A Bull In China's Shop

We make the case for strong Chinese growth and where to invest to profit from this.

Chatter over greater stimulus should help to support the key property sector.

First rate cut since August 2022 this week should further help to boost consumer demand.

Trade ideas from indices, individual stocks and FX.

For all the chat and focus this week on the US Fed, the ECB and the BoJ, some have missed several interesting developments out of China. In recent months, the bear case for China has been flagged (yet again), which we disputed here.

Now, it appears that we were correct, with a breakout in both the CSI Emerging Markets ETF (which includes China exposure) and also the more specific IShares China Equity (FXI). Here are some reasons to be positive on China, along with some trade ideas.

Stimulus is coming

We’re not going to plaster over the fact that the post-Covid recovery in China wasn’t as good as many had hoped. Yet the drawdown in the value of different Chinese assets has reflected this.

From where we currently stand, actions are being taken to help get things moving again. To this end, stimulus proposals have been drafted, covering a wide range of measures.

This is reported to include help for the property market. Items including lowering costs on outstanding residential mortgages and boosting relending through the main banks.

In the car market, tax incentives and credit support are being rolled out, especially for electric vehicles.

The upshot of all of this should help to get consumer demand going and ease some of the credit tightness.

Rates Being Cut

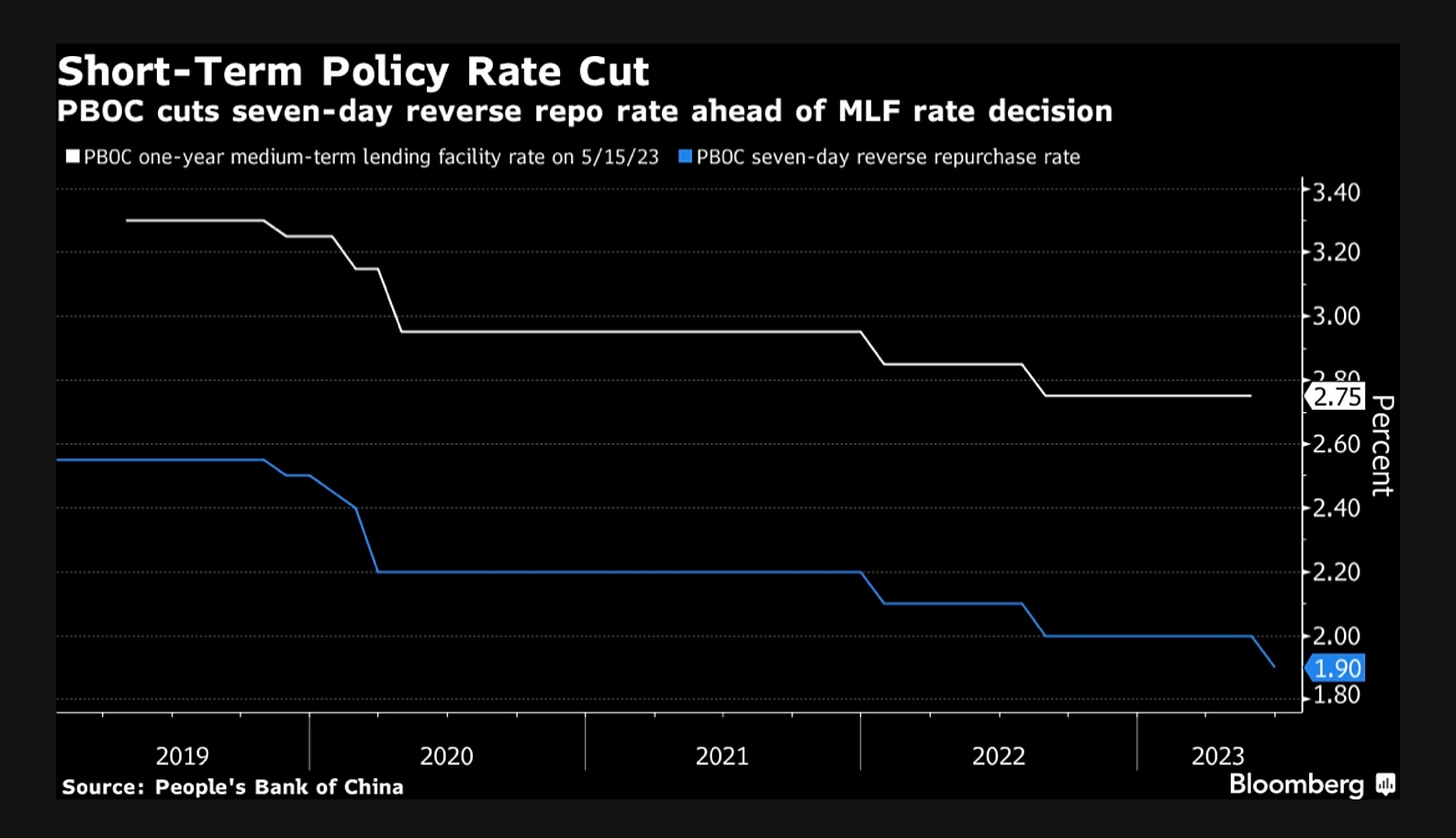

This week, the People’s Bank of China (PBOC) cut interest rates for the first time since August 2022. It cut the short-term seven day Repo rate from 2% down to 1.90%.

Although not reflected in the below chart, the medium-term one year rate (shown in white) was also cut yesterday from 2.75% to 2.65%.

The purpose of these cuts is clearly to help boost demand in classic economic theory. It should help the industrial sector via facilitating new debt issuance at a lower level. Again, the property market should benefit from this, with lower funding costs relating to mortgages.

At a time when the US Fed and most developed markets are still in the process of reaching a terminal rate, the PBOC are happy to go against the grain and ease policy instead of tightening it.

We feel this is a good move to help support growth over the course of the next year.

Other data supports the view

Finally, we note that green shoots are starting to emerge in some data sets. For example, we flag up consumer confidence, which hit fresh 12-month highs in the March release.

The YoY change in retail sales also paints an improving picture. At a more granular level, there has been good growth this year in retail sales for food and cosmetics. We feel this is encouraging and shows that consumers are happy to spending, especially in some non-necessity categories.

Trade ideas

For those that agree with our view, we like the below ideas which we feel could do well based on either direct or indirect China exposure/sentiment.

First is an index based idea:

Long IShares China

Entry: 29.08

Take Profit: 34.00 (52-week high)

Stop Loss: 27.00

For individual name exposure, we like:

NIO Calls

Buy Jul-21 expiry NIO calls at $11 for 5.2%

Targeting a move to $14

For those wanting this via FX:

Long AUD/NZD

Limit Order: 1.0995

Take Profit: 1.1200

Stop Loss: 1.0915

As a side note, we publish our favourite trade ideas each Monday for the coming week.

Is that good to buy $BABA july expiry contracts?