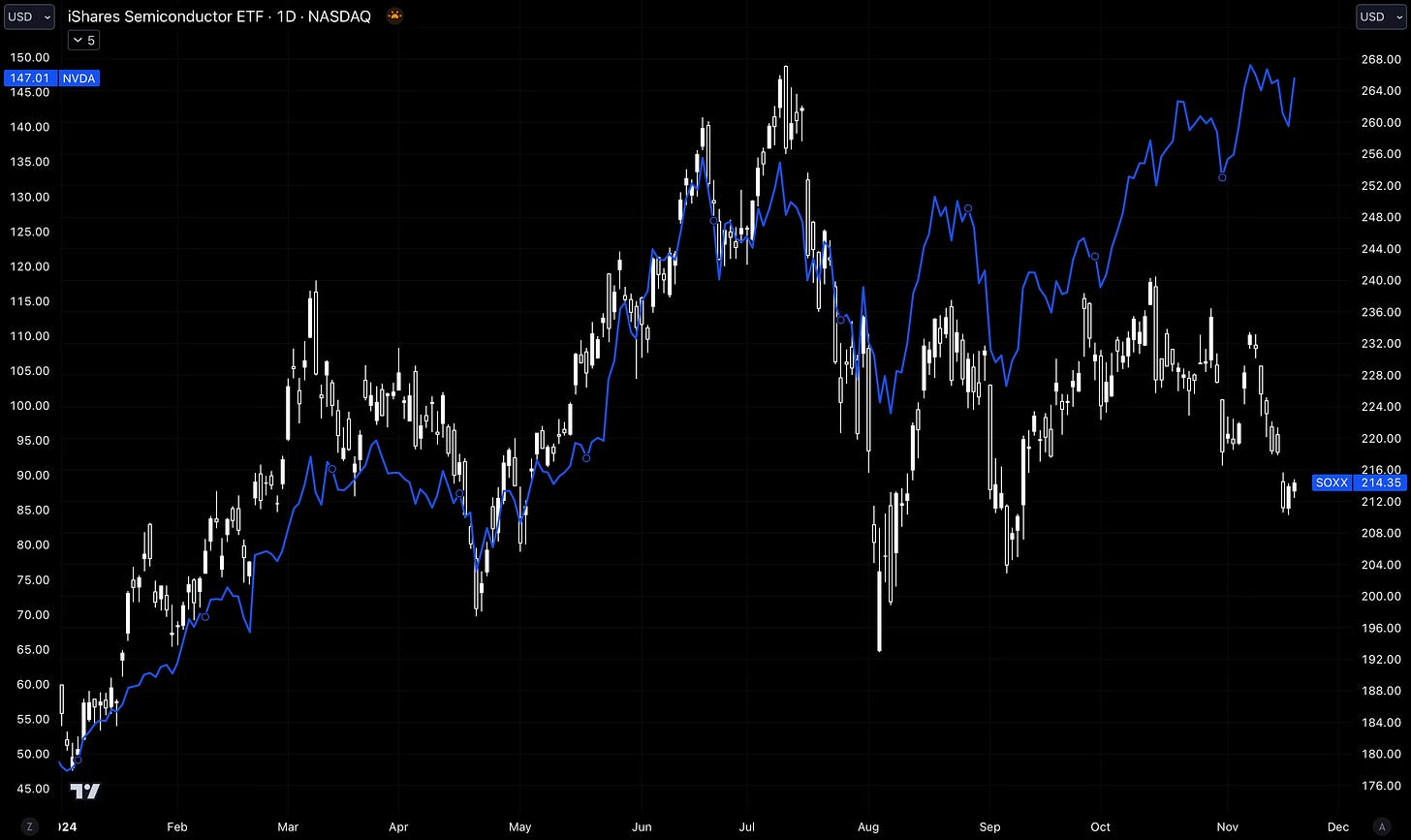

Knock Your SOXX Off

As a frontrunner in generative AI, Nvidia’s outcomes will influence broader market dynamics, especially given its pivotal role in tech and innovation. Nvidia is expected to report a significant 82.8% sales increase to $33.13 billion, showcasing robust growth despite supply-chain constraints, a key factor in maintaining its impressive 180% stock rise this year.

For markets, Nvidia’s innovation stirs global markets, and the guidance given by the management team will impact investor sentiment in tech. The upcoming earnings report arrives as the S&P 500, despite a 23% rise this year, has recently dipped in a post-election cool-off.

The 180% return may conceal the fact that chip stocks have struggled this year. iShare’s Semiconductor ETF (SOXX) is up just 12% this year, trailing the broader equity market by ~50%.

Maybe that’s an indication that AI isn’t “buy the basket”, and stock selection is still necessary.

You can manage your account here to access this full article and all other research.

“Generational Opportunity”

Despite the immense rally to become the largest company by market cap ever, some banks seem to just be discovering NVDA and AI: