Adding Your Two Cents May Cost A Lot

Four lessons for all investors taken from a Joel Greenblatt experiment.

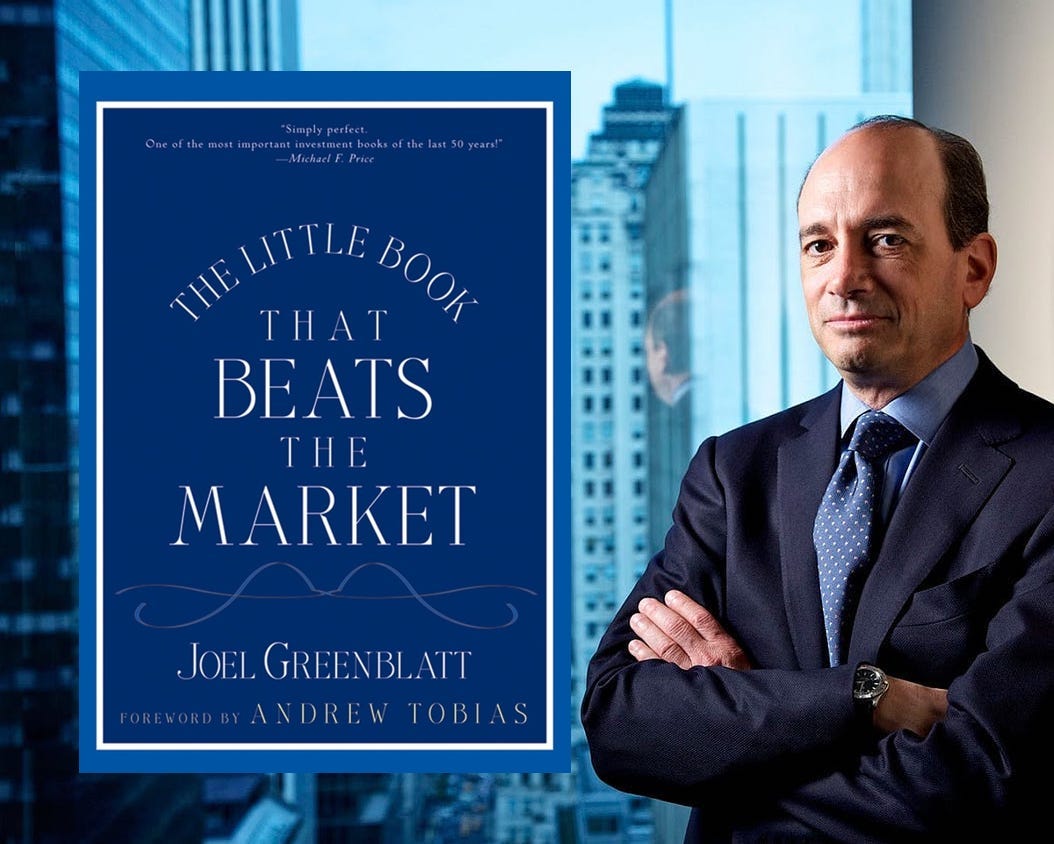

Joel Greenblatt is amongst the greats when it comes to investing. In 1985, he established Gotham Capital, a venture that yielded an impressive annualised return of 50% from 1985 to 1994. The success of this firm was down to one “magic” formula.

However, today’s article is not a summary of Joel Greenblatt and his impressive success. If you’d like some extra weekend material, you can read our article on him, linked at the end of this one.

Today’s article dives into an experiment and observation that Greenblatt made:

“Adding your two cents may cost a lot over the long term.”

Investors who 'self-managed' his Magic Formula using pre-approved stocks underperformed the professionally managed systematic accounts. Over a two-year observation, Greenblatt described the results as “stunning.” But not for the reasons you think. Let’s explain.

Firstly, the formula

Greenblatt introduces the “Magic Formula” in his Little Book That Beats the Market, which is a two-step process for selecting stocks:

Rank stocks by their earnings yield (Earnings Before Interest and Taxes / Enterprise Value)

Rank stocks by their return on capital (Net Operating Profit After Tax / Working Capital + Net Fixed Assets)

Combine the rankings from both steps, giving equal weight to each, and you have yourself a rating system. Then, proceed to invest in the highest-rated stocks.

Secondly, the experiment

Formula Investing was a brokerage firm that Joel Greenblatt set up. This brokerage provided two choices for retail clients to invest in U.S. stocks, either through a “self-managed” account or through a “professionally managed” account.

A self-managed account allows clients to make a number of their own choices about which top-ranked stocks to buy or sell and when to make these trades. The brokerage would also encourage clients to hold a portfolio of at least 20 stocks from this list to aid in the creation of a diversified portfolio and to send them reminders to make trades at the proper time to help maximise tax efficiency.

Professionally managed accounts follow a systematic process that buys and sells top-ranked stocks with trades scheduled at predetermined intervals. This account would follow a pre-set plan and serve as a “do it for me”, removing any judgement and decisions needed from the investor.

During the two years under study, both account types chose from the same list of top-ranked stocks based on the formulas described.

The results?

So, what happened? Well, as it turns out, the “self-managed” accounts didn't do too badly. Compiling all self-managed accounts for the two years showed a cumulative return of 59.4% after all expenses. Pretty good, right?

Unfortunately, the S&P 500 during the same period was actually up 62.7%.

But how did the “professionally managed” accounts do over the same period? A compilation of all the professionally managed accounts earned 84.1% after all expenses over the same two years, beating the “self-managed” accounts by almost 25% (and the S&P by well over 20%). For just two years, that’s a huge difference!

It’s incredibly huge since both “self-managed” and “professionally managed” chose investments from the same list of stocks and supposedly followed the same basic game plan.

We could put it another way: On average, the people who “self-managed” their accounts took a winning system and used their judgment to unintentionally eliminate all the outperformance and then some.

What investors can learn from this

There are four lessons Joel Greenblatt gave to investors off the back of this experiment. We can think of these as what not to do in the markets.

1. Self-managed investors avoided buying many of the biggest winners

How? The market prices certain businesses cheaply for reasons that are usually very well known. Whether you read the newspaper or follow the news in some other way, you’ll usually know what’s “wrong” with most stocks that appear at the top of the magic formula list. That’s part of the reason they’re available cheap in the first place! Most likely, the near future for a company might not look quite as bright as the recent past, or there’s a great deal of uncertainty about the company for one reason or another.

Buying stocks that appear cheap relative to trailing measures of cash flow or other measures (even if they’re still “good” businesses that earn high returns on capital) usually means buying companies that are out of favour. These types of companies are systematically avoided by both individuals and institutional investors.

Most people, and especially professional managers, want to make money now. A company that may face short-term issues isn’t where most investors look for near-term profits. Many self-managed investors eliminate companies from the list because of a newspaper headline that they know, or the company faces a near-term problem or some uncertainty. But many of these companies turn out to be the biggest future winners.

2. Many self-managed investors changed their game plan after the strategy underperformed for a period of time

Many self-managed investors got discouraged after the magic formula strategy underperformed the market for a period of time and sold stocks without replacing them, held more cash, and/or stopped updating the strategy periodically.

It’s hard to stick with a strategy that’s not working for a while. The best-performing mutual fund for the decade of the 2000s actually earned over 18% per year over a decade where the popular market averages were essentially flat. However, because of the capital movements of investors who bailed out during periods after the fund had underperformed for a while, the average investor (weighted by dollars invested) actually turned that 18% annual gain into an 11% loss per year during the same 10-year period.

3. Many self-managed investors changed their game plan after the market and their self-managed portfolio declined (regardless of whether the self-managed strategy was outperforming or underperforming a declining market).

This is a similar story to the second lesson above. Investors don’t like to lose money. Beating the market by losing less than the market isn’t that comforting. Many self-managed investors sold stocks without replacing them, held more cash, and/or stopped updating the strategy on a periodic basis after the markets and their portfolios declined for some time. It didn’t matter whether the strategy was outperforming or underperforming over this same period. Investors in that best-performing mutual fund of the decade mentioned above likely withdrew money after the fund declined, regardless of whether it was outperforming a declining market during that same period.

4. Many self-managed investors bought more after good periods of performance.

You get the idea. Most investors sell right after bad performance and buy right after good performance. This is a great way to lower long-term investment returns.

So, is there any good news from this analysis of “self-managed” vs. “professionally managed” accounts? Other than learning what mistakes not to make (which is pretty important in itself), two additional observations were made.

First, most clients ended up asking Formula Investing to “just do it for me” and selected “professionally managed” accounts, with over 90% of clients choosing this option. Perhaps most individual investors actually know what’s best after all.

Second, the best-performing “self-managed” account didn’t actually do anything. What that means is after the initial account was opened, the client bought stocks from the list and never touched them again for the entire two-year period. The strategy of doing nothing outperformed all other “self-managed” accounts. This sends a great, simple message:

When it comes to long-term investing, doing “less” is often “more”.

We hope there is something that you were able to take away from this article. After all, our goal is to bring value to the reader. If you’d like to support us, you can subscribe for free to our page. It means a lot to see the continued support across our content.

Our Sunday articles are entirely free for all. But we also post more research and insights throughout the week, some of which are available just for our premium subscribers. But don’t worry, you can become a premium subscriber for just £5, €6 or $7, depending on your location.

If Joel Greenblatt had a magic formula for newsletters, he’d probably rank us as great value with a high return on capital. :)

Agreed. The discipline to go against instinctive behaviour when investing is very difficult.

Analyzing psychological traits hive helped my account more than much of the market analysis.